[Focus on hot topics]

Insai Group (300781.SZ): Holding subsidiaries participate in short drama projects, explore and develop interactive story games, etc.

Insai Group (300781.SZ) announced abnormal fluctuations in stock trading. Recently, hot topics such as AIGC and short dramas have received widespread attention from investors. Relevant products recently released by the company will face risks related to iterative technology updates, product market competition, etc. in the subsequent technology development and application process. There is uncertainty about whether the expected results will be achieved in the future; the company's holding subsidiaries participate in short drama projects, explore and develop interactive story games, etc., currently only for the company to explore and experiment with new businesses. It is expected that all of the above matters will have little impact on the company's 2023 performance.

NetDa Software (603189.SH): The current business does not involve “automatic text generation video technology”

NetDa Software (603189.SH) announced abnormal fluctuations in stock trading. The company's stock closed for three consecutive trading days on November 30, 2023, December 1, 2023, and December 4, 2023, and December 4, 2023, with a cumulative deviation value of more than 20%. According to the “Shanghai Stock Exchange Stock Trading Rules”, this is an abnormal fluctuation in stock trading. Currently, the market is paying close attention to concepts related to “AI video generation,” and the company's current business does not involve “automatic text generation video technology.”

8. Dongan Power (600178.SH): There have been no major changes in fundamentals, and there is no major information that should be disclosed but not disclosed

Dongan Dynamics (600178.SH) announced serious abnormal fluctuations in stock trading. From November 8 to December 4, 2023, the cumulative increase in stocks reached 136.20%, which had been rising for 8 consecutive days. The short-term increase was far higher than the industry and the Shanghai Stock Exchange Index during the same period. However, there were no major changes in the company's fundamentals, and there was no major information that should be disclosed but not disclosed. On November 27, 2023, Changan Automobile published an announcement and signed a “Memorandum of Investment Cooperation” with Huawei. Huawei plans to establish a company engaged in R&D, design, production, sales and service of intelligent automotive systems and component solutions. Changan Automobile plans to invest in the company. The company and Changan Automobile are also holding subsidiaries of China Changan Automobile Group Co., Ltd., and the above cooperation projects do not involve Dongan Power.

Liangpin Store (603719.SH): Price adjustments for some products have little impact on the company's short-term performance

Liangpin Shop (603719.SH) announced abnormal fluctuations in stock trading. The company's stock trading daily closing price deviation value for two consecutive trading days since December 1 and December 4, 2023 has accumulated an abnormal fluctuation in stock trading according to the relevant provisions of the “Shanghai Stock Exchange Trading Rules”. Based on the judgment and understanding of changes in consumer demand, the competitive environment and the current state of the enterprise, the company recently adjusted the prices of some products sold in offline stores. The adjustment range was 10%-47%. The offline store channel revenue of this product in the first half of the year accounted for 13.5% of the total revenue in the first half of the year. This price adjustment had little impact on the company's short-term performance, so investors are kindly requested to pay attention to investment risks. The company's current production and operation activities are normal. There are no major issues affecting the abnormal fluctuations in the company's stock trading price, and there is no major information that should be disclosed but not disclosed.

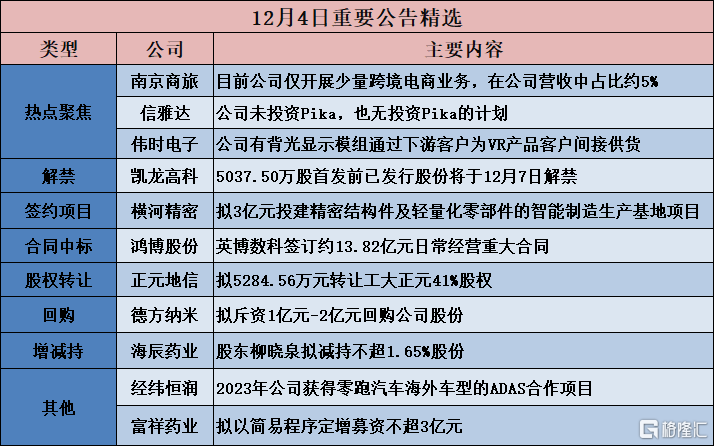

Nanjing Business Travel (600250.SH): Currently, the company only engages in a small number of cross-border e-commerce businesses, accounting for about 5% of the company's revenue

Nanjing Business Travel (600250.SH) announced a stock trading risk warning announcement. Recently, there have been media reports related to the company's name change. The company's name change is in line with the company's “travel+commerce” dual main business development strategy and the characteristics of the current business structure, but there have been no major changes in the company's main business. In the first three quarters of 2023, the company achieved operating income of 605 million yuan, down 7.99% from the same period last year, mainly due to the decline in trade business revenue. Furthermore, there are market rumors that the company is involved in the concept of cross-border e-commerce. Currently, the company only engages in a small number of cross-border e-commerce businesses, accounting for about 5% of the company's revenue, and contributing extremely low net profit.

Xinyada (600571.SH): The company has not invested in Pika and has no plans to invest in Pika

Xinyada (600571.SH) announced a stock trading risk alert announcement. The company's stock closed on three consecutive trading days on November 29, November 30, and December 1, 2023, with a cumulative deviation value of more than 20%. After announcing abnormal fluctuations in stock trading, the company's stock rose and stopped again after the closing price on December 4, 2023. The stock closing price on that day was 13.35 yuan/share. Compared with the closing price of the company's stock on November 28, 2023, the cumulative increase in stock prices reached 31.66%. The short-term increase was far higher than the industry and the Shanghai Stock Exchange Index during the same period. However, there were no major changes in the company's fundamentals, and there were no important matters or important information that should be disclosed but not disclosed. As of the date of this announcement, the company has not invested in Pika and has no plans to invest in Pika. The company does not have any business dealings with Pika, and Guo Wenjing, one of the founders of Pika's development team, does not work for the company. As of the date of this announcement, the company has no products or businesses related to artificial intelligence video generation. The company's current product categories and business scope are quite different from the products and businesses involved in Pika.

Weishi Electronics (605218.SH): The company has backlight display modules that are indirectly supplied to VR product customers through downstream customers

Weishi Electronics (605218.SH) announced abnormal fluctuations in stock trading. The company paid attention to media reports related to the VR concept. The company is mainly engaged in R&D, production and sales of products such as backlight display modules, liquid crystal display modules, touch decorative panels, display components, and intelligent displays. The company has backlight display modules that are indirectly supplied to VR product customers through downstream customers. In 2022, this portion of sales revenue accounted for 2.59% of total revenue, accounting for a relatively low share. The company itself does not produce VR terminal products.

[Contract project]

Shenling Environment (301018.SZ): Plans to invest no less than 400 million yuan to build the “Shenling Special Air Conditioning and Ventilation Equipment Manufacturing (Gaozhou) Project”

Shenling Environment (301018.SZ) announced that it plans to sign the “Shenling Special Air Conditioning and Ventilation Equipment Manufacturing (Gaozhou) Project Investment Agreement” with the Gaozhou Municipal People's Government, the Foshan-Maoming Counterpart Support Cooperation Headquarters, and Maoming Industrial Investment and Development Co., Ltd. to invest in the construction of the “Shenling Special Air Conditioning and Ventilation Equipment Manufacturing (Gaozhou) Project”. The manufacturing base covers an area of about 131.8 acres. It is planned to be built as a R&D and manufacturing base for complete ventilation and air conditioning systems in the nuclear power field and rail transit field. The project plans to invest no less than 400 million yuan in fixed assets. The fixed asset investment amount they are responsible for will be separately agreed between the Industrial Investment Company and Shenling Environmental.

Yokogawa Seimitsu (300539.SZ): Plans to invest 300 million yuan in an intelligent manufacturing production base project for precision structural parts and lightweight components

<投资协议>Yokogawa Precision (300539.SZ) announced that on December 4, 2023, the company held the 13th meeting of the fourth board of directors to deliberate and pass the “Proposal on Proposed Signing and Foreign Investment”. The company plans to sign the “Investment Agreement on the South China Headquarters Project of the South China Headquarters Project in Xiegang Town” with the People's Government of Xiegang Town. The company will invest in the purchase of land use rights located in Renziyuan Village and Zhaolin Village in Xiegang Town through its own capital and self-financing to invest in the construction of an intelligent manufacturing base for precision structural components and lightweight components. The project will be implemented in Dongguan City, Guangdong Province. The planned investment of the project is about RMB 300 million, and the construction period is 18 months.

[Contract won the bid]

Hongbo Co., Ltd. (002229.SZ): InBev Mathematics signed a major contract for daily operations of about 1,382 billion yuan

Hongbo Co., Ltd. (002229.SZ) announced that Beijing Yingbo Mathematics Technology Co., Ltd. (“Yingbo Mathematics”), a wholly-owned subsidiary of the company, recently signed a “Cloud Service Agreement” with Beijing Baichuan Intelligent Technology Co., Ltd. (“Baichuan Intelligence”) in Beijing. During the period of the agreement, InBev Mathematics will provide Baichuan Intelligence with services such as high-performance computing or GPU computing technology. The total transaction amount involved in the agreement is estimated at 1,382 million yuan. If the number of services is increased, the two parties will sign a separate supplementary agreement to confirm the price and execution details.

Yitong Century (300310.SZ): Won the bid for a total of 1,471 billion yuan for the China-Mobile Tietong 2024-2026 (three-year period) comprehensive business support service centralized procurement project (Jiangsu and other regions)

Yitong Century (300310.SZ) announced that it was previously disclosed that the company became one of the winning candidates for the China-Mobile Tietong 2024-2026 (three-year period) comprehensive business support service centralized procurement project (Jiangsu and other regions). Recently, the company received an election notice from the relevant bidding agency and learned that the company became the winning bidder for the above project. The total amount selected was 1,471 billion yuan.

Huaxi Energy (002630.SZ): Leading the bid to win the 1,634 billion yuan domestic waste power plant expansion project design, procurement and construction general contracting (EPC)

Huaxi Energy (002630.SZ) announced that on December 4, 2023, the company received the winning bid notice from Wuhan Green Environmental Protection Energy Co., Ltd. and Wuhan Zongruida Engineering Consulting Co., Ltd., confirming that the consortium formed by the company as the lead person was the winning bidder for the “Southern Wuhan Domestic Waste Power Plant Expansion Project (including the Wuhan Urban Domestic Waste Incineration Power Generation Environmental Protection Upgrading and Renovation Project and the Wuhan Urban Domestic Waste Incineration Power Turbine Generator Set Renovation Project)” design, procurement, and construction general contracting (EPC), which won the bid amount of 1,6342.5 million yuan.

[[Share acquisition]

Zhengyuan Dixin (688509.SH): Plans to transfer 41% of HKIC's shares for 52,8456 million yuan

Zhengyuan Dixin (688509.SH) announced that the 16th meeting of the company's second board of directors deliberated and passed the “Proposal on the Company's Sale of Shares in Holding Subsidiaries and Related Transactions”, which agreed to sell 41% of the shares of the company's holding subsidiary Harbin Institute of Technology Zhengyuan Information Technology Co., Ltd. (“Target Company”, or “Target Company”) to the Zhongnan Bureau of the China Metallurgical Geology Administration (“Zhongnan Bureau”). The share transfer price was RMB 52,8456 million. The sale of shares in the holding subsidiary is conducive to further focusing on the company's main business, enhancing core competitiveness, enhancing core functions, and improving development quality and efficiency.

[[Ban lifted]

Kailong Hi-Tech (300912.SZ): The ban on 503.75 million shares issued before the initial launch will be lifted on December 7

Kailong Hi-Tech (300912.SZ) announced an indicative announcement on the listing and circulation of issued shares prior to the initial public offering. The shares the company lifted from sale restrictions this time are shares issued before the company's initial public offering. The total number of shareholders whose sale restrictions were lifted this time is 7. The number of shares lifted is 503.75 million shares, accounting for 43.7960% of the company's total share capital at present. The sale restriction period is 36 months from the date of listing of the issuer's shares. The listing date for the shares whose sale restrictions have been lifted is December 7, 2023 (Thursday).

[Repurchase]

Great Wall of China (000066.SZ): Plans to repurchase 16 million shares to 23 million shares of the company

The Great Wall of China (000066.SZ) announced that the company plans to use its own capital to repurchase some A-shares already issued by the company through centralized bidding transactions to implement equity incentives. The total amount of capital to be used for the repurchase does not exceed RMB 300 million, and the repurchase price does not exceed RMB 13.02 per share. The number of shares to be repurchased is not less than 16 million shares, not more than 23 million shares, accounting for 0.50%-0.71% of the company's current total share capital. The specific number of shares to be repurchased is based on the number of shares actually repurchased at the end of the repurchase period. The repurchase implementation period is not more than 12 months from the date the board of directors deliberates and approves the share repurchase plan.

German Nano (300769.SZ): Plans to spend 100 million yuan to 200 million yuan to buy back the company's shares

German Nano (300769.SZ) announced that the company plans to use its own capital to buy back the company's shares through centralized bidding. The repurchased company shares are used for equity incentives or employee stock ownership plans. The type of repurchased shares is RMB common stock (A shares) issued by the company. The total capital for this share repurchase is not less than RMB 100 million (inclusive) and no more than RMB 200 million (inclusive), and the repurchase price does not exceed RMB 112.69 per share.

Tianrun Industrial (002283.SZ): Plans to spend 50 million yuan to 100 million yuan to repurchase shares

Tianrun Industrial (002283.SZ) announced that the company plans to use its own capital to repurchase some RMB common stock (A shares) shares already issued by the company through centralized bidding transactions. The shares purchased this time will be used to implement equity incentive plans or employee stock ownership plans. The total capital of this repurchase is not less than RMB 50 million (inclusive), and no more than RMB 10 million (inclusive), and the repurchase price is no more than RMB 9.42 per share (inclusive).

[Increase or decrease holdings]

Haichen Pharmaceutical (300584.SZ): Shareholder Liu Xiaoquan plans to reduce shares by no more than 1.65%

Haichen Pharmaceutical (300584.SZ) announced that Mr. Liu Xiaoquan, a shareholder holding 7,982,608 shares of the company (accounting for 6.65217% of the company's total share capital), plans to reduce his holdings of the company by no more than 1,982,700 shares (1.65225% of the company's total share capital) through centralized bidding and bulk trading within 3 months of 15 trading days from the date of disclosure of the announcement.

China Science Soft (603927.SH): Shareholder Guo Dan plans to reduce his holdings by no more than 4,712,900 shares

China Science Soft (603927.SH) announced that due to personal capital needs, shareholder Ms. Guo Dan plans to reduce her holdings of the company's shares by a total of no more than 4,712,900 shares through centralized bidding and bulk transactions, accounting for no more than 0.7939% of the company's current total shares. The implementation period of this holdings reduction plan is within six months (including the expiration date of the six-month period) from the date the company issued the announcement of this holdings reduction plan.

Qi Xiang Tengda (002408.SZ): General manager Che Chengju increased his holdings by a total of 909.64,400 yuan in company shares

Qi Xiang Tengda (002408.SZ) announced that as of December 4, 2023, the current holdings increase plan period has reached half. General manager Mr. Che Chengju has increased his holdings of the company's shares by a total of 14,752,920 shares through centralized bidding through the Shenzhen Stock Exchange trading system, accounting for 0.52% of the company's total share capital, with an increase of 909.644 million yuan. Based on his firm confidence in the company's future development prospects and a reasonable judgment on the company's stock value, general manager Mr. Che Chengju will continue to implement this plan to increase his holdings in the future.

Yuheng Pharmaceutical (002437. SZ): Shen Zhenyu and his co-actors increased their holdings by a total of 5.36 million shares and plans to continue to increase their shares by 60 million yuan to 80 million yuan

Yuheng Pharmaceutical (002437.SZ) announced that the concerted activist of Shen Zhenyu, a shareholder holding more than 5%, Shanghai Fangyuan Dachuang Investment Partnership (Limited Partnership) (“Shanghai Fangyuan”) (“Shanghai Fangyuan”) through “Shanghai Fangyuan Dachuang Investment Partnership (Limited Partnership) - Fangyuan-Dongfang No. 27 Private Equity Fund” from November 30, 2023 to December 4, 2023, increased the company's shares by a total of 5.36 million shares through centralized bidding, accounting for 0.24% of the company's total share capital, with an increase of 14.16 million yuan (above) Increase in holdings”). Shen Zhenyu and his co-actor, Shanghai Fangyuan, plan to increase their holdings of the company through centralized bidding or bulk transactions within six months from December 5, 2023. The increase amount is not less than RMB 60 million and not more than RMB 80 million.

[Other]

Fuxiang Pharmaceutical (300497.SZ): Plans to increase capital of no more than 300 million yuan using simple procedures for new projects with an annual output of 5,000 tons of carboxylic acid series products, etc.

Fuxiang Pharmaceutical (300497.SZ) announced plans to issue shares to specific targets in 2023 using simple procedures. The total amount of capital raised in this offering does not exceed (inclusive) RMB 300 million. After deducting related issuance expenses, the net capital raised will be used for new projects with an annual output of 5,000 tons of carboxylic acid series products, and 8700,000 million yuan to supplement working capital.

Jingwei Hengrun (688326.SH): In 2023, the company won an ADAS cooperation project for overseas models of Zero Sports cars

Jingwei Hengrun (688326.SH) said on the investor interactive platform that the company's cooperation with Zero Sports is mainly in the business of electronic products, R&D services and solutions. In 2023, the company received an ADAS cooperation project for overseas models of Zero Sports cars.

Soho Hongye (600128.SH): Deferred payment for the purchase of 15 million yuan of China Finance Trust products

Soho Hongye (600128.SH) announced that the company purchased the 15 million yuan Zhongrong-Zhuoli 122 pooled fund trust plan on December 30, 2022, with an expiration date of December 30, 2023. Recently, the company received a notice from Zhongrong Trust regarding the extension of Zhuoli No. 122 product, informing them that trust benefits cannot be distributed when the product's life period expires, and that it will enter an extension period, which is expected to be extended until November 24, 2026.