Renrui Human Resources Technology Holdings Limited (HKG:6919) shareholders have had their patience rewarded with a 28% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 10.0% in the last twelve months.

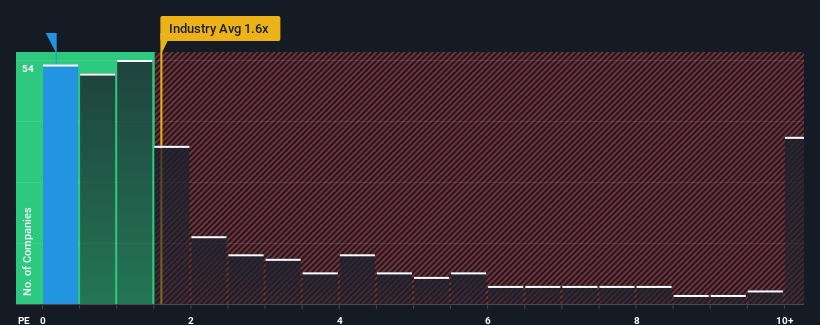

In spite of the firm bounce in price, Renrui Human Resources Technology Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Professional Services industry in Hong Kong have P/S ratios greater than 1x and even P/S higher than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Renrui Human Resources Technology Holdings

How Renrui Human Resources Technology Holdings Has Been Performing

The recently shrinking revenue for Renrui Human Resources Technology Holdings has been in line with the industry. It might be that many expect the company's revenue performance to degrade further, which has repressed the P/S. You'd much rather the company continue improving its revenue if you still believe in the business. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Renrui Human Resources Technology Holdings.How Is Renrui Human Resources Technology Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Renrui Human Resources Technology Holdings' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.6%. Even so, admirably revenue has lifted 65% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 23% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 12%, which is noticeably less attractive.

In light of this, it's peculiar that Renrui Human Resources Technology Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Renrui Human Resources Technology Holdings' P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Renrui Human Resources Technology Holdings' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Renrui Human Resources Technology Holdings that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.