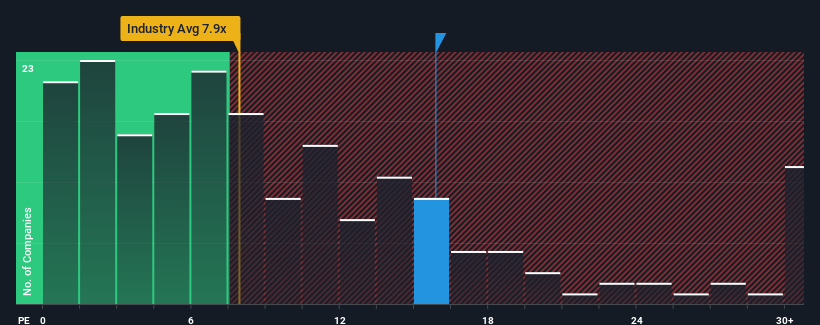

With a price-to-sales (or "P/S") ratio of 15.9x Dioo Microcircuits Co., Ltd. Jiangsu (SHSE:688381) may be sending very bearish signals at the moment, given that almost half of all the Semiconductor companies in China have P/S ratios under 7.9x and even P/S lower than 3x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Dioo Microcircuits Jiangsu

What Does Dioo Microcircuits Jiangsu's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Dioo Microcircuits Jiangsu's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Dioo Microcircuits Jiangsu's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Dioo Microcircuits Jiangsu's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's top line. Even so, admirably revenue has lifted 60% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 37% over the next year. That's shaping up to be similar to the 41% growth forecast for the broader industry.

In light of this, it's curious that Dioo Microcircuits Jiangsu's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

What We Can Learn From Dioo Microcircuits Jiangsu's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Analysts are forecasting Dioo Microcircuits Jiangsu's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about these 3 warning signs we've spotted with Dioo Microcircuits Jiangsu (including 1 which is potentially serious).

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.