Getty Images Holdings, Inc. (NYSE:GETY) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

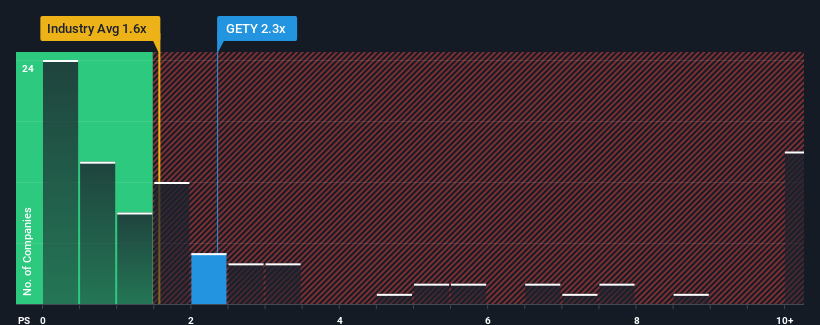

Following the firm bounce in price, when almost half of the companies in the United States' Interactive Media and Services industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Getty Images Holdings as a stock probably not worth researching with its 2.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Getty Images Holdings

How Getty Images Holdings Has Been Performing

Getty Images Holdings hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Getty Images Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Getty Images Holdings' is when the company's growth is on track to outshine the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 13% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 3.9% per year as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% per year, which is noticeably more attractive.

In light of this, it's alarming that Getty Images Holdings' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Getty Images Holdings' P/S Mean For Investors?

Getty Images Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Getty Images Holdings, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Getty Images Holdings that you should be aware of.

If these risks are making you reconsider your opinion on Getty Images Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.