Most readers would already be aware that CETC Cyberspace Security Technology's (SZSE:002268) stock increased significantly by 15% over the past month. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on CETC Cyberspace Security Technology's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for CETC Cyberspace Security Technology

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for CETC Cyberspace Security Technology is:

6.3% = CN¥332m ÷ CN¥5.3b (Based on the trailing twelve months to September 2023).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each CN¥1 of shareholders' capital it has, the company made CN¥0.06 in profit.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company's earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of CETC Cyberspace Security Technology's Earnings Growth And 6.3% ROE

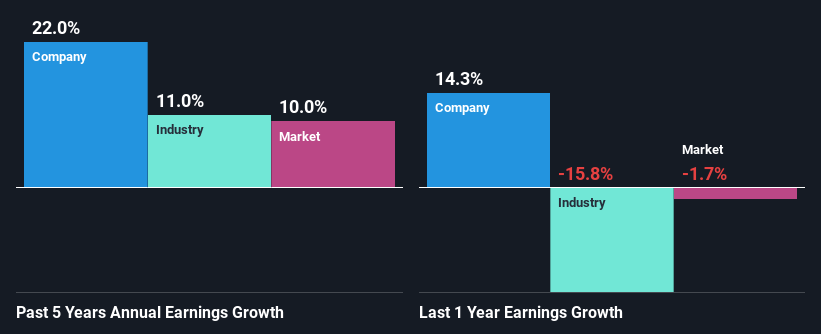

When you first look at it, CETC Cyberspace Security Technology's ROE doesn't look that attractive. However, its ROE is similar to the industry average of 6.5%, so we won't completely dismiss the company. Looking at CETC Cyberspace Security Technology's exceptional 22% five-year net income growth in particular, we are definitely impressed. Taking into consideration that the ROE is not particularly high, we reckon that there could also be other factors at play which could be influencing the company's growth. Such as - high earnings retention or an efficient management in place.

Next, on comparing with the industry net income growth, we found that CETC Cyberspace Security Technology's growth is quite high when compared to the industry average growth of 11% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if CETC Cyberspace Security Technology is trading on a high P/E or a low P/E, relative to its industry.

Is CETC Cyberspace Security Technology Efficiently Re-investing Its Profits?

CETC Cyberspace Security Technology's three-year median payout ratio to shareholders is 15%, which is quite low. This implies that the company is retaining 85% of its profits. So it seems like the management is reinvesting profits heavily to grow its business and this reflects in its earnings growth number.

Besides, CETC Cyberspace Security Technology has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders.

Conclusion

Overall, we feel that CETC Cyberspace Security Technology certainly does have some positive factors to consider. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.