Aspen Aerogels, Inc. (NYSE:ASPN) shares have continued their recent momentum with a 43% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 32%.

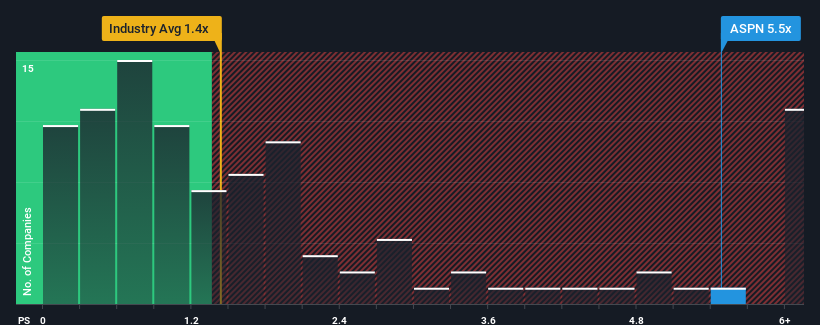

After such a large jump in price, when almost half of the companies in the United States' Chemicals industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Aspen Aerogels as a stock not worth researching with its 5.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Aspen Aerogels

What Does Aspen Aerogels' P/S Mean For Shareholders?

Aspen Aerogels certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It seems that many are expecting the company to continue defying the broader industry adversity, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Aspen Aerogels will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Aspen Aerogels would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 41% gain to the company's top line. The latest three year period has also seen an excellent 73% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 57% per year as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 10% per annum, which is noticeably less attractive.

With this in mind, it's not hard to understand why Aspen Aerogels' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Aspen Aerogels' P/S

Shares in Aspen Aerogels have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Aspen Aerogels maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Chemicals industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Aspen Aerogels has 2 warning signs we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.