Whales with a lot of money to spend have taken a noticeably bearish stance on MongoDB.

Looking at options history for MongoDB (NASDAQ:MDB) we detected 17 trades.

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 58% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $56,960 and 15, calls, for a total amount of $950,401.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $260.0 to $500.0 for MongoDB during the past quarter.

Analyzing Volume & Open Interest

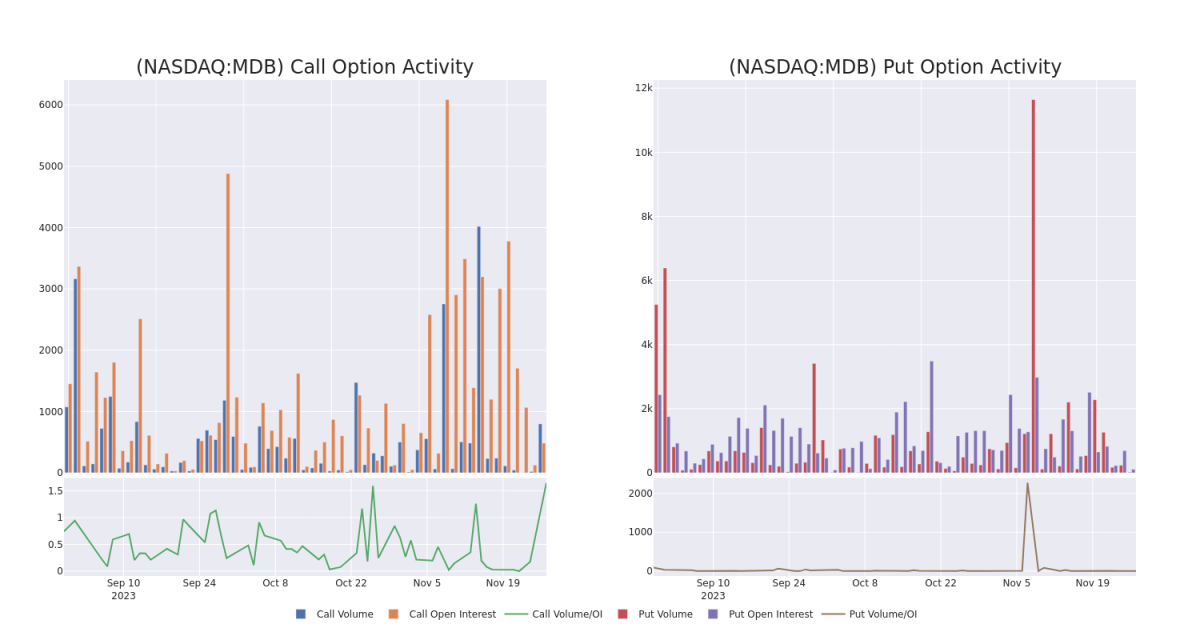

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for MongoDB's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of MongoDB's whale activity within a strike price range from $260.0 to $500.0 in the last 30 days.

MongoDB Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| MDB | CALL | TRADE | BULLISH | 06/21/24 | $410.00 | $109.1K | 310 | 31 |

| MDB | CALL | TRADE | BULLISH | 06/21/24 | $410.00 | $104.9K | 310 | 91 |

| MDB | CALL | TRADE | BULLISH | 06/21/24 | $410.00 | $101.0K | 310 | 45 |

| MDB | CALL | TRADE | BEARISH | 06/21/24 | $410.00 | $91.7K | 310 | 104 |

| MDB | CALL | TRADE | BULLISH | 06/21/24 | $410.00 | $78.3K | 310 | 57 |

About MongoDB

Founded in 2007, MongoDB is a document-oriented database with nearly 33,000 paying customers and well past 1.5 million free users. MongoDB provides both licenses as well as subscriptions as a service for its NoSQL database. MongoDB's database is compatible with all major programming languages and is capable of being deployed for a variety of use cases.

Following our analysis of the options activities associated with MongoDB, we pivot to a closer look at the company's own performance.

Where Is MongoDB Standing Right Now?

- Trading volume stands at 577,702, with MDB's price down by -0.3%, positioned at $406.46.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 8 days.

Professional Analyst Ratings for MongoDB

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $452.3333333333333.

- In a positive move, an analyst from Capital One has upgraded their rating to Overweight and adjusted the price target to $427.

- Reflecting concerns, an analyst from Wells Fargo lowers its rating to Overweight with a new price target of $500.

- An analyst from Truist Securities has revised its rating downward to Buy, adjusting the price target to $430.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest MongoDB options trades with real-time alerts from Benzinga Pro.