Ushizan and private equity are the main players behind the scenes

Following yesterday's stock price drop of 20cm, this morning*ST Zuojiang opened and dropped by 20cm again. By the close, the stock price fluctuated and closed down 15.22%. Over the past eight trading days, it had a cumulative decline of more than 81%, and fell 20% in 8 days and 6 trading days.

It is worth mentioning that since it involves many popular concepts such as chips, *ST Zuojiang has been bombarded with capital since this year. At one point, the stock price doubled. The highest price during the year was 299.8 yuan/share. At the same time, A-shares are known as “the most expensive ST stock in history.”

However, as the tide recedes, the former big bull stocks are facing an unprecedented crisis. Currently, *ST Zuojiang is not only facing a huge risk of delisting, but the company is also being investigated by the Securities Regulatory Commission for suspected credit disclosure violations.

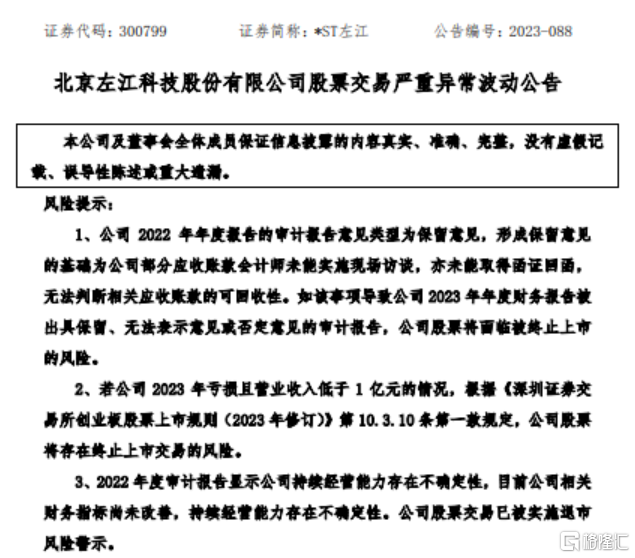

Yesterday, ST Zuojiang issued a stock price change announcement. The 2022 audit report shows that there is uncertainty about the company's ability to continue operating. Currently, the company's relevant financial indicators have not improved, and there is uncertainty about its ability to continue operating. The company's stock trading has been subject to a delisting risk warning.

Sales of 400 pieces of DPU are mostly slow to be sold in warehouses

The reason why Zuojiang Technology was able to gain market optimism before was mainly due to its DPU chip business.

Since 2021, there has been market news that Zuojiang Technology is developing DPU chips. In November 2021, some investors asked about this on the investment platform. Zuojiang Technology answered that the chip is in the development stage and is progressing smoothly, and is expected to be released in the second half of 2022.

In the technology industry, DPU is considered the new “third main chip”. Chip giants such as Nvidia and Intel have all invested in its R&D and design.

Beginning in 2022, *ST Zuojiang's stock price also skyrocketed as a result, rising frantically from around 38 yuan to 299.8 yuan per share.

However, it is worth noting that *ST Zuojiang has received 6 consecutive inquiries or letters of concern from the regulatory authorities during this year, and has also been investigated by the Securities Regulatory Commission for suspected information disclosure violations.

Beginning November 4, the Shenzhen Stock Exchange issued several inquiries to *ST Zuojiang for the Third Quarterly Report. It was delayed until December 12, when the market finally waited for*ST Zuojiang Shanshan's late reply.

In response, *ST Zuojiang introduced the company's DPU chip (data process unit, data processing chip) business revenue for key regulatory inquiries.

According to the announcement,*ST Zuojiang's DPU sales fell short of expectations, and the vast majority of the first batch of DPU chips sold by the company are being placed in terminal customer warehouses.

According to the announcement, Zuojiang Technology confirmed the contract in January 2023 as revenue from “DPU chips”, amounting to 12.61 million yuan. The counterparty is Haotian Xuhui, and Haotian Xuhui is only a trade distributor; the actual end user is Juxian Technology. According to verification, up to now, the 400 NE6000 chips purchased by Juxian Technology have used 20 chips for marketing and 10 chips for research and development. The remaining chips are stored in warehouses and have not yet been sold abroad.

Since then, *ST Zuojiang has embarked on an endless path of falling and falling. The stock price experienced 6 20cm drops in 8 days, which was very drastic.

Performance has been declining for three consecutive years

In addition, *ST Zuojiang's company performance has also been declining for three consecutive years, with annual losses of over 100 million yuan, and has reached the brink of delisting.

According to data, *ST Zuojiang was established in August 2007 and is mainly engaged in the design, development, production and sales of hardware platforms and boards related to network information security applications. Launched on GEM in October 2019.

From 2020 to 2022, the company returned to the mothernet profitThey were 93.6416 million yuan, 5.665 million yuan, and -147 million yuan respectively, showing a continuous downward trend. In 2022, profit changed to loss.

2020revenueAt 201 million yuan, revenue was only 118 million yuan, down 41.04%, while 2022 revenue was only 589.612 million yuan, a decline of 50.18%.

In addition, the company's revenue for the first three quarters of this year was 337.221 million yuan, and losses reached 97.3273 million yuan. According to the rules of the Shenzhen Stock Exchange, if the audited net profit is negative and the operating income is less than 100 million yuan, the listing will be terminated.

Ushizan and private equity are the main players behind the scenes

According to public information, the top ten shareholders of the company are mainly natural persons. The company's three-quarter report shows that among the top ten tradable shareholders, with the exception of an investment company and a private equity firm, the other eight shareholders are all natural persons, and the total shareholding ratio of the top ten tradable shareholders is about 57%.

In the third quarter of this year, well-known Niushan Peng Guohua, Yin Ying, and private equity Hongdao Investment increased their holds*ST Zuojiang.Furthermore,Niusan Guo Yanchao also added 82,100 shares of ST Zuojiang in the second quarter of this year*ST, but only in the third quarterGuo Yanchao has withdrawn from the top ten tradable shareholders.

It is worth noting that at a time when *ST Zuojiang's stock price soared, Zhang Jun, the company's actual controller, left early.

According to data, the company's employee shareholding platform, Wuxi Zuojiang Mirai, reduced its holdings by 3 million shares in 2022, accounting for 2.94% of the company's total share capital, and cashed out about 300 million yuan. Speaking of an employee shareholding platform, in fact, most of the members are company executives headed by Zhang Jun.

Also, judging from the number of shareholders, *ST Zuojiang's number of shareholders has been declining since the number of shareholders reached 10,000 in 2021. The total number of shareholders in the first quarter was 5,372, and the total number of shareholders in the second quarter was 2,951. In the third quarter, *ST Zuojiang had only 2,803 shareholders.