Gelonghui November 20 | Due to repurchase matters, on November 15, Dongfang Yuhong announced the latest list of the top ten shareholders as of November 13. This latest shareholder list revealed that Zhu Shaoxing increased his position in the fourth quarter.

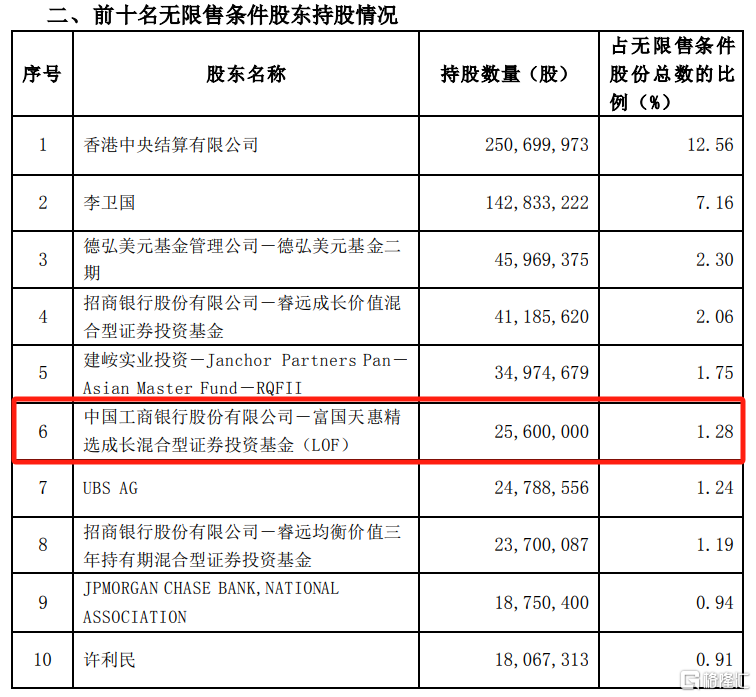

Compared to the end of the third quarter of this year, Zhu Shaoxing's Fuguo Tianhui Select Growth Hybrid Securities Investment Fund has increased its position by 1.1 million shares. The latest number of shares held is 25.6 million shares. According to incomplete statistics, Zhu Shaoxing may have increased his position or spent more than 26 million yuan in capital.

(Source: Dongfang Yuhong announcement)

Zhu Shaoxing initially bought Dongfang Yuhong in 2016 and made several high-frequency deals in the middle. This is the third time since this year that Zhu Shaoxing has publicly increased his holdings in Dongfang Yuhong. According to Fuguo Tianhui Fund's announcement, during the second quarter of this year, fund products increased the holdings of Dongfang Yuhong, which was further strengthened in the third quarter, and added to the company's top ten shareholders list at the end of the third quarter of this year. As of November 13, it had once again increased its position of 1.1 million shares in the fourth quarter.

Dongfang Yuhong began adjustments after reaching a record high of 63.74 yuan/share in June 2021. The stock price hit 21.68 yuan/share on November 17, hitting a new low. The stock price fell more than 65% from its high point.

Dongfang Yuhong mainly engages in waterproofing business. Influenced by the real estate industry chain, its performance declined last year. In 2022, Dongfang Yuhong achieved revenue of 31,214 billion yuan, a year-on-year decrease of 2.25%; net profit of 2.118 billion yuan, a year-on-year decrease of 49.73%.

In the first three quarters of 2023, Dongfang Yuhong achieved revenue of 25.36 billion yuan, an increase of 8.48% over the previous year; net profit of the mother was 2.353 billion yuan, an increase of 42.22% over the previous year.

As of the third quarter of this year, investment veteran Zhu Shaoxing managed a scale of 30.877 billion yuan, a decrease of 1,265 billion yuan from the end of the second quarter. In the third quarter, Zhu Shaoxing greatly increased his holdings in Jerry, a leading private oil service company. The number of shares held increased from 7.5 million shares at the end of the second quarter to 29 million shares at the end of the third quarter, making it the third largest shareholding stock.

(The content of this article is a list of objective data and information and does not constitute any investment advice)

In addition, Zhu Shaoxing increased his holdings in Bank of Ningbo, Lixun Precision, Hualu Hengsheng, Jinyu Medicine, Chunfeng Power, China Porcelain Materials, and Oriental Yuhong; and reduced his holdings in Kweichow Moutai and Aier Ophthalmology in the third quarter.

In terms of industry allocation, Zhu Shaoxing covered almost all industries, where rain and dew spread evenly. At the same time, shareholding concentration was low all year round, which fully validates his investment style of maintaining a balanced and diversified investment throughout the year.

Regarding Zhu Shaoxing's balanced style, he once said, “He never takes extreme positions in a certain industry or style theme. Because the portfolio is balanced, it is difficult to achieve the ultimate performance, and it is also difficult to enter the top few rankings in the market.”