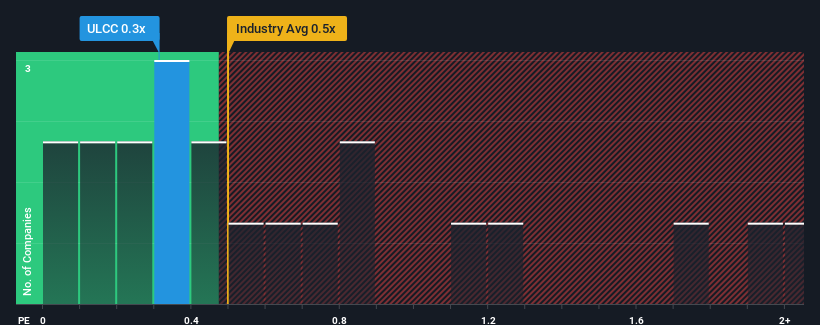

There wouldn't be many who think Frontier Group Holdings, Inc.'s (NASDAQ:ULCC) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Airlines industry in the United States is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Frontier Group Holdings

How Has Frontier Group Holdings Performed Recently?

Recent revenue growth for Frontier Group Holdings has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on Frontier Group Holdings will help you uncover what's on the horizon.How Is Frontier Group Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Frontier Group Holdings' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. Pleasingly, revenue has also lifted 120% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 11% as estimated by the ten analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 5.2%, which is noticeably less attractive.

In light of this, it's curious that Frontier Group Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Frontier Group Holdings' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Frontier Group Holdings currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for Frontier Group Holdings you should be aware of, and 1 of them is significant.

If you're unsure about the strength of Frontier Group Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.