Jiangsu Lettall Electronic Co.,Ltd (SHSE:603629) shares have retraced a considerable 29% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 97%, which is great even in a bull market.

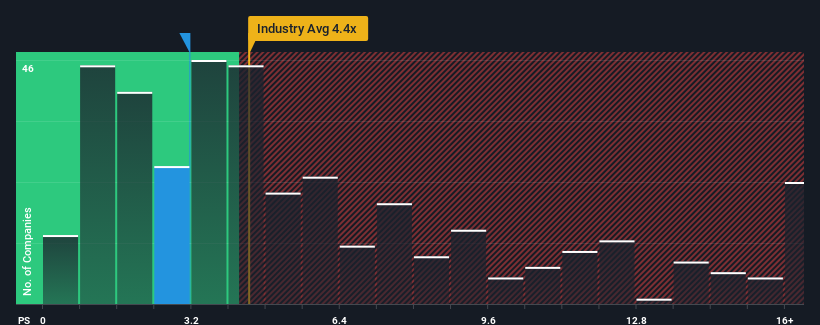

In spite of the heavy fall in price, Jiangsu Lettall ElectronicLtd may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3.2x, considering almost half of all companies in the Electronic industry in China have P/S ratios greater than 4.4x and even P/S higher than 9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Jiangsu Lettall ElectronicLtd

What Does Jiangsu Lettall ElectronicLtd's P/S Mean For Shareholders?

Jiangsu Lettall ElectronicLtd has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jiangsu Lettall ElectronicLtd will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Jiangsu Lettall ElectronicLtd's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. Pleasingly, revenue has also lifted 30% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 62% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Jiangsu Lettall ElectronicLtd's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What Does Jiangsu Lettall ElectronicLtd's P/S Mean For Investors?

Jiangsu Lettall ElectronicLtd's recently weak share price has pulled its P/S back below other Electronic companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Jiangsu Lettall ElectronicLtd confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Jiangsu Lettall ElectronicLtd (at least 2 which don't sit too well with us), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.