Those holding PLBY Group, Inc. (NASDAQ:PLBY) shares would be relieved that the share price has rebounded 87% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 73% share price drop in the last twelve months.

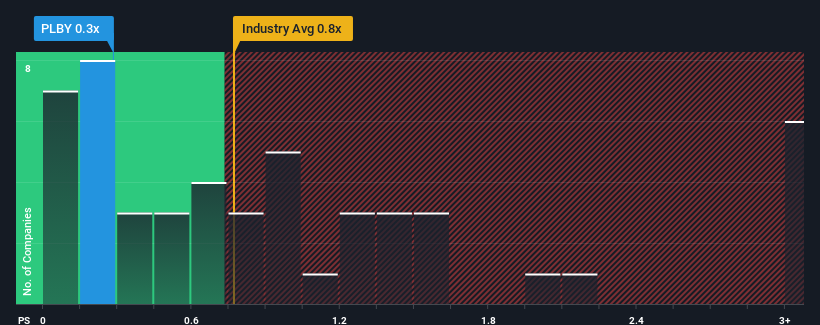

In spite of the firm bounce in price, there still wouldn't be many who think PLBY Group's price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S in the United States' Luxury industry is similar at about 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for PLBY Group

What Does PLBY Group's Recent Performance Look Like?

PLBY Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PLBY Group.Do Revenue Forecasts Match The P/S Ratio?

PLBY Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 2.7% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 88% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 17% per year over the next three years. That's not great when the rest of the industry is expected to grow by 8.7% per annum.

With this in consideration, we think it doesn't make sense that PLBY Group's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Its shares have lifted substantially and now PLBY Group's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

While PLBY Group's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

There are also other vital risk factors to consider and we've discovered 9 warning signs for PLBY Group (4 are significant!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.