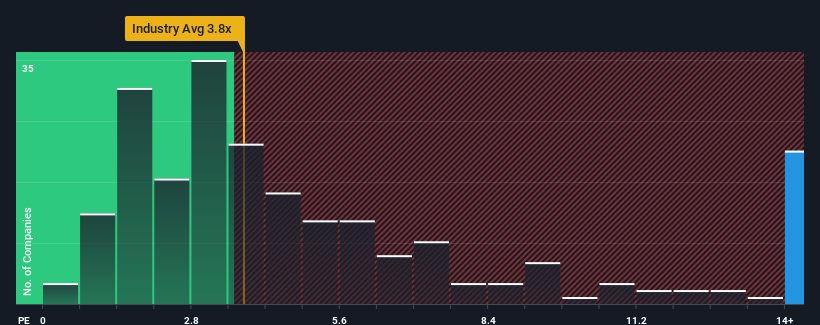

When close to half the companies in the Pharmaceuticals industry in China have price-to-sales ratios (or "P/S") below 3.8x, you may consider Shenyang Xingqi Pharmaceutical Co.,Ltd. (SZSE:300573) as a stock to avoid entirely with its 15.5x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Shenyang Xingqi PharmaceuticalLtd

What Does Shenyang Xingqi PharmaceuticalLtd's P/S Mean For Shareholders?

Shenyang Xingqi PharmaceuticalLtd could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shenyang Xingqi PharmaceuticalLtd.Is There Enough Revenue Growth Forecasted For Shenyang Xingqi PharmaceuticalLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Shenyang Xingqi PharmaceuticalLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.0% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 124% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 39% over the next year. With the industry predicted to deliver 40% growth , the company is positioned for a comparable revenue result.

With this information, we find it interesting that Shenyang Xingqi PharmaceuticalLtd is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given Shenyang Xingqi PharmaceuticalLtd's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Shenyang Xingqi PharmaceuticalLtd (of which 1 is significant!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.