Since the fourth quarter, veteran public fundraiser Zhu Shaoxing has made frequent moves. Following the addition of positions at Dongfang Yuhong and Lan Xiao Technology, he has continued to step up third-party medical testing and pathological diagnosis companies.

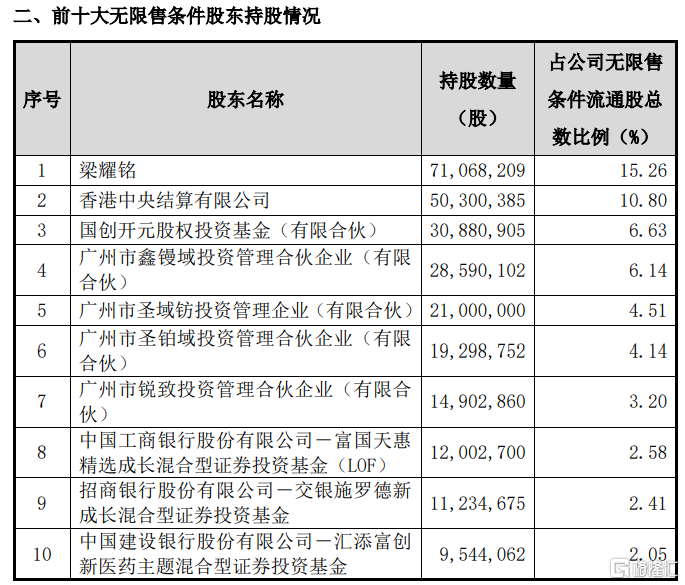

On December 22, Jinyu Medical revealed the latest list of the top ten shareholders as of December 18. Compared with the end of the third quarter, the number of shares held by Fuguo Tianhui Select, managed by Zhu Shaoxing, increased by about 500,000 shares. Combined with Jinyu Medical's average price estimates of 62 yuan/share since the fourth quarter, Zhu Shaoxing increased its position or spent about 32 million yuan.

Zhu Shaoxing has added 12.2 million new shares of Jinyu Medical since the first quarter of this year. His position was slightly adjusted several times during this period, but his overall shareholding remained almost unchanged. The latest position was 12.27 million shares.

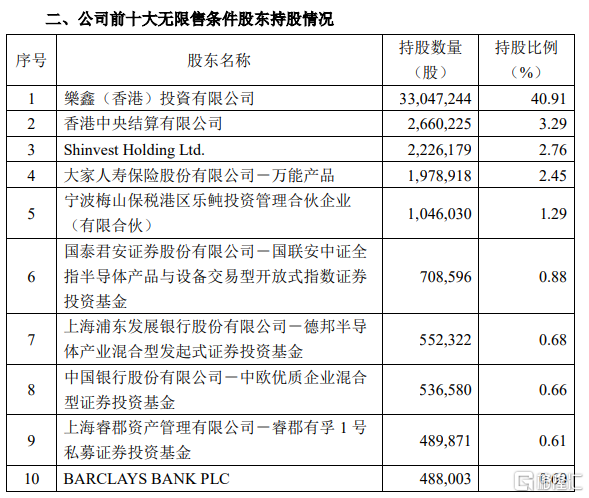

Ruijun Youfu 1, a subsidiary of Top Class Dong Chengfei, appeared on the list of the top ten shareholders of Lexin Technology on December 20, and ranked the 9th largest tradable shareholder of the company with 489,900 shares.

Lexin Technology is a global waferless semiconductor company. It has been deeply involved in the development and design of software and hardware products in the AIoT field for many years. Its main products include IoT Wi-Fi MCU communication chips and modules.

On December 20, at the 8th Global Investment Carnival hosted by Gelonghui, Dong Chengfei gave a keynote speech entitled “Core Industry, New Cycle “2.0"”. He analyzed the semiconductor industry from a perspective and gave everyone an analysis of the industry from the perspective of an investment manager.

Dong Chengfei pointed out, “The process of 0 to 1 in China's chip industry has been completed and is on the path from 1 to N. The semiconductor industry is a very typical cyclic+growth industry. The next boom peak always surpasses the previous boom peak. Currently, the inflection point of the semiconductor industry boom has arrived. It is a cyclical recovery and a starting point for growth. If AI is just the beginning and continues to be interpreted, it will reshape terminals in every way, and this round of AI innovation cycle will drive the semiconductor industry into a long cycle of prosperity.”2023 is coming to an end, and the 2024 curtain will begin. Most fund managers and brokerage institutions have given optimistic expectations for the 2024 market.

Some fund managers said that the European and American interest rate hike cycle is coming to an end, and interest rate cuts are expected to begin in 2024. The global macro environment is relaxed. The A-share market is worth looking forward to in 2024. The main indices are expected to show a volatile upward trend, and investment opportunities may increase markedly. Investors are advised to remain strategically positive and optimistic.

According to CITIC Securities, the inflection point of the market and confidence is approaching.

On the one hand, the northbound capital outflow since August of this year came to an end before Christmas. Since this week, according to CITIC Securities channel research data, the net redemption rate of the sample public fund products has declined sharply. Statistics show that the average return of the top 100 largest public fund stocks in the past 4 years was positive for the last 5 trading days of each year, and market clearance is nearing its end.

On the other hand, CITIC Securities believes that the real estate policy is under observation. It is expected that subsequent policies will continue to be strengthened. There is a high probability that the LPR will be lowered in January next year, and there is still plenty of room for improvement in the market's economic growth expectations compared to policy goals. A game industry policy that exceeds expectations will help ease the recent pure “speculative” atmosphere and strengthen the market's confidence in growth sectors with strong policy certainty such as hard technology. The inflection point of the market and confidence is approaching. Mid-January next year is a critical point.