[Focus on hot topics]

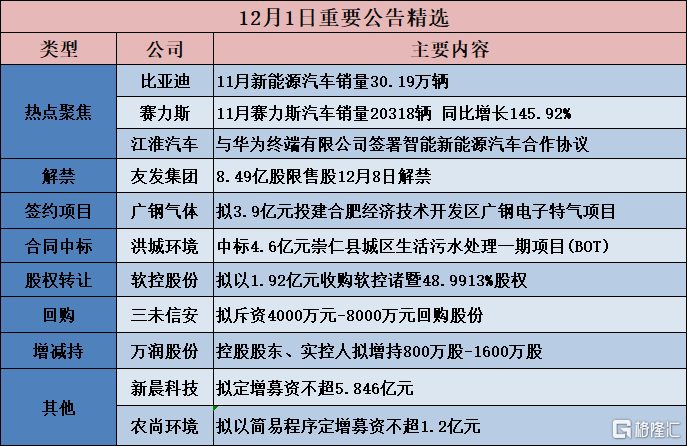

BYD (002594.SZ): November NEV sales volume is 301,900 units

BYD (002594.SZ) announced the November 2023 production and sales report. The sales volume of new energy vehicles in November was 3019.03 million units; the company sold a total of 306.29 million new energy passenger vehicles in November 2023; the company's total installed capacity of new energy vehicle power batteries and energy storage batteries in November 2023 was about 16.945 GWh, and the cumulative total installed capacity in 2023 was about 133.162 GWh.

Jianghuai Automobile (600418.SH): Signed an intelligent new energy vehicle cooperation agreement with Huawei Terminal Co., Ltd.

Jianghuai Automobile (600418.SH) announced that in view of the successful experience of building high-end products in the field of users, JAC will join forces with Huawei terminals and have complementary advantages. The two sides will cooperate fully in product development, manufacturing, sales, service and other fields based on Huawei smart car solutions to focus on building luxury intelligent connected electric vehicles. Through continuous upgrading and iteration of cooperative models, it will meet users' higher demand and expectations for intelligent connected vehicles. Ultimately, it will win the favor and love of users. The two sides follow the principles of equality, voluntariness, fairness, honesty and credit on cooperation matters for new intelligent connected new energy vehicles, reached consensus and reached a cooperation agreement through friendly negotiations.

The product development of cooperative models is the overall responsibility of JAC. The specific division of labor is based on relevant agreements signed between Huawei terminals and/or affiliated companies and JAC. Jianghuai Automobile is responsible for building an advanced production base, giving full play to the advantages of JAC in the advanced manufacturing field, relying on the industrial Internet and mature manufacturing management experience to provide users with comprehensive solutions for intelligent manufacturing, and using the advantages of Huawei terminals in related fields to build advanced manufacturing capabilities, thus achieving efficient delivery of cooperative models. Given that the Huawei terminal has a global sales network and strong brand marketing and user operation capabilities, JAC has agreed that the Huawei terminal or its designated third party will exclusively provide sales services for partner models on a global scale, including but not limited to marketing, sales, users and ecological operations. Export business for cooperative models requires both parties to reach an agreement before it can be implemented.

Cyrus (601127.SH): In November, Cyrus's sales volume of 20,318 vehicles increased 145.92% year on year

Cyrus (601127.SH) announced the November production and sales report. The sales volume of Cyrus cars was 20,318 units, an increase of 145.92% over the previous year.

Zhongguang Tianze (603721.SH): The company's revenue structure does not involve the short drama business

Zhongguang Tianze (603721.SH) announced abnormal fluctuations in stock trading. Recently, there have been media reports that the company is involved in “short drama concept stocks.” Up to now, the company's revenue structure does not involve the short drama business, and the short drama business has no impact on the company's performance. Investors are kindly requested to pay attention to investment risks and invest rationally.

[Contract project]

Dawei Co., Ltd. (300535.SZ): Plans to establish a wholly-owned subsidiary company and invest in the construction of a production base in Cambodia with 5 million US dollars

Dawei Co., Ltd. (300535.SZ) announced that due to the strategic needs of the layout of the international market, the company plans to invest 5 million US dollars (approximately RMB 35.75 million) with its own or self-raised capital. The wholly-owned subsidiary Dawei International (Hong Kong) Co., Ltd. will invest in the establishment of a wholly-owned subsidiary Dawei (Cambodia) Co., Ltd. (tentative name, subject to final local approval and registration). The investment funds will be used for the construction of Dawei Co., Ltd.'s chemical production base in Cambodia. The Cambodian production base plans to invest 5 million US dollars and cover an area of about 90 acres. The construction mainly includes the construction of chemical production lines and the Southeast Asia Operation Center of Dawei Co., Ltd.

Zhongyuan Environmental Protection (000544.SZ): Proposed investment in Yichuan County Sewage Treatment Plant Phase I and Phase II upgrade projects

Zhongyuan Environmental Protection (000544.SZ) announced that the 62nd meeting of the 8th board of directors of the company held on November 30, 2023 deliberated and passed the “Proposal on Investing in the Construction of Phase I and Phase II Upgrading Projects of the Yichuan County Sewage Treatment Plant”. According to the deployment of the Luoyang Water Pollution Prevention and Control Action Plan and the special action requirements for the upgrading of pollution prevention and control facilities in the Yellow River Basin, Zhongyuan Environmental Protection Yichuan Water Co., Ltd. (“Yichuan Water” for short), a wholly-owned subsidiary of the company, is responsible for the Yichuan County Sewage Treatment Plant Phase I and Phase II upgrade projects. The estimated investment amount for the project is 43.13,600 yuan. In the end, the final amount of the project is based on the final settlement amount of the project. The first phase of transformation mainly includes the first phase of biological pond transformation, the first phase of intermediate lifting pump tank transformation, and the first phase of mixed reaction sedimentation tank transformation. The second phase of transformation mainly includes phase II biological pond transformation, phase II intermediate lift pump tank transformation, phase II hybrid reaction sedimentation tank transformation, new denitrification reaction tank, new fiber rotary filter, new blower room, new sludge concentration tank, and new sludge lifting pump room.

Guangzhou Steel Gas (688548.SH): Plans to invest 390 million yuan in the Guanggang Electronic Special Gas Project in Hefei Economic and Technological Development Zone

Guangzhou Steel Gas (688548.SH) announced that in order to expand the electronic gas product category, improve the electronic gas product chain, and enhance the company's market position and brand influence, on December 1, 2023, the company signed an “Investment Agreement” with the Hefei Economic and Technological Development Zone Management Committee, agreeing that the company plans to invest 390 million yuan in the Hefei Economic and Technological Development Zone to build an annual production of 300 tons of electronic grade hydrogen bromide, 1,438 tons of high-purity hydrogen, 35.71 tons of high-purity helium, and 20,000 bottles of alkane mixed gas (hereinafter referred to as “this project”). Construction of this project is scheduled to begin in March 2024, and is expected to be completed and put into operation in December 2025.

[Contract won the bid]

Runjian Co., Ltd. (002929.SZ): Pre-winning the bid for China Telecom Guangxi's communications construction project and maintenance construction services (2023-2025) municipal management project

Runjian Co., Ltd. (002929.SZ) announced that China Telecom Sunshine Procurement Network recently published the “Announcement on Successful Candidates for the Communications Construction Project and Maintenance Construction Services (2023-2025) of China Telecom Guangxi Company”. Runjian Co., Ltd. was the winning candidate for the above project, with a total bid scale of 219.9 million yuan (excluding tax) throughout the service cycle.

Hongcheng Environment (600461.SH): Won the bid of 460 million yuan for the Chongren County Domestic Sewage Treatment Phase I Project (BOT)

Hongcheng Environment (600461.SH) announced that Jiangxi Hongcheng Water Industry Environmental Protection Co., Ltd. (consortium members: Nanchang Water Engineering Co., Ltd., Shanghai Urban Construction Design and Research Institute (Group) Co., Ltd.), a wholly-owned subsidiary of the company, became the winning bidder for the Chongren County Urban Domestic Sewage Treatment Phase I Project (BOT) (project number: AHLF-2023-CR002) through the bidding process. The total bidding investment for the project is 460 million yuan. The project is a franchise (BOT) model.

[[Share acquisition]

Rujing Technology (301525.SZ): Plans to acquire 26.6667% of Rujing Electronic Control's shares for 50 million yuan

Rujing Technology (301525.SZ) announced that on November 30, 2023, the company held the 16th meeting of the first board of directors to deliberate and pass the “Proposal on the Purchase of Minority Shareholders' Shares in Holding Subsidiaries”, and agreed that the company would use 50 million yuan of its own capital to transfer 26.6667% of Rujing Electronic Control Technology Co., Ltd. (“Rujing Electronic Control”)'s minority shareholder Zhang Wei from Shanghai Rujing Electronic Control Technology Co., Ltd. (“Rujing Electronic Control”). After the transaction is completed, the company will hold 100% of the shares in Rujing Electronic Control.

HKUST Intelligence (300222.SZ): Smart Electric plans to transfer 50% of Hefei Technology Corporation's shares to Songuo Technology for 50 million yuan

HKUST Intelligence (300222.SZ) announced that on December 1, 2023, HKUST Intelligent Electric Technology Co., Ltd. (“Smart Electricity”), a wholly-owned subsidiary of HKUST Intelligent Technology Co., Ltd., Hefei Songuo Power Technology Partnership (Limited Partnership) (“Songuo Technology”), and HKUST Intelligent (Hefei) Technology Co., Ltd. (“Hefei Technology Company”) jointly signed “HKUST Electric Technology Co., Ltd. and Hefei Songuo Power Technology Partnership (Limited Partnership), and HKUST Intelligence (Hefei) Technology Co., Ltd. on HKUST Intelligence (Limited Partnership) (Fertilizer) Technology According to the “Stock Transfer Agreement of Co., Ltd.”, Intelligent Electric plans to transfer 50% of the shares of Hefei Technology Company, a holding subsidiary holding 70% of the shares (corresponding to registered capital of 25 million yuan) to Songuo Technology, at 50 million yuan. Other current shareholders of Hefei Technology Company, the Hefei Smart Joy Charge Intelligent Technology Partnership (Limited Partnership) (limited partnership) (“Smart Joy Charge”) agreed to relinquish priority purchasing rights in this transaction.

China Merchants Highway (001965.SZ): No more than 291 million yuan to acquire 2% shares of China Merchants China Railway

China Merchants Highway (001965.SZ) announced that the company intends to acquire ICBC Financial Asset Investment Co., Ltd. (“ICBC Investment”) to hold 2% of the shares of China Merchants Railway Holdings Limited (“China Merchants Railway” or the “target company”). Since the company acquires 2% of China Merchants Railway's shares, China Merchants China Railway will become the holding subsidiary of the company's consolidated statement. According to the regulatory rules of listed companies, the matter still needs to be submitted to the China Merchants Highway Shareholders' Meeting for approval. There is still uncertainty about whether this matter can be completed. Investors are kindly requested to pay attention to investment risks. The transaction price did not exceed 290.87 million yuan.

Chengmai Technology (300598.SZ): Plans to transfer 12.1429% of Tongxin Software's shares to Jiashu Investment for 850 million yuan

Chengmai Technology (300598.SZ) announced that the company (“Party A”) currently holds 32.54% of the shares of Tongxin Software Technology Co., Ltd. (“Tongxin Software”). The company plans to transfer 12.1429% of its shares in Tongxin Software to Beijing Jiashu Investment Co., Ltd. (“Jiashu Investment” or “Party B” for short) at a price of RMB 850 million. According to the provisions of the “Shenzhen Stock Exchange Venture Market Stock Listing Rules” and “Articles of Association”, this transaction does not constitute a related transaction, nor does it constitute a material asset restructuring as stipulated in the “Administrative Measures on Major Asset Restructurings of Listed Companies”.

China Xidian (601179.SH): Plans to transfer 62.96% of Hengchi Electric's shares for 123 million yuan

China Xidian (601179.SH) announced that in order to further optimize the company's business layout, promote the healthy and sustainable development of the company's switching business, and enhance the company's overall operating efficiency, on November 30, 2023, the 21st meeting of the fourth board of directors of the company deliberated and passed the “Proposal on China Xidian's acquisition of 62.96% of Hengchi Electric's shares through a private agreement”, and all five related directors avoided voting. The independent directors of the company issued prior approval opinions and independent opinions in agreement, agreeing that the company would transfer 62.96% of Hengchi Electric's shares held by China Xidian Group through a private agreement, with a transaction amount of 122,9075 million yuan.

Soft Holdings (002073.SZ): Plans to acquire 48.9913% of Soft Control Zhuji's shares for 192 million yuan

Soft Holdings (002073.SZ) announced that the company plans to sign an “Share Transfer Agreement” with Zhuji Gaoying Equity Investment Partnership (Limited Partnership) (“Gaoying Investment”) to acquire all of Gaoying Investment's 48.9913% shares in Soft Control (Zhuji) Intelligent Equipment Co., Ltd. (“Soft Control Zhuji”) for RMB 1920.9 million. After the acquisition is completed, Soft Control Zhuji will become a wholly-owned subsidiary of the company and continue to be included in the scope of the company's consolidated statements.

[[Ban lifted]

Youfa Group (601686.SH): The ban on 849 million restricted shares was lifted on December 8

Youfa Group (601686.SH) announced that the total number of shares listed and distributed is 849 million shares. The current stock listing and circulation date is December 8, 2023.

Hanghua Co., Ltd. (688571.SH): 173 million restricted shares will be listed and distributed from December 11

Hanghua Co., Ltd. (688571.SH) announced that the number of restricted shares listed and circulated is 2, holding a total of 173 million limited shares, accounting for 41.4975% of the company's current total share capital. This portion of the restricted shares will be listed and distributed on December 11, 2023.

[Repurchase]

Sanwei Xin'an (688489.SH): Plans to spend 40 million yuan to 80 million yuan to repurchase shares

Sanwei Xin'an (688489.SH) announced that the company plans to use its own capital to repurchase the company's shares through centralized bidding transactions through the Shanghai Stock Exchange trading system. The shares purchased this time are intended to be used for employee stock ownership plans or equity incentives. The total repurchase capital is not less than RMB 40 million (inclusive) and no more than RMB 80 million (inclusive). The repurchase price does not exceed RMB 73.33 per share (inclusive).

[Increase or decrease holdings]

Shengyi Electronics (688183.SH): Guohong Investment increased the company's shares by a total of 10 million yuan

Shengyi Electronics (688183.SH) announced that from the date of disclosure of the shareholding increase plan to December 1, 2023, Guohong Investment has accumulated an increase of 863,936 shares of the company's shares through centralized bidding through the Shanghai Stock Exchange trading system, accounting for 0.10% of the company's total share capital. The total increase amount is about RMB 10 million. It has reached 50% of the minimum amount of RMB 20 million in the current holdings increase plan. Entities that have increased their holdings will continue to increase their holdings of the company during the implementation period of the increase in holdings in accordance with the relevant plans to increase their holdings.

Wanrun Co., Ltd. (002643.SZ): Controlling shareholders and actual controllers plan to increase their holdings by 8 million shares - 16 million shares have increased their holdings by 175,000 shares

Wanrun Co., Ltd. (002643.SZ) announced that on December 1, 2023, the company received the “Notice of China Energy Conservation and Environmental Protection Group Co., Ltd. on the increase in holdings of Wanrun Company and the plan to increase its holdings”. The company's controlling shareholder and actual controller, China Energy Conservation and Environmental Protection Group Co., Ltd. (“China Energy Saving”) increased its holdings by 175,000 shares through centralized bidding transactions on December 1, 2023. The increase amount was RMB 2,797,850, with an average increase of 15.99 yuan/share, accounting for the company's current total share capital of 930,130,215 shares 0.0188% In addition, China's energy saving plan uses its own capital through centralized bidding transactions within 6 months from December 1, 2023, to choose an opportunity to increase the company's shares at an appropriate price. The proposed increase in the number of shares held is not less than 8 million shares and no more than 16 million shares (including the increase on December 1, 2023).

[Other]

Xinchen Technology (300542.SZ): Proposed capital increase of no more than 584.6 million yuan for next-generation banking digital intelligent platform projects, etc.

Xinchen Technology (300542.SZ) announced plans to issue A-shares to specific targets in 2023. The number of shares issued to specific targets this time does not exceed 89 million shares (including principal amount). The total amount of capital raised by issuing shares to specific targets is expected to be no more than 584.6 million yuan (including capital) for next-generation bank digital intelligent platform projects, intelligent airport take-off and landing safety management system R&D and upgrading projects, R&D center construction projects, and supplementary working capital.

Zhuoyi Technology (002369.SZ): Controlling shareholder and actual controller Xia Chuanwu has been approved for arrest

Zhuo Yi Technology (002369.SZ) announced that on December 1, 2023, the company received the “Notice of Arrest” issued by the Shenzhen Public Security Bureau from the Shenzhen Public Security Bureau from the family of Mr. Xia Chuanwu, the controlling shareholder and actual controller of the company. It learned that Mr. Xia Chuanwu was arrested by the Shenzhen Municipal Public Security Bureau on December 1, 2023, with the approval of the Shenzhen Intermediate People's Court on December 1, 2023, on suspicion of insider trading and manipulation of the securities market. Mr. Xia Chuanwu resigned as general manager and chairman of the company in May 2018 and August 2018 respectively. After resigning, he did not hold a specific position in the company.

Nongshang Environment (300536.SZ): It is proposed to raise no more than 120 million yuan in additional capital using simple procedures for display panel drive technology development, application and industrialization projects

Nongshang Environment (300536.SZ) announced plans to issue shares to specific targets in 2023 using simple procedures. The total capital raised in this offering does not exceed 120 million yuan (including 120 million yuan). The net capital raised after deducting issuance fees will all be used for display panel drive technology development, application and industrialization projects.