Sunny Side Up Culture Holdings Limited (HKG:8082) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 38%.

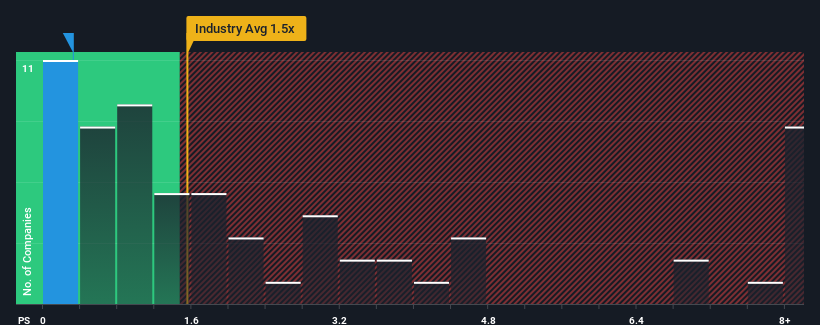

Even after such a large jump in price, Sunny Side Up Culture Holdings' price-to-sales (or "P/S") ratio of 0.3x might still make it look like a buy right now compared to the Entertainment industry in Hong Kong, where around half of the companies have P/S ratios above 1.5x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Sunny Side Up Culture Holdings

How Has Sunny Side Up Culture Holdings Performed Recently?

With revenue growth that's exceedingly strong of late, Sunny Side Up Culture Holdings has been doing very well. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on Sunny Side Up Culture Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Sunny Side Up Culture Holdings' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Sunny Side Up Culture Holdings?

Sunny Side Up Culture Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. Pleasingly, revenue has also lifted 295% in aggregate from three years ago, thanks to the last 12 months of explosive growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 46%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it odd that Sunny Side Up Culture Holdings is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Sunny Side Up Culture Holdings' P/S Mean For Investors?

Despite Sunny Side Up Culture Holdings' share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Sunny Side Up Culture Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Having said that, be aware Sunny Side Up Culture Holdings is showing 3 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Sunny Side Up Culture Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.