Patient layout

Unexpectedly, with the flick of a finger, A-shares have been underdeveloped for three years.

Thousands of investors in pig stocks have suffered greatly. I had imagined a reversal in the pig cycle in May of last year, but in the end, it was ruthlessly lost and falsified, and pig stocks followed the A-share trend and continued to collapse.

At the end of October this year, Muyuan Co., Ltd., which had a market capitalization, was once close to the 30 yuan mark, a sharp retreat of more than 60% from the all-time high of 90 yuan. New Hope's maximum retracement is nearly 80%, and Zhengbang Technology's maximum retracement is 90%.

Behind the cold numbers is a true picture of pig stock shareholders being frustrated and scarred. Perhaps, they are already discouraged, insensitive to future pig stock markets, and have no hope.

There is often a simple truth in financial markets: supermarkets are often born in times of complete despair. In my opinion, the win rate and odds of the best pig stocks that have bottomed out at this time will be relatively high.

01

Big PK for the business model

On the market, large pig companies have two main business models. One is based on pastoral fields, which adopt a model of self-breeding and self-cultivation and industrialized farming. However, most of a large number of pig companies, such as Wen's, New Hope, Zheng Bang, and Tianbang, have adopted the “company+farmer” asset-light model.

Before swine fever, the market was unable to see the truth clearly, believing that the two models were indistinguishable, and production capacity could be expanded at a low cost. However, over the past few years, African swine fever has proven to be a better model of self-breeding and self-raising, which is an important killer weapon for pig companies to maintain their core competitiveness.

Why is that?

In the medium to long term, the capital market is a weighing machine. Since the outbreak of African swine fever began in November 2018, Muyuan shares have increased by 330%, Wenshi shares have risen slightly by 5%, New Hope has risen 57%, Zhengbang Technology has fallen by 26%, and Tianbang Foods has risen slightly by 4%. From a market perspective, self-cultivation triumphs over “company+farmer”.

Let's take a look at the number of columns again. The “company+farmer” model is basically in an awkward situation where there is less support, while self-cultivation can buck the trend and expand.

In 2018-2022, the annual listing volume of Wen's shares was 22.297 million, 18.517 million, 9546 million, and 17.9 million, respectively. New Hope was 2.55 million, 3.55 million, 8.29 million, and 14.53 million, respectively, for the same period. In the same period, Zhengbang Technology was 5.54 million, 5.784 million, 9.56 million, and 8.447 million, respectively. Makihara was 1.01 million, 10.25 million, 18.11 million, 40.26 million, and 61.2 million, respectively, for the same period.

As a former pig company brother, Mr. Wen raised less and less. New Hope's expansion is aggressive, but the current financial situation has deteriorated, and the situation is very difficult. Zheng Bang, on the other hand, is following in the footsteps of young eagle farming and herding, and bankruptcy and restructuring are already on the agenda. The herding principle is meteoric, and the number of entries has expanded sevenfold in five years.

Let's take another look at the profit situation after the plague. From 2019 to 2023Q3, Makihara, Wen's, New Hope, and Zhengbang had cumulative profits of 51.89 billion, 8.75 billion, -4.9 billion, and -27.63 billion. Most leading pig companies have already taken full advantage of the high pig price dividends brought about by the plague, yet Muyuan continues to make huge profits.

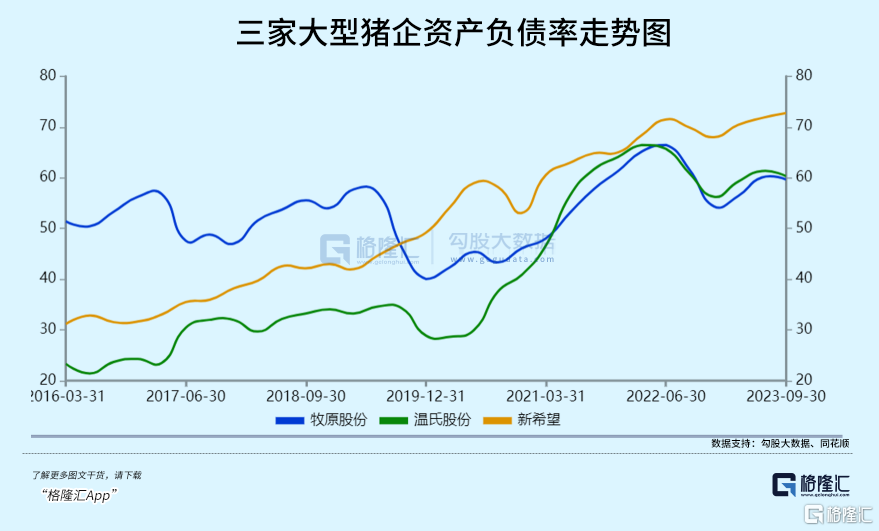

Let's look at solvency again. As of the end of the third quarter of this year, Mu Wenzheng's balance ratio was 59.65%, 60.3%, 72.76%, and 162.6%, respectively. As can be seen, against the backdrop of a large expansion, Makihara's financial situation is also tight, but it is the best performer among several leading pig companies.

Looking at the above dimensions, the model of self-cultivation and self-nourishment is the right path. Because only by adopting this model can farming costs be truly reduced and production capacity expanded steadily and safely.

From the perspective of a business model, pig stocks with alpha opportunities in the future focus on self-cultivation and self-cultivation. For example, there are signs that Muyuan's stock price has stabilized, and the current price has rebounded 25% from the end of October. The small pig company Superstar Farming and Animal Husbandry recently reached a record high. Its core logic is that the company's breeding model is gradually becoming in line with self-breeding. In addition, the small number of listings, small market capitalization, and stock price elasticity is also relatively good.

However, the stock prices of pig companies that stick to “company+farmer” are basically lying at the bottom, including large and medium-sized enterprises such as New Hope, Tianbang, Zhengbang, and Aonong Biotech.

02

The end of the traditional pig cycle

Over the past 20 years, the pig industry has had a clear cycle, roughly 4 years. Specifically: 2006/7-2010/2, with an upward cycle of 20 months, a decline cycle of 27 months; 2010/5-2014/4, an upward cycle of 16 months, a downward cycle of 31 months; 2014/4-2018/5, an upward cycle of 26 months, a downward cycle of 23 months; 2014/4-2018/5, an upward cycle of 26 months, a downward cycle of 23 months.

Why 4 years? Are the upward and downward cycles about 2 years each?

At the bottom of the pig price cycle, breeding agents need to start by supplementing the breeding of sows. However, from being able to breed sows until the final commercial pig is released, it will go through this process: ancestral generation, one-yuan pig hybrid breeding, 4 months of pregnancy — parent generation, binary breeding, birth of sows — 8 months to sexual maturity — binary breeding of sows, 4 months of pregnancy — commercial pig breeding, birth of commercial pigs — 6 months of growth and release.

According to the above process calculation, the upward cycle of pig prices is 22 months. Conversely, if you remove production capacity, it will also be 22 months. However, in the big cycle, there will be small cycles, and because of the impact or impact of the epidemic such as blue ear disease, the timing of each upward or downward cycle will be slightly different.

In May of last year, according to the four-year historical rule, the pig cycle should have reversed around this point, followed by an upward period of about 22 months.

However, the capital market, commodity futures market, and the physical industry all made mistakes in anticipation, and a fake pig cycle began. The real industry's expectations for the future upward cycle are too consistent. During this period, there were reasons such as delays in raising big pigs, secondary fattening, and optimism that the future market would not cut production capacity (or even fill the column, not accept losses), etc., so they misstepped on the pig cycle.

After African swine fever, the traditional four-year pig cycle was broken. why?

In the traditional pig cycle, breeding costs are basically stable, and the cost gap between various breeding entities is not large. There has been a drop in the price of raising more, and the price of raising less is high. Furthermore, one characteristic of the larger traditional pig cycle is that neither the loss of industrial capital nor blood supplementation will greatly disrupt the overall breeding production order—the range of sows that can breed is reduced by 10-20%. Essentially, the removal of production capacity has not affected the normal production order!

However, after African swine fever, the industry's production order was seriously disrupted (50% of sows that could be raised were removed at one point). Furthermore, capital from inside and outside the industry is frantically leveraging to expand production capacity, making it longer and more difficult to remove production capacity.

03

Pig cycle reversal points

On December 16, the average price of foreign three-yuan pigs was 14.9 yuan, which is lower than the breeding costs of most pig farmers. This slump in pig prices has continued for a long time, and has already made many leading pig companies feel threatened by their survival.

At the end of September this year, Liu Chang, chairman of New Hope, issued a letter to all members saying that in recent years, global economic uncertainty has increased, the situation at home and abroad is complicated, raw material prices have fluctuated frequently, pig prices have continued to be low, social inventories are high, terminal consumption is weak, and various external passive factors have left the company in an “unprecedentedly difficult environment.”

For investors, it is also a source of suffering. If you do a cycle, you can't hope for a cycle. After running out of patience, you run away. When valuers see a decline in stock prices, they fear that valuation logic will deteriorate.

So, roughly when will the current pig cycle reverse?

I personally think that the probability of around the middle of next year is quite high.

Logically speaking, the time has also come to remove production capacity and credit. In May 2021, pig prices fell below 20 yuan, and the industry began to lose money. By May next year, with the exception of Muyuan, the industry is basically at a loss for 3 years. Production capacity was drastically expanded in the early stages, compounded by the fact that pig prices continued to be sluggish. The large-scale production capacity balance sheet under leverage deteriorated rapidly, cash flow continued to lose blood, and credit runs occurred among players of various sizes. The industry is in the midst of large-scale decapitalization.

Second, let's look at pig price guidelines from the pig commodity futures market. As of the close of trading on December 15, 2401, 2403, 2405, 2407, 2409, and 2411 were 14825 (14.825 yuan/kg), 14325, 15280, 16250, 17245, and 17265, respectively. Judging from the commodity futures price structure, it also suggests that pig prices may reverse in May next year.

Furthermore, Qin Jun, director of Muyuan Co., Ltd., recently stated that it is expected that the first half of next year will be affected by the ability to breed sows, pork prices may still not be very good, and there may be an improvement in the second half of the year. In addition, some brokerage agencies and futures companies also generally expect a reversal from May to August next year is quite likely.

04

Epilogue

Pig stocks have been adjusted for more than 3 years, and the overall valuation has reached a relatively cheap level. For example, the current PB of Muyuan Co., Ltd. is 3.35 times, which is lower than most of the time since it was listed in 2014.

However, the certainty that the pig cycle will reverse next year is quite strong. Once it appears, it will drive the pig stock sector to usher in a good beta upward trend, which is expected to last quite a long time.

Of course, as an investor, the wiser choice is to look for pig stocks that still have good growth potential. Makihara shares, for example, have this characteristic, even though the market capitalization is already very large. There are also small pig stocks such as Superstar Farming and Animal Husbandry. The business model relies on self-cultivation. There is not much room for imagination in the market, but the current valuation has returned to a relatively high level.

Furthermore, the valuation levels of the major stock indices, led by the Shanghai and Shenzhen 300, have returned to seven years ago. It is very likely that the average will return next year, which will also drive the valuation recovery of most sectors, including pork.

The time and place are favorable to the people. Be patient. Currently, opportunities are selected and high-quality pig stocks are laid out in batches. When is the next year, you may feel a great deal of emotion.