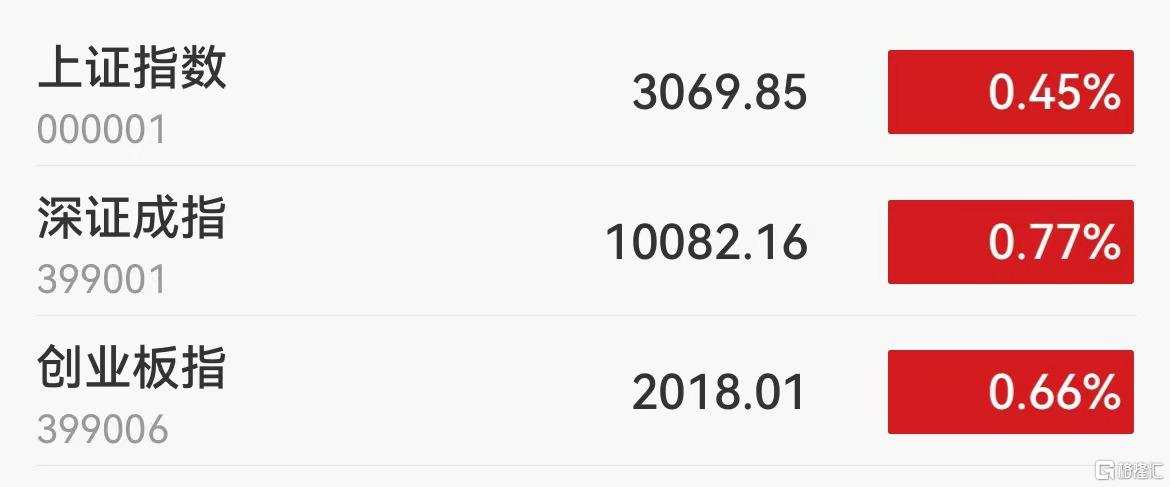

The three major A-share indices fluctuated slightly after opening high today. The Shanghai Index closed up 0.45% to 3069.85 points in the morning; the Shenzhen Stock Exchange Index rose 0.77%, and the GEM Index rose 0.66%.

The three major A-share indices fluctuated slightly after opening high today. By the midday closing, the Shanghai Index had risen 0.45% to 3069.85 points; the Shenzhen Stock Exchange Index had risen 0.77%, and the GEM Index had risen 0.66%. Nearly 3,600 shares in the two markets rose, with half-day transactions of 647.7 billion yuan, and net capital purchases from going north exceeded 4.9 billion yuan.

On the market, the non-metallic materials sector led the way, and Longgao Co., Ltd. continued to be active; the salt lake lithium extraction concept continued to be active; Jinyuan shares and Xianfeng Holdings rose and stopped; the power equipment sector generally rose; King Kong Photovoltaics and Funeng Dongfang rose and stopped by 20cm; and the steel, auto parts, and consumer electronics sectors registered the highest gains. Furthermore, the lithography sector led the decline, with Fullerton falling by more than 7%; the pharmaceutical commercial sector fell, and Runda Healthcare fell 6.5%; the gaming sector generally fell, with Chinese online falling 3.9%; and sectors such as national defense, military industry, and China shipping had the highest declines.

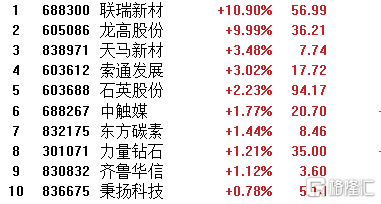

The non-metallic materials sector led the way. Longgao Co., Ltd. had 4 consecutive shares, Lianrui New Materials rose 10.9%, and Tianma New Materials and Suotong Development rose more than 3%.

The concept of lithium extraction from Salt Lake continued to be active. Jinyuan, Xianfeng Holdings, and Chuaneng Power rose and stopped, and Tiantie Co., Ltd. rose 13.6%.

The power equipment sector generally rose. King Kong Photovoltaics and Funeng Dongfang rose and stopped by 20cm, One Stone Pass rose nearly 15%, and Tongxiang Technology rose nearly 12%.

The lithography sector led the decline. Fuller fell by more than 7%, Maolai Optics and Tengjing Technology fell by more than 5%, and Lan Ying Equipment and Wavelength Optoelectronics followed suit.

The pharmaceutical business sector declined. Runda Healthcare fell 6.5%, while the citizens of Yixintang, Jianzhijia, Shuyu, and ordinary people all fell by more than 2%.

The gaming sector generally declined. Chinese online fell 3.9%, Shengtian Internet fell 3.3%, and Mingchen Health fell nearly 3%.