NIO needs to sell more cars

Once again, the Middle East's local magnates have increased NIO's capital in a big way.

Recently, NIO announced the signing of a new round of share subscription agreements with Abu Dhabi investment agency CYVN Holdings. CYVN Holdings will invest a total of about 2.2 billion US dollars in strategic investment in NIO in the form of cash through its subsidiary CyVN Investments. Combined with the investment of 1.1 billion US dollars in July this year, the total strategic investment amount has reached 3.3 billion US dollars.

1. CYVN's cumulative share ratio has reached number one, but Li Bin's voting power is still the highest

Local giants from the Middle East once again transfused blood to NIO and used 2.2 billion US dollars to subscribe for Class A common shares newly issued by Nio's 294 million shares. Combined with the previous initial investment of 1.1 billion US dollars in July, CYVN holds a total of about 20.1% of NIO's total issued foreign shares.

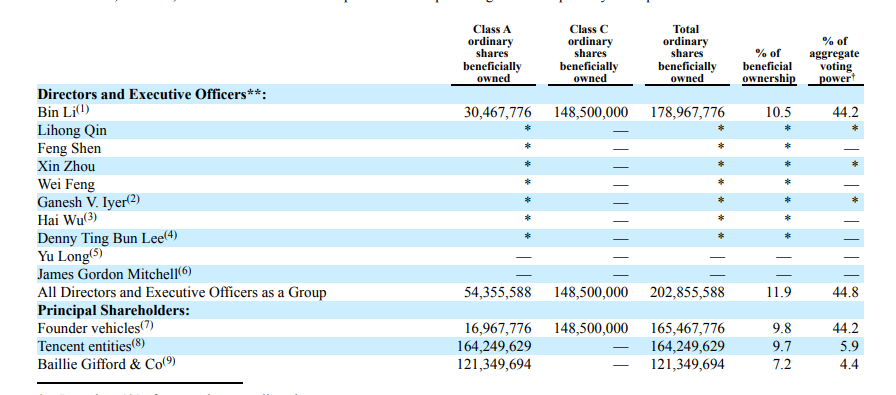

CYVN's shareholding ratio has surpassed all of NIO's shareholders. According to NIO's 2022 annual report, NIO's major shareholders are the founder company, Tencent Entity, and Baillie Gifford & Co., respectively, with a shareholding ratio of 9.8%, 9.7%, and 7.2%, respectively, while Li Bin, the founder, has a shareholding ratio of only 10.5%.

However, this does not mean that NIO's decision-making power is about to be abandoned. Li Bin, who holds 148,500,000 shares of Class C common shares (Li Bin holds 30,467,776 shares of Class A common stock), still maintains the most voting rights due to the adoption of super voting rights. Among them, Class A common stock holders can vote once per share, and Class C common stock holders can vote eight per share.

It is worth noting that NIO's cumulative financing amount has already exceeded 100 billion yuan. Since its establishment in 2015, in just 8 years, NIO's performance in the capital market has been very impressive. It has completed more than 20 rounds of financing, and the total financing amount has exceeded 100 billion yuan. Among them, in 2023 alone, NIO's financing amount will exceed 30 billion yuan. In the increasingly competitive NEV market, NIO is still a promising option for many investors.

2. NIO's cash shortage problem has been solved, and the arms race continues

As many new car builders enter the market and traditional car companies accelerate their transformation, the NEV industry is moving from the Blue Ocean to the Red Sea competition. In order to maintain its market position and competitive advantage, NIO had to invest more in launching new models, increasing power exchange facilities, and upgrading intelligent driving technology, so expensive expenses became inevitable.

Currently, NIO is already taking action to reduce costs and increase efficiency, including layoff plans, the reduction of the smartphone business, and the slowdown in the development of self-developed batteries. Although it has done a good job in terms of “throttling,” the “open source” aspect still needs to be strengthened.

In the third quarter of 2023, the growth of NIO's R&D, sales, and administrative expenses all slowed down, but since the overall situation was still in loss, operating losses reached 4.8 billion yuan in a single quarter, which still had a significant impact on the company's cash flow.

As of the end of the third quarter of this year, NIO's total cash and equivalents, restricted cash, and short-term and long-term investments was only RMB 45.2 billion, far lower than competitor Ideal Auto's RMB 88.5 billion. Although NIO is facing some financial pressure, its future investment needs are still huge, and it is difficult to lower it, including the new model ET9, which is about to be launched, the new brand Alps, which is scheduled to be launched next year, promotion of third-generation power exchange stations, and intelligent driving research and development.

Based on NIO's current loss rate of 4.8 billion yuan per quarter, NIO's cash reserves can only support about 2.5 years of operation. Fortunately, CYVN's recent investment of 2.2 billion US dollars has alleviated NIO's urgent capital needs and increased its cash reserves to 60.9 billion yuan.

However, even if NIO's capital situation improves, NIO still has to face real challenges. After all, the success of new car builders ultimately depends on sales volume.

In the first 11 months of this year, as a new car builder and the car company with the largest number of new energy models, NIO's sales performance was not as good as expected. The total sales volume was only 142,000 units, a year-on-year increase of only 32.7%, which is lower than the overall year-on-year growth rate of the NEV passenger car market of 35.2%. It is impossible to meet the sales target of 250,000 vehicles set at the beginning of the year.

After overcoming external difficulties such as declining production capacity, model changes, and lack of independent car building qualifications, NIO is entering a new stage. It is no longer possible to use these factors as an excuse for poor sales. The main challenge is how to turn the increase in the number of models into an increase in sales volume, particularly in terms of the sustainability of sales of popular models. Furthermore, Alps, a mid-range and low-end popular brand to be launched next year, is also highly anticipated by the market.

It is worth mentioning that NIO's power exchange business has begun to show potential. Thanks to the expansion of power exchange stations nationwide and the comprehensive upgrade of third-generation power exchange stations, and the support of the new purchase tax plan for electric exchange models, the competitiveness and attractiveness of electric exchange models in the NEV market is increasing, and it is expected that they will reach the same industry position as mainstream charging models.

Specifically, by the end of this year, the number of NIO power exchange stations is expected to exceed 2,300. Among them, the third-generation power exchange stations have improved markedly in terms of the number of power batteries, single-day service capacity, and power exchange time. About 20% of the power exchange stations have reached a break-even point.

NIO's leading position in the power exchange field has also attracted brands such as Changan Automobile and Geely to join forces to cooperate in battery exchange standards, technology, service network construction and operation, and power exchange model research and development. At the same time, 4-5 new energy vehicle companies are also discussing cooperation matters with NIO, showing NIO's influence and potential in this field.

In summary, it is hoped that after solving the short-term cash flow problem, NIO can achieve major breakthroughs in future sales volume and technological innovation, regain recognition from the market and consumers, and once again become a leader in new car builders. In the increasingly fierce NEV market, the time pressure faced by NIO is indeed not small, and there is an urgent need to break through the competition.