Metis Energy Limited (SGX:L02) shares have had a really impressive month, gaining 45% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 25% over that time.

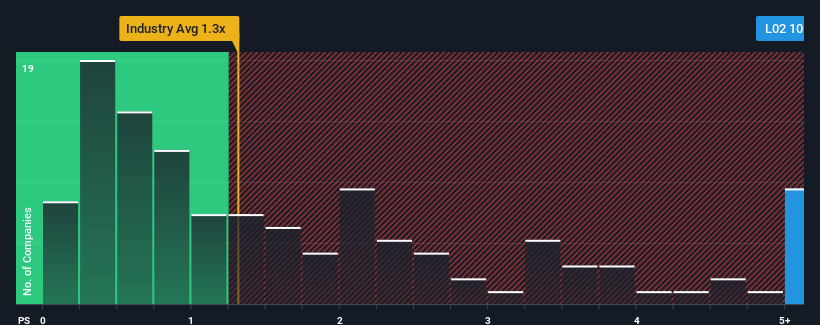

Since its price has surged higher, when almost half of the companies in Singapore's Shipping industry have price-to-sales ratios (or "P/S") below 1.9x, you may consider Metis Energy as a stock not worth researching with its 10.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Metis Energy

What Does Metis Energy's Recent Performance Look Like?

Metis Energy has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Metis Energy's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Metis Energy?

In order to justify its P/S ratio, Metis Energy would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. Revenue has also lifted 18% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 9.5% shows it's a great look while it lasts.

With this in mind, it's clear to us why Metis Energy's P/S exceeds that of its industry peers. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. However, its current revenue trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

What Does Metis Energy's P/S Mean For Investors?

Metis Energy's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As detailed previously, the strength of Metis Energy's recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. If things remain consistent though, shareholders shouldn't expect any major share price shocks in the near term.

It is also worth noting that we have found 1 warning sign for Metis Energy that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.