Over the past year, many JFrog Ltd. (NASDAQ:FROG) insiders sold a significant stake in the company which may have piqued investors' interest. Knowing whether insiders are buying is usually more helpful when evaluating insider transactions, as insider selling can have various explanations. However, if numerous insiders are selling, shareholders should investigate more.

While insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for JFrog

JFrog Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Lead Independent Director, Yoseph Sela, for US$604k worth of shares, at about US$29.15 per share. That means that even when the share price was below the current price of US$30.18, an insider wanted to cash in some shares. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. It is worth noting that this sale was only 7.8% of Yoseph Sela's holding.

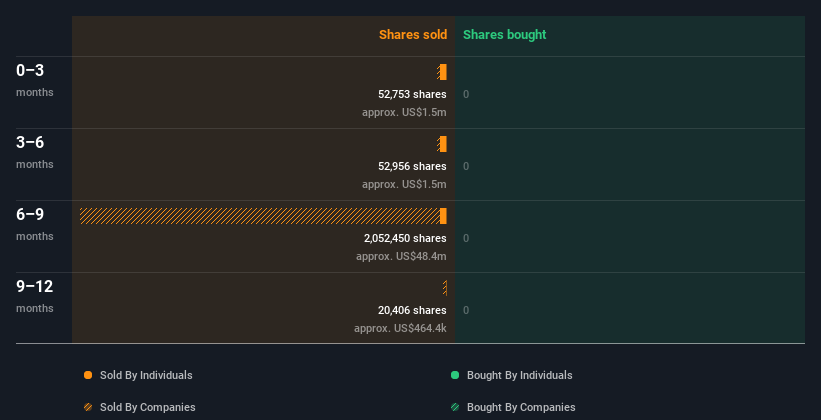

In the last year JFrog insiders didn't buy any company stock. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

JFrog Insiders Are Selling The Stock

The last three months saw significant insider selling at JFrog. In total, insiders dumped US$940k worth of shares in that time, and we didn't record any purchases whatsoever. Overall this makes us a bit cautious, but it's not the be all and end all.

Does JFrog Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It's great to see that JFrog insiders own 17% of the company, worth about US$549m. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The JFrog Insider Transactions Indicate?

Insiders sold JFrog shares recently, but they didn't buy any. And even if we look at the last year, we didn't see any purchases. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. For example - JFrog has 3 warning signs we think you should be aware of.

Of course JFrog may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.