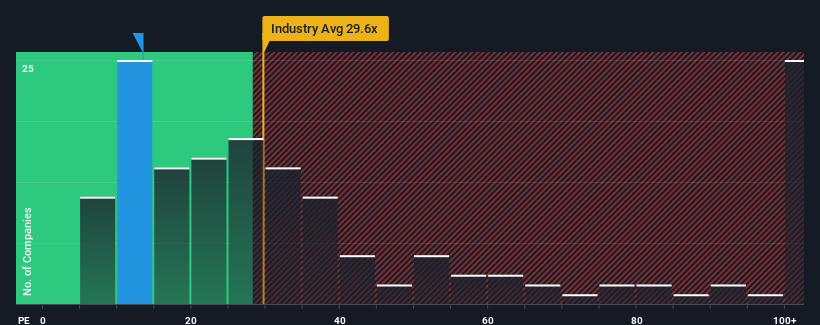

With a price-to-earnings (or "P/E") ratio of 13.4x Zhejiang Huayou Cobalt Co.,Ltd (SHSE:603799) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 34x and even P/E's higher than 62x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Zhejiang Huayou CobaltLtd has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Zhejiang Huayou CobaltLtd

Is There Any Growth For Zhejiang Huayou CobaltLtd?

Zhejiang Huayou CobaltLtd's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 15%. Still, the latest three year period has seen an excellent 343% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 45% during the coming year according to the analysts following the company. With the market predicted to deliver 44% growth , the company is positioned for a comparable earnings result.

In light of this, it's peculiar that Zhejiang Huayou CobaltLtd's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Zhejiang Huayou CobaltLtd's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Zhejiang Huayou CobaltLtd (1 is a bit concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Zhejiang Huayou CobaltLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.