Humanoid robot dexterous hand - hollow cup motor

Tesla's humanoid robots have brought popularity to midstream components. The industry benefits not only speed reducers and actuators, but also hollow cup motors in dexterous hands.

Leading companies in hollow cup motors are still dominated overseas. The only domestic company that can compete with the giants is Mingzhi Electric, but in the past two years, due to the impact of the industry cycle, traditional business performance has declined. Can Mingzhi Electric seize the opportunity of humanoid robots to achieve another breakthrough in growth?

Highlights:

1. How much increase does the humanoid robot bring to the hollow cup motor?

2. What step has domestic companies progressed to?

Humanoid robots spawn new demand for hollow cup motors

In the humanoid robot industry chain, not only actuators, speed reducers, and screws are worth paying attention to, but there is also an indispensable link, which is the core component of dexterous hands: the hollow cup motor.

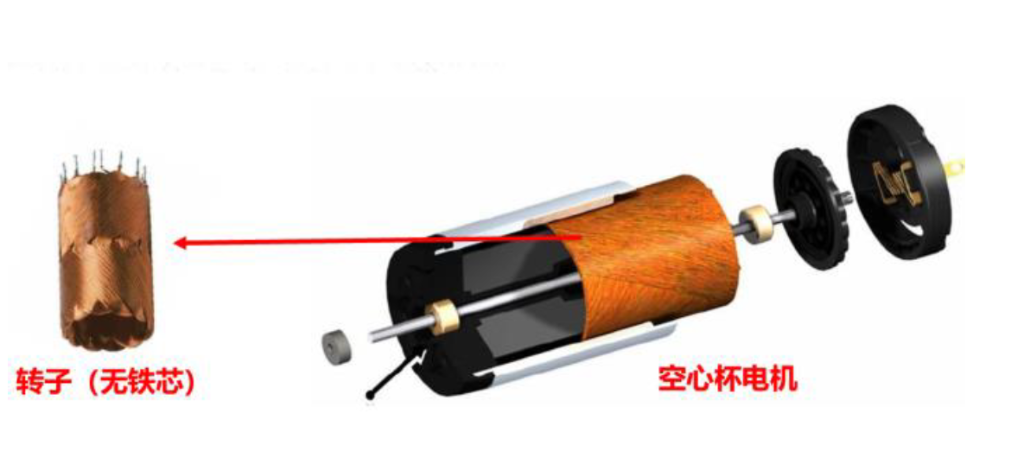

Because the dexterous hand is the final part that determines the robot's execution, it is extremely important and complex, so the motor requirements are extremely high, and a hollow cup motor is needed. Because traditional motors have iron cores, high power loss, and low power generation efficiency, hollow cup motors have higher energy conversion efficiency; second, hollow cup motors respond faster, start and brake more quickly than traditional motors, and compared with iron core motors of the same power, are lighter, have higher energy density, and are more suitable for dexterous hands in humanoid robots.

(hollow cup motor)

Hollow cup motors are used in a wide range of fields. In addition to humanoid robots, they also include traditional fields such as military and industrial automation, but humanoid robots are the only application links that can make this industry explode on a large scale in the future.

In terms of market space, according to the forecast of Huaan Securities, sales volume of humanoid robot dexterous hands is expected to reach 1.38 million by 2028. Assuming that after years of cost reduction, the price of dexterous hands will drop to 20,000 yuan/unit in 2028, then the market for dexterous humanoid robots will reach 27.6 billion yuan by 2028.

Assuming that the current price of hollow cups supplied in batches is 1,000 yuan, the optimistic assumption is that due to large-scale cost reduction, the price will drop to 500 yuan by 2028. If each hand requires 6 hollow cup motors, then the market size increase brought by humanoid robots to hollow cups in 2028 is about 4.14 billion yuan, while the global market size of hollow cup motors in 2022 is only about 5 billion yuan. This is only an increase brought about by future humanoid robots.

Similar to other links, the hollow cup motor market is also dominated by overseas companies, and the market is highly concentrated. CR3 is about 70-80%. Among them, the three overseas giants Maxon, Faulhaber, and Portescap have occupied the high-end market for a long time due to their early start, rich technical experience, and long-term occupation of the high-end market. Their market share is basically divided by the three giants.

Domestic enterprises are developing late, and there is a gap with overseas enterprises in terms of scale and technology accumulation. In terms of scale, the size of domestic enterprises is small, and the size of overseas enterprises is still in the starting period, and the scale of overseas enterprises is large; in terms of technology, the big three overseas companies have been established for over 60 years, have accumulated technology for a long time, and domestic enterprises have accumulated technology for a long time, and there is a big gap with overseas enterprises in terms of power and efficiency. Moreover, domestic hollow cups are still heavily dependent on foreign production capacity, and the localization rate is low.

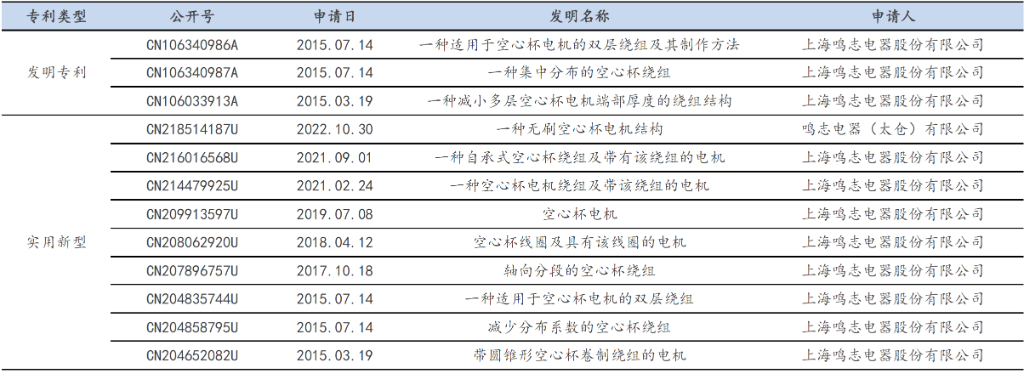

Major domestic companies include Mingzhi Electric, Tuobang Co., Ltd., and Dingzhi Technology. Among them, Mingzhi Electric takes the lead in domestic hollow cup motors and ranks second in the world. It is one of the most powerful domestic companies that can compete with overseas giants. Because of the high process content of hollow cup motors, if you want to develop your own, it takes years of technical paving. Compared with other domestic companies, Mingzhi Electric has been developing hollow cups for nearly 10 years. In recent years, the company has accumulated a total of 12 patents in the field of hollow cup motors. Because leading overseas technology has high patent barriers, Mingzhi Electric's R&D is aimed, on the one hand, at breaking down overseas barriers and building its own professional barriers.

(Anxin Securities)

Narushi Electric is expected to be the first to break through

Mingzhi Electric's main business is to control motors and their drive systems, accounting for about 70-80% of revenue. Specifically, they include stepper motors, DC brushless motors, coreless motors, servo motors, etc. However, since downstream demand has not yet exploded, hollow cup motors have not contributed much to revenue.

Mingzhi Electric's breakthrough in hollow cup motors began with two mergers and acquisitions. In 2015, Mingzhi Electric acquired Lin Engineering in the US, and obtained high-end stepper motor technology after the acquisition. Only then did the product enter the high-end field, while also opening up the North American market. In particular, Switzerland's Technosoft Motion AG was acquired in 2019, and leading technology for hollow cup motors was obtained through the acquisition. Since then, it has established a position in the hollow cup motor industry.

There is still a gap between overseas giants and domestic companies in terms of power, efficiency, etc. The smaller the diameter of the hollow cup motor, the harder it is to make. The technical difficulty is high, and the value is also high. International giant hollow cup motors can reach 3-5 mm in diameter, and few domestic companies have hollow cup motors that can reach 12 mm or less.

Mingzhi Electric is the only domestic company that can achieve a diameter of 8 mm. The size can already be close to Portescap, and the gap with the giants is gradually narrowing. In addition to hollow cup motors, the company in the field of stepper motors also broke Japan's monopoly with its technological advantages, and is the only domestic company that can compete with Europe, America, and Japan.

Most of Mingzhi Electric's downstream customers are giants, including top customers such as Google, Huawei, Amazon, Walmart, GM, Facebook, Dutch ASML, Philips, Tesla Starlink, US B-2 bombers, and GE, as well as industrial giants such as Siemens, Ericsson, Panasonic, Sharp, and Schneider. Some major customers, such as Huawei and Tesla, are deploying humanoid robots. With the accumulation of top customer resources, the possibility of humanoid robot companies receiving orders after mass production has been greatly increased.

However, even if Mingshi Electric, as a leader, tries to enter overseas markets with pure high-end technology, it is still unrealistic in the short term. The really reliable strategy is still the price advantage in the context of technical compliance. For example, for a hollow cup motor with the same 16 mm outer diameter, the price of Mingzhi Electric is only about 28% of Maxon's price. Later, as the industry expanded, costs fell further, and the advantages of domestic substitution were even more obvious.

There are concerns about declining traditional performance. Humanoid robots are the best choice for growth

Looking back at the performance of Mingzhi Electric in the past 10 years, the overall performance is excellent. Operating income increased steadily from 930 million yuan in 2013 to 2.96 billion yuan in 2022, with a compound annual growth rate of 13.7%; gross margin did not fluctuate much in the past 10 years and remained stable at around 37%. Moreover, the company's share of overseas business has increased year by year. Currently, it has exceeded 50%. Since the gross margin of overseas business is generally around 42%, and the domestic gross margin is between 35-37%, which is lower than overseas, the increase in the share of overseas business year by year has also increased the company's average gross profit level.

Although the company has continued to excel over the past ten years, it is also important to pay attention to the pressure on profits after 2022. In 2022, the company's net profit to the mother fell for the first time in ten years, down 11.58% year on year. There was no improvement in 2023. There was no improvement in 2023. Net profit for the first three quarters fell 47.5% year on year. The decline in performance in 2022 was mainly affected by the pandemic, and the harvest was delayed due to extended logistics customs clearance and transportation. However, this year's decline is mainly affected by traditional stepper motors, because stepper motors account for a high share, while demand for downstream communications, industrial automation, security, etc. is weak, and procurement of stepper motors is weak. Other than photovoltaics, etc., demand for servo motors is good, others are still weak. Hollow cup motors are too small, and performance is under pressure.

Similar to other industrial control enterprises, motors, as basic components in the field of industrial control, have remarkable cyclicality. Like other general automation companies such as Huichuan Technology, they are also affected by industry cycles.

Actively laying out a high-growth track such as humanoid robots is also an option for the company to seek further growth.

Summarizing:

Simply put, the explosion of humanoid robots will inevitably drive demand for hollow cup motors. Although the top 3 companies are currently monopolized overseas, some of Mingzhi Electric's products are already comparable to US foreign leaders. With their cost performance advantage, they are expected to benefit first after the industry explodes. Furthermore, although Mingzhi Electric's performance has been growing steadily over the past ten years, profits have continued to be under pressure in the past two years, making it difficult to compete with the impact of the bottom of the industry cycle, so seizing humanoid robots is tantamount to seizing opportunities for the company's future growth.