For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Sherwin-Williams (NYSE:SHW), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Sherwin-Williams

How Fast Is Sherwin-Williams Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Over the last three years, Sherwin-Williams has grown EPS by 11% per year. That growth rate is fairly good, assuming the company can keep it up.

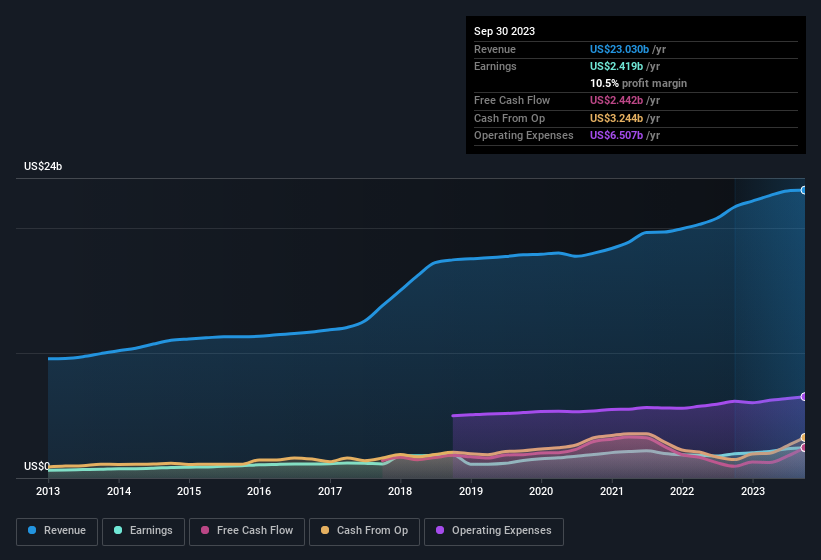

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Sherwin-Williams is growing revenues, and EBIT margins improved by 2.8 percentage points to 16%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Sherwin-Williams' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Sherwin-Williams Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While some insiders did sell some of their holdings in Sherwin-Williams, one lone insider trumped that with significant stock purchases. To be exact, Chairman & CEO John Morikis put their money where their mouth is, paying US$1.0m at an average of price of US$232 per share It's hard to ignore news like that.

Along with the insider buying, another encouraging sign for Sherwin-Williams is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth US$220m. This comes in at 0.3% of shares in the company, which is a fair amount of a business of this size. This should still be a great incentive for management to maximise shareholder value.

Does Sherwin-Williams Deserve A Spot On Your Watchlist?

One positive for Sherwin-Williams is that it is growing EPS. That's nice to see. In addition, insiders have been busy adding to their sizeable holdings in the company. That makes the company a prime candidate for your watchlist - and arguably a research priority. Still, you should learn about the 1 warning sign we've spotted with Sherwin-Williams.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Sherwin-Williams, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.