Cross-border e-commerce is one of the hottest fields today.

At a time when domestic e-commerce has reached a high peak and it is difficult to find new growth points, cross-border e-commerce has given sellers and platforms a new journey.

Behind the crazy growth of cross-border e-commerce, cross-border logistics has also made great strides, and many companies are struggling to enter the capital market.

Recently, the official website of the Hong Kong Stock Exchange revealed that Fanyuan International Holding Group Limited (hereinafter referred to as “Fanyuan International”) passed the Hong Kong Stock Exchange listing hearing, and Zhongyi Capital Co., Ltd. was its sole sponsor.

From December 12 to 19, Fanyuan International plans to sell 140 million shares globally. Hong Kong's public offering accounts for 10%, placement accounts for 90%, and 15% over-allotment rights. The offering price per share is HK$0.9-1.22, with each lot of 4,000 shares. It is expected that trading of shares will begin on the Stock Exchange on December 22, 2023.

Furthermore, the company has signed a cornerstone investment agreement with Yeung Ying-wu, Lau Lai-kwan and Kwok Siu-chun. According to the agreement, the three Cornerstone investors will subscribe to a number of shares that may be purchased for a total of HK$50 million at the sale price, subject to conditions. Based on the median offering price range of HK$1.06, the total number of shares offered to Cornerstone investors would be 47.16 million shares.

The listing is imminent, Fanyuan International, is it worth looking forward to?

01

Fanyuan International is a cross-border e-commerce logistics service provider. Its main business is to provide end-to-end cross-border logistics services. Currently, it has more than 30 outlets across the country.

Tracing back in time, the earliest days of Fanyuan International can be traced back to 2004. At that time, Hangzhou Fanyuan International Logistics Co., Ltd. was established, which became the origin of Fanyuan International, and is now a wholly-owned subsidiary of Fanyuan International.

Hangzhou, the cradle of e-commerce, gave Pan Yuan International a unique environment to grow. Therefore, the later development of Pan Yuan International can be described as smooth sailing.

In 2005, Hangzhou Fanyuan contracted UPS services in China, and later obtained exclusive management rights in various parts of Zhejiang Province.

After ten years of operation, in 2015, Fanyuan International became one of the first UPD operators in China, and in the same year it also became one of the first pilot enterprises in the China (Hangzhou) Cross-border E-Commerce Comprehensive Pilot Zone.

At the beginning of 2017, Hangzhou Fanyuan signed separate subscription agreements with companies such as Shanghai Dongzheng Ruipeng Investment Center, Zhuji Dongzheng Ruipeng Investment Center, and Shenzhen Energy Gaofei Fund Management Co., Ltd., while behind Shanghai Dongzheng Ruipeng Investment Center and Zhuji Dongzheng Ruipeng Investment Center are Shanghai Orient Securities and Jinshiyuan, respectively.

In the same year, Fanyuan International acquired the port, became DHL's business partner, and completed the business layout in South and Southwest China.

In 2018, Fanyuan International began cooperation with Yidatong, a subsidiary of Alibaba Holdings. In 2021, Alibaba China subscribed for 10% of Hangzhou Fanyuan's registered share capital at a price of about 139 million yuan, becoming one of Fanyuan International's shareholders.

In 2022, Fanyuan International took the lead in launching Alibaba's voluntary central warehouse business.

Photo source: Fanyuan International Logistics official website

In 2023, Fanyuan International began cooperation with TEMU to launch a cross-border logistics project.

Currently, Pan Yuan International already has more than 30 direct-run outlets across the country. The outlets are mainly concentrated in China's major trade centers, such as the Yangtze River Delta and the Guangdong-Hong Kong-Macao Greater Bay Area.

The period of rapid growth of Fanyuan International is also in a period of rapid development of cross-border e-commerce logistics in China.

According to data from the General Administration of Customs, in 2022, the import and export volume of cross-border e-commerce exceeded 2 trillion yuan for the first time, an increase of 7.1% over the previous year.

The boom in cross-border e-commerce has also brought about the rapid development of cross-border e-commerce logistics.

In 2018, the market size of cross-border e-commerce logistics in China was only 1.5 trillion yuan, but in 2022, it increased to 3.2 trillion yuan, with a compound annual growth rate of 20.4%。 By 2027, China's cross-border e-commerce logistics market is expected to reach 5.0 trillion yuan, with a compound annual growth rate of 9.2% between 2022 and 2027.

However, after a period of rapid growth, at present, Fanyuan International is already facing a crisis.

02

In the past two years, Fanyuan International's revenue has been declining year after year.

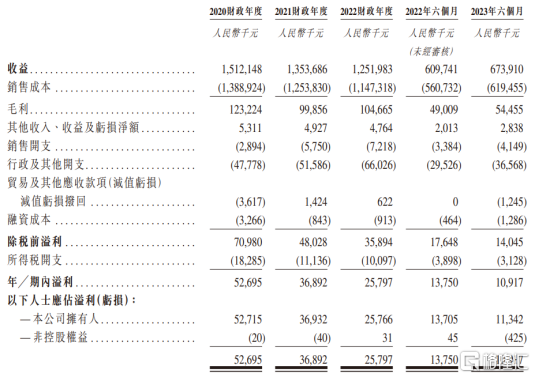

From 2020 to 2022, Fanyuan International's revenue was about 1,512 billion yuan, 1.354 billion yuan, and 1,252 billion yuan respectively. At the same time, the annual profit was 52.695 million yuan, 36.892 million yuan, and 25.797 million yuan, respectively. The performance trend was declining.

In the first half of 2023, Fanyuan International's revenue was 674 million yuan, an increase over the previous year, but profit declined further during the period, to only 10.917 million yuan.

Photo source: Fanyuan International prospectus

Moreover, as of June 30, 2023, Fanyuan International's operating cash flow was negative, about 58.9 million yuan.

While the business conditions are poor, Fanyuan International's overall state of the industry is not optimistic.

According to the revenue of the cross-border e-commerce logistics industry in 2022, Fanyuan International ranked between 25 and 30 in the cross-border e-commerce logistics market in China, with a share of about 0.03% in the overall market.

However, China's cross-border e-commerce logistics pattern is highly fragmented. According to the same standards, the top five e-commerce logistics companies in China also account for only 2.5% of the overall market share.

The highly fragmented pattern of cross-border e-commerce logistics is mainly due to the fragmentation of the overall system.

According to the prospectus, Fanyuan International's business mainly provides customers with various flexible delivery options and provides overall management of the entire logistics process, including formulating distribution routes, transportation methods, distribution cost control, and whether it can meet customs requirements.

Since there is no connection between the different lines of cross-border e-commerce logistics, there is no communication for different overseas routes. Therefore, although the companies are of a certain size, they have not formed a network with each other.

In specific business, cross-border e-commerce logistics companies mainly provide services in collaboration with suppliers to provide solutions such as freight forwarding, customs clearance, delivery, warehouse operation, transportation, and last-mile delivery according to customer needs. Although Fanyuan International has a self-developed logistics and transportation system and uses a direct-managed network model, most implementation projects still rely on suppliers to complete.

As far as Pan Yuan International is concerned, the business depends on suppliers, so once the operating costs of suppliers rise or are unable to maintain cooperative relationships, it will cause considerable damage to the business. However, this is true for quite a few companies in the cross-border e-commerce logistics industry. Therefore, the major cross-border e-commerce logistics companies do not have an absolute advantage, nor are there absolute leaders.

However, compared to other companies, Fanyuan International's disadvantages are even more prominent. For example, for logistics companies of the same type, the four parties will integrate resources through business cooperation and capital acquisition, and the scale effect is even more obvious.

So how much potential does the cross-border e-commerce logistics industry have? In fact, cross-border e-commerce logistics exists closely based on cross-border e-commerce. It can be said that lips and teeth depend on each other, and lips die of cold teeth.

03

Cross-border logistics in a broad sense includes a relatively large number of types, including logistics companies such as Cainiao and Extreme Rabbit, and last-mile delivery, such as Amazon Logistics, etc., but many related companies already have their original business, and have expanded their business scope or changed their business direction with the development of cross-border e-commerce.

Previously, “Yanwen Logistics”, which was expected to impact the first cross-border logistics stock, and Fanyuan International's business targeted two directions.

Fanyuan International is a cross-border e-commerce logistics company that really exists for cross-border e-commerce, and is more closely linked to cross-border e-commerce.

The actual origin of cross-border e-commerce is similar to that of domestic e-commerce, but it has been fighting alone for a long time.

In 2012, Amazon opened entry to Chinese sellers. This largest e-commerce platform overseas gave domestic sellers an export to the world. Subsequently, cross-border e-commerce entered a state of barbaric growth for a long period of time.

In 2014-2015, cross-border e-commerce ushered in its first small peak. At this time, the domestic platform AliExpress gradually emerged. Major overseas e-commerce platforms invited domestic sellers to settle in, and cross-border e-commerce entered a blowout period.

However, cross-border e-commerce logistics during this period, like cross-border e-commerce, was not systematized. Overall, it was also relatively chaotic, and freight forwarder fraud occurred from time to time.

After the epidemic began in 2020, cross-border e-commerce exports entered a blowout period, and cross-border e-commerce logistics also grew rapidly.

However, in 2021, Amazon began a “blockade wave”, and cross-border e-commerce entered the boutique period. The industry became more regulated, and a large number of small sellers withdrew, but the industry also began to gradually enter the right track.

In line with the reform of cross-border e-commerce, cross-border sellers have become more prominent in their pursuit of efficiency, and with it, the rise of large-scale and systematic logistics enterprises in cross-border e-commerce logistics.

Cross-border e-commerce logistics has also gradually moved in three directions, namely resource-based, operational, and marketing-oriented enterprises.

Resource-based enterprises, such as Sinotrans, Huamao, etc., usually have a certain amount of resource accumulation at single or multiple levels, enabling such enterprises to continuously strengthen their resource advantages and economic value through a virtuous cycle of resource barriers and scale effects.

Operational enterprises, on the other hand, focus on operational efficiency, strictly control operating profits throughout the process, and maximize profit margins by seamlessly connecting and maximizing the use of various resources in the goods chain, avoiding waste and idling of resources, and reducing operating costs.

Marketing-oriented enterprises, on the other hand, are based on marketing, and sales and marketing personnel account for the majority of the total number of employees. The company's business focus is mainly on building and intensive cultivation of front-end customer acquisition capabilities, while internal operations or resource accumulation are overcome.

In the current cross-border e-commerce logistics industry, marketing enterprises have the largest number, but the ones that account for the most revenue are still operating enterprises, while Pan Yuan International falls into this category.

What is obvious, however, is that as the business gradually deepens, it will eventually be resource-based enterprises that will gain a foothold. The question is how to change upward for the next level of enterprises.

Now, as many domestic e-commerce platforms such as Shein and TEMU export overseas, independent cross-border e-commerce sites have sprung up, and cross-border e-commerce logistics companies are also waiting for new opportunities.

04

epilogue

The popularity of cross-border e-commerce has made many logistics companies with overseas business popular.

Currently, Jibu Express has become a logistics giant second only to SF Express and Zhongtong in market capitalization, and Cainiao has also become a super unicorn, getting closer to listing.

However, compared to popular traditional logistics companies, cross-border e-commerce logistics companies that started with cross-border e-commerce all performed mediocre.

Yanwen Logistics, which once hoped to impact the first stock in cross-border logistics, signed a listing guidance agreement with CITIC Securities as early as September 2020 and plans to go public on the GEM market. However, since then, it has moved to the main board. In July 2021, Yanwen Logistics completed the pre-disclosure of its prospectus and plans to go public on the Shenzhen Main Board.

In February 2022, Yanwen Logistics updated its prospectus once again. However, at the beginning of this year, Yanwen Logistics had withdrawn the application materials.

After Yanwen Logistics, Fanyuan International will soon enter the capital market. However, in the face of internal and external worries, Fanyuan International may be “the pinnacle of listing”.