To the annoyance of some shareholders, Allego N.V. (NYSE:ALLG) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 64% loss during that time.

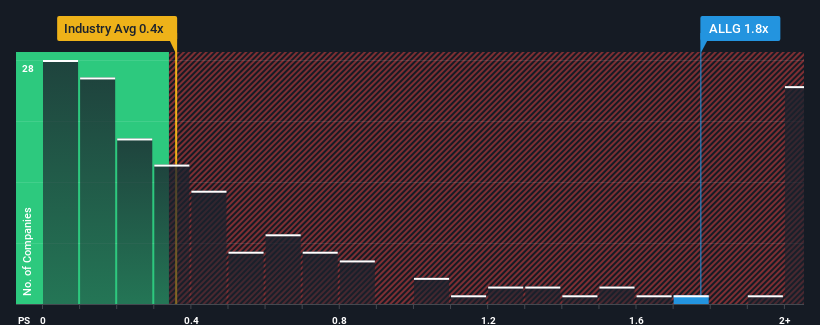

Even after such a large drop in price, when almost half of the companies in the United States' Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider Allego as a stock probably not worth researching with its 1.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Allego

How Allego Has Been Performing

With revenue growth that's superior to most other companies of late, Allego has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Allego will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Allego's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. The latest three year period has also seen an excellent 256% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 47% each year during the coming three years according to the four analysts following the company. With the industry only predicted to deliver 6.8% each year, the company is positioned for a stronger revenue result.

With this information, we can see why Allego is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Allego's P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Allego's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Allego (2 are a bit concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Allego, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.