Nurix Therapeutics, Inc. (NASDAQ:NRIX) shares have had a really impressive month, gaining 53% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 12% over that time.

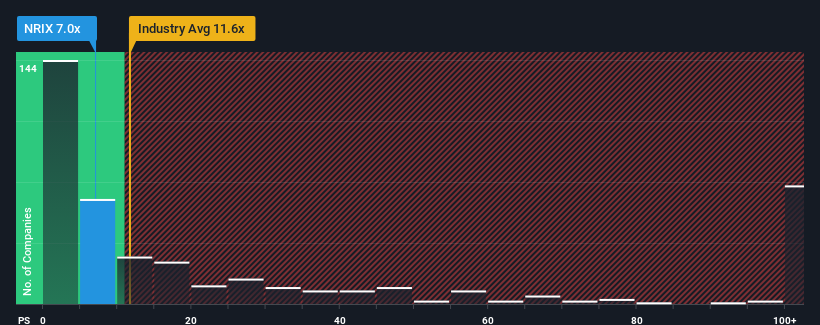

Even after such a large jump in price, Nurix Therapeutics' price-to-sales (or "P/S") ratio of 7x might still make it look like a buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 11.6x and even P/S above 49x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Nurix Therapeutics

How Nurix Therapeutics Has Been Performing

Recent times have been advantageous for Nurix Therapeutics as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Nurix Therapeutics will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Nurix Therapeutics would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 75% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 39% per year during the coming three years according to the eleven analysts following the company. That's shaping up to be materially lower than the 235% each year growth forecast for the broader industry.

With this information, we can see why Nurix Therapeutics is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Nurix Therapeutics' P/S

The latest share price surge wasn't enough to lift Nurix Therapeutics' P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Nurix Therapeutics maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

You should always think about risks. Case in point, we've spotted 3 warning signs for Nurix Therapeutics you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.