Zillow Group, Inc. (NASDAQ:ZG) shareholders would be excited to see that the share price has had a great month, posting a 50% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 84% in the last year.

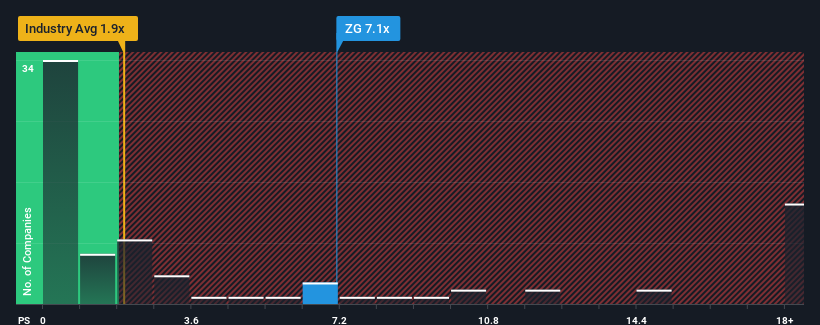

Following the firm bounce in price, given around half the companies in the United States' Real Estate industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider Zillow Group as a stock to avoid entirely with its 7.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Zillow Group

How Has Zillow Group Performed Recently?

Zillow Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Zillow Group will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Zillow Group?

In order to justify its P/S ratio, Zillow Group would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 7.4% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 45% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 10% per annum during the coming three years according to the analysts following the company. With the industry predicted to deliver 11% growth per year, the company is positioned for a comparable revenue result.

In light of this, it's curious that Zillow Group's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Shares in Zillow Group have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Zillow Group currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Zillow Group that you should be aware of.

If you're unsure about the strength of Zillow Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.