The top three net purchases on the Dragon Tiger list today are Jingao Technology, Wufang Optoelectronics, and Tianci Materials

On December 28, the main A-share indices showed strong performance throughout the day. More than 4,400 shares rose in the two markets, traded 884.4 billion yuan throughout the day, and the net purchase of capital from North China exceeded 13.5 billion yuan.

On the market, the photovoltaic, lithium battery, and energy storage sectors experienced a wave of ups and downs, the liquor sector collectively rose, and the insurance, hotel and catering sectors registered the highest gains. The coal mining and processing sector declined, the port shipping sector continued to decline, and sectors such as aquaculture, road and railway transportation registered the highest declines.

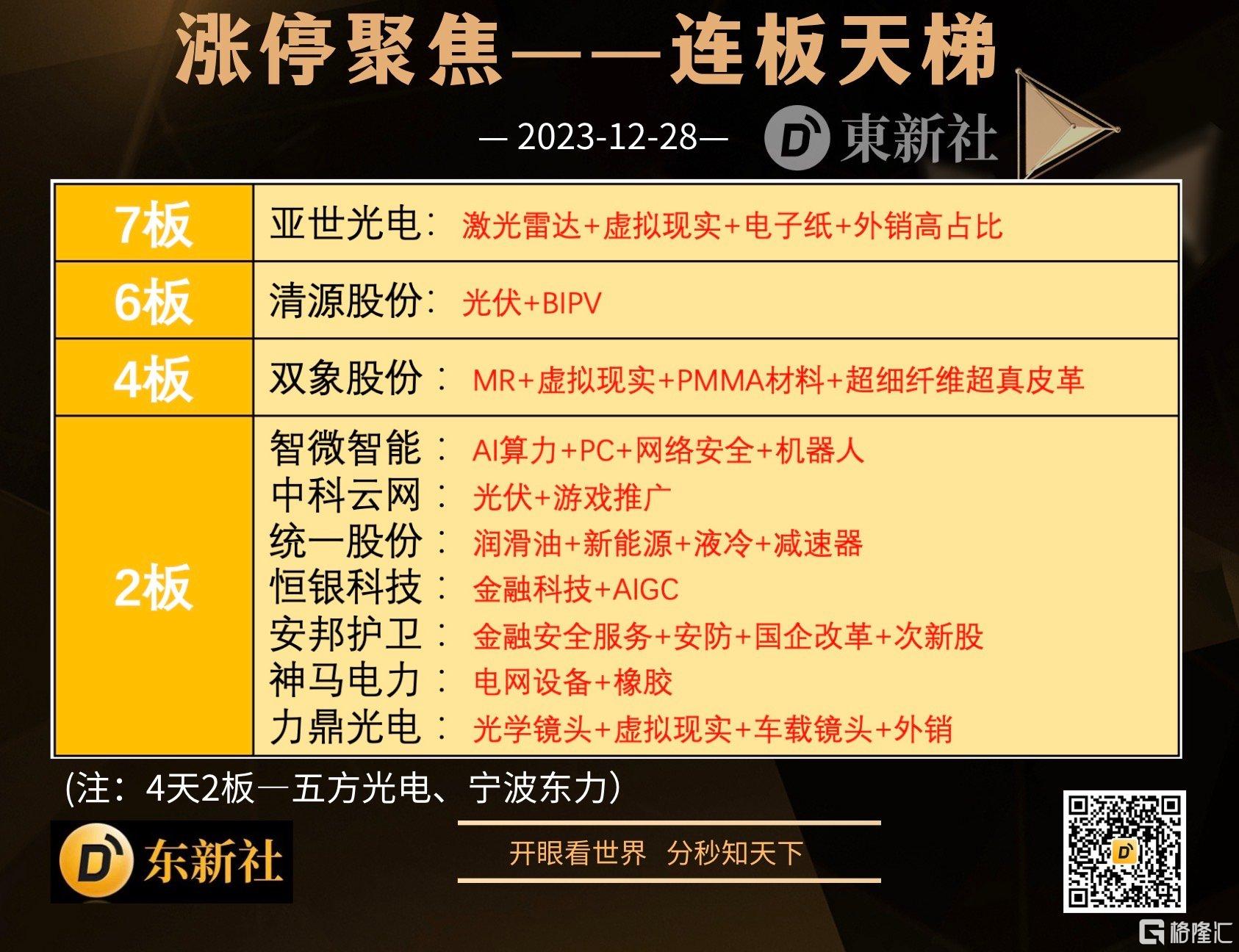

A total of 60 shares rose or closed today. The total number of shares on the board was 11, and 16 shares failed to be sealed. The sealing rate was 79% (excluding ST shares, delisted stocks, and unopened IPOs).

In terms of individual stocks, MR mixed reality concept stock Yashi Optoelectronics 7 day 5 board, Liding Optoelectronics 2 board, photovoltaic sector Qingyuan Co., Ltd. 6 board, Zhongke Cloud Network 8 day 5 board, Phosphorus Chemical's Zhongyida 8 day 4 board, Beijing Stock Exchange Yabaoxuan Beijing Stock Exchange 2 board, AI concept stock Smart Smart 2 board, Hengyin Technology 2 board, lithium battery sector Longxing Chemical 3 day 2 board, and Ningbo Dongli 4 day 2 board of robotics+wind power. Today, individual stocks closed up 4,282 and individual stocks closed down 734.

Let's take a look at today's Dragon Tiger rankings:

The top three net purchases on the Dragon Tiger list today were Jingao Technology, Wufang Optoelectronics, and Tianci Materials, which were 272 million yuan, 113 million yuan, and 110 million yuan respectively.

The top three net sales in the Dragon Tiger list were Hi-Tech Development, Jiachuang Video, and Tianwei Video, which were 199 million yuan, 199 million yuan, and 81.7768 million yuan respectively.

Among the individual stocks on the Dragon Tiger list involving exclusive institutional seats, the top three were Guangbo Shares, Jingao Technology, and Haiyou New Materials on the same day, which were 62.8549 million yuan, 47.6406 million yuan, and 32.5964 million yuan respectively.

Among the individual stocks involving exclusive institutional seats on the Dragon Tiger List, the top three in single-day net sales were Oriental Fashion, Yuhuan CNC, and Yinbaoshanxin, which were 897.752 million yuan, 71.8293 million yuan, and 39.1544 million yuan respectively.

The subject of some of the individual stocks on the list:

Jingao Technology (N-type battery+photovoltaic integrated module+silicon wafer)

1. The company's main business is the research, production and sale of solar silicon wafers, cells and modules, as well as the development, construction and operation of solar photovoltaic power plants.

2. The conversion efficiency of the company's latest mass-produced N-type Beixiu battery reached a maximum of 25.3% and will continue to be optimized. The pilot line of the “Haoxiu” heterojunction high-efficiency battery R&D project has been tested one after another, and the pilot conversion efficiency has been steadily improving. According to the plan, the company's N-type battery production capacity will reach nearly 40 GW by the end of 2023. The company interacted that it already has technical reserves related to BC batteries.

3. The company has built a full industrial chain including silicon rods/silicon ingots, silicon wafers, solar cells and solar cell modules, and solar power plant operation, and has become one of the leading enterprises with a complete industrial chain and coordinated structural layout among domestic photovoltaic industry enterprises; it has owned various types of photovoltaic power plant projects in more than 20 provinces across the country, including frontrunner photovoltaic power plants, ordinary ground power plants, and rooftop distributed photovoltaic power plants.

4. The company's module production capacity is nearly 50 GW. According to the company's future production capacity plan, the company's module production capacity will exceed 80 GW by the end of 2023, and the production capacity of silicon wafers and batteries is about 90% of the module production capacity.

Wufang Optoelectronics (MR+ Narrowband Filter+Huawei+CPO)

1. The company's main product is the narrowband filter NBPF, which is mainly used in smart phones, virtual reality/augmented reality/mixed reality, 3D somatosensory games, 3D cameras and displays.

2. The company has entered the supply chain of many smartphone brands around the world. The products are already used in many well-known smartphone products such as Huawei, Xiaomi, OPPO, and VIVO. Huawei is an important end customer of the company.

3. The company has launched an optical film panel project, an optical component project for LIDAR, and an optical communication filter project. The optical communication filter project has been mass-produced to help the company enter the optical communication industry, open up new markets, and increase new revenue and profit growth points.

Tianci materials (lithium battery+sodium ion battery)

1. The company's main business is R&D, production and sales of new fine chemical materials. It belongs to the fine chemical industry. The main products are lithium-ion battery materials, daily chemical materials and specialty chemicals. The world's leading electrolyte, lithium hexafluorophosphate has the highest market share in the world.

2. At present, the company has mass production technology for sodium hexafluorophosphate. The company's electrolyte is suitable for most lithium-ion batteries, not limited to power batteries.

High-tech development (computing power+Huawei Shengteng concept)

According to the news, yesterday's high-tech development announcement. As of the date of disclosure of the announcement, the company had received 350 million yuan in execution of the case from the People's Court of the Chengdu High-tech Industrial Development Zone. The recovery of the 350 million yuan execution fee mentioned above is expected to increase the company's net profit attributable to shareholders of listed companies by about 65 million yuan in 2023. The specific data is based on the audit results of the company's 2023 financial report.

Tianwei Video (5G+ cloud computing+short game)

Today, Tianwei Video stalled the “Sky Floor”. Tianwei Video stated on the interactive platform that the company's current business and products do not involve MR or VR.

Previously, on December 26, the company issued an announcement stating that the cumulative deviation value of the closing price increase of Shenzhen Tianwei Video Co., Ltd. reached more than 20% for 2 consecutive trading days on December 25, 2023 and December 26, 2023. There are no corrections or additions to the information previously disclosed by the company.

Institutions focus on trading individual stocks:

Guangbo Co., Ltd.:Today's flat market turnover rate was 24.52%, with a turnover of 644 million yuan, or 15.70%. According to data from the Dragon Tiger List, the net purchase of the organization was 62.8549 million yuan, and the total net sales of sales department seats was 3.5967 million yuan.

Jingao Technology:It rose and stopped today. The turnover rate for the whole day was 3.19%, and the turnover was 2.117 billion yuan, an increase of 10.89%. According to Dragon Tiger Index data, the net purchase of institutions was 47.6406 million yuan, the net purchase of Shenzhen Stock Connect was 128 million yuan, and the total net purchase of sales department seats was 96.6979 million yuan.

Haiyu New Materials:Today's rise and fall rate was 65.69 yuan, with a turnover rate of 13.37%. The volume was 69,600 lots, and the turnover was 426 million yuan. According to data from the Dragon Tiger List, the total net purchases of institutions were 32.5964 million yuan, and the total net purchase of Northbound capital was 1.0352 million yuan.

Oriental fashion:Today's decline was 9.44%, with a turnover of 239 million yuan and a turnover rate of 7.79%. According to Dragon Tiger Index data, the Shanghai Stock Connect exclusive seat bought 13.7074 million yuan and sold 9.2905 million yuan, with a net sale of 897.752 million yuan by the three institutions.

Yuhuan CNC:Today's increase was 3.13%, with a turnover of 1,026 billion yuan and a turnover rate of 39.22%. According to Dragon Tiger List data, the net purchase of the two institutions was 7.3058 million yuan, and the net sales of the four institutions were 79.1351 million yuan.

Yin Baoshan New:It fell to a halt today, with a turnover rate of 16.97% throughout the day, with a turnover of 1,436 billion yuan, or 5.82%. According to data from the Dragon Tiger List, the net sales of the organization were 39.154,400 yuan, and the total net sales of sales department seats was 28,900 yuan.

In the Dragon Tiger list, there are 5 individual stocks involving exclusive seats on Shanghai Stock Connect. Aixu Co., Ltd. had the largest net purchase amount of the Shanghai Stock Connect exclusive seat, with a net purchase of 45.21,400 yuan.

In the Dragon Tiger list, there are 10 individual stocks involving Shenzhen Stock Connect exclusive seats. Jingao Technology's Shenzhen Stock Connect exclusive seat had the largest net purchase amount, with a net purchase of 128 million yuan.

Trends in volatile capital operations:

The new fried family:Net purchase of League of Nations shares of 107.5 million yuan

Hujialou:Net purchase of Jingang PV was 98.07 million yuan

Wenzhou gang:Net purchases of shares in Yinbao Xinshan, Zhenshitong, and Tongda were 26.64 million yuan, 21.54 million yuan, and 2.08 million yuan respectively; net sales increased to 15.24 million yuan of shares

Xu Liusheng:Net purchase of Guolian shares of RMB 61.22 million

Shangtang Road:Net purchases of Wufang Optoelectronics, Yuhuan CNC, and Wenyi Technology were 41.86 million yuan, 30.28 million yuan, and 30.28 million yuan respectively; net sales of Yinbao Xinshan were 45.46 million yuan

HAPPY COAST:Net sale of Jingao Technology for 2013 million yuan

Shandong gang:Net purchase of Jiangsu Huachen 1.31 million yuan

Stock trading to support the family:Net purchases of Hi-Tech Development and Guosheng Technology were 29.99 million yuan and 4.12 million yuan respectively