When you buy and hold a stock for the long term, you definitely want it to provide a positive return. Better yet, you'd like to see the share price move up more than the market average. But Hunan Friendship&Apollo Commercial Co.,Ltd. (SZSE:002277) has fallen short of that second goal, with a share price rise of 26% over five years, which is below the market return. Zooming in, the stock is actually down 5.2% in the last year.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Hunan Friendship&Apollo CommercialLtd

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Hunan Friendship&Apollo CommercialLtd's earnings per share are down 50% per year, despite strong share price performance over five years.

Since the EPS are down strongly, it seems highly unlikely market participants are looking at EPS to value the company. Given that EPS is down, but the share price is up, it seems clear the market is focussed on other aspects of the business, at the moment.

The revenue reduction of 34% per year is not a positive. So it seems one might have to take closer look at earnings and revenue trends to see how they might influence the share price.

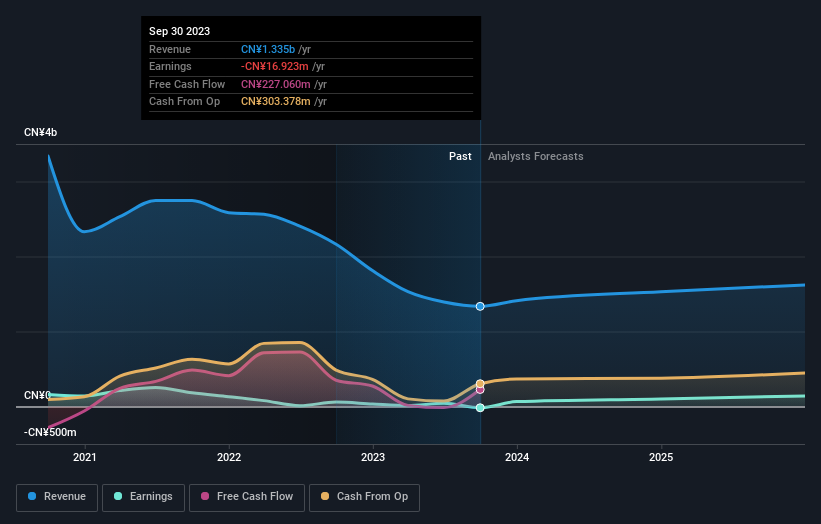

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

We've already covered Hunan Friendship&Apollo CommercialLtd's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Hunan Friendship&Apollo CommercialLtd shareholders, and that cash payout contributed to why its TSR of 29%, over the last 5 years, is better than the share price return.

A Different Perspective

Although it hurts that Hunan Friendship&Apollo CommercialLtd returned a loss of 5.2% in the last twelve months, the broader market was actually worse, returning a loss of 6.9%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 5% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Hunan Friendship&Apollo CommercialLtd (of which 1 is a bit concerning!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.