What is the impact?

On November 15, Beijing time, the international index compiling company MSCI announced the results of the November quarterly index review. Among them, the MSCI China A-share index added 17 A shares, excluding 10, and all changes will take effect after the market closes on November 30, 2023.

In this adjustment, the MSCI ACWI Index will add 46 stocks, excluding 69 stocks. According to the company's total market value ranking, the top three new places in the MSCI Global Index are Vertiv Holdings A (US stocks), Celsius Holdings (US stocks), and Leonardo (Italy); the top three in the MSCI Emerging Markets Index are Tata Motors A (India), Amman Mineral International Tbk PT (Indonesia), and China Broadcasting Corporation (China).

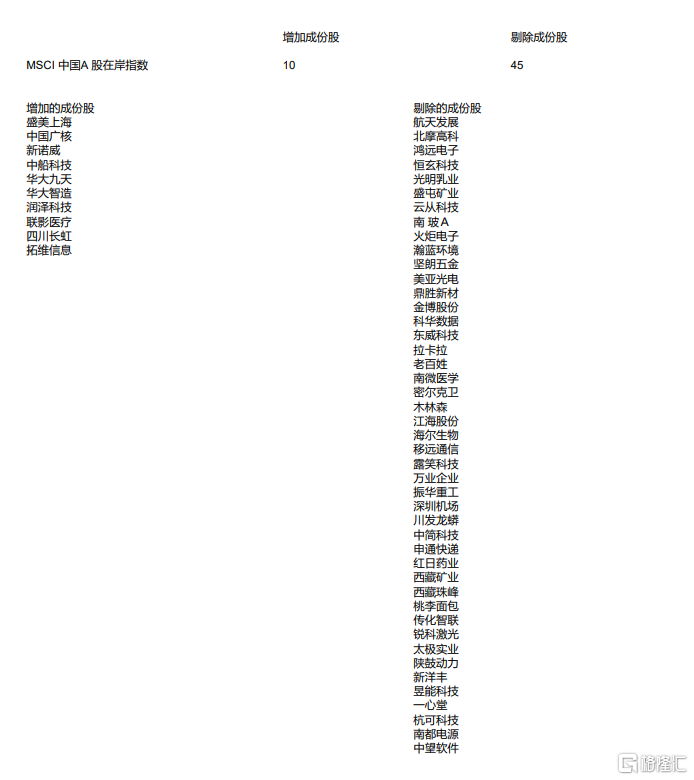

MSCI China A-share Onshore Index10 new shares were added, and 45 shares were removed. Among them, CGN, Lianying Medical, Huada Jiutian, Sichuan Changhong, Tuowei Information, etc. were added, and Yuncong Technology, China Southern Glass A, Taopan, etc. were removed.

MSCIThe China All-Stock Small Cap Index added 146 new shares, excluding 77 stocks.MSCI Hong Kong IndexThe Jiulongcang Group was added, and no individual stocks were excluded.

MSCI China Index19 new stocks were added and 19 stocks were removed. The newly included individual stocks include Zero Sports Auto, Brilliance China, Huiding Technology, etc.; the excluded stocks include China Resources Cement, Jiumaojiu, and Meidong Auto.

MSCI China A Shares IndexSeventeen new stocks were added, and 10 stocks were excluded. The newly added individual stocks include Ophite, Heilan Home, Tianfeng Securities, and Zhangjiang Hi-Tech. The excluded stocks include Fuling Mustard, CNNC Titanium White, and Daikin Heavy Industries.

What signal does it reflect?

MSCI IndexIt is a series of global stock market indices compiled and published by MSCI (Morgan Stanley Capital International). The MSCI Index covers stock markets in many countries and regions and is used to measure investment performance and risk in different markets. Generally, MSCI will evaluate index constituent stocks in the middle of every quarter (mid-February/mid-May/mid-August/mid-November) to decide whether to add or remove them.

MSCI divides different indices according to various dimensions such as market capitalization, region, industry, and theme. Among the many indices involving Chinese assets, what do people pay the most attention toMSCI China Index.Among them, the MSCI China Index covers representatives of large and medium-sized stocks of A shares, H shares, B shares, red chip stocks, and P shares, and overseas listings (such as ADR). The MSCI China Index is one of the important reference indicators that investors around the world pay attention to. It is widely used to measure the performance of the Chinese stock market, conduct market comparisons, and build portfolios.

The trend of the MSCI China Index in recent years Source: MSCI official website

As the constituent stocks of multiple MSCI indices are adjusted, the positions of the relevant index funds will also be adjusted accordingly. The newly included companies will receive more capital allocation, the excluded companies will be passively sold by the relevant index funds, and the relevant individual stocks may experience an “abnormal” increase in trading volume and volatility, especially at the end of the session.

In terms of stock prices, after the results are announced until the official implementation date, some arbitrage funds will lay out corresponding individual stocks based on the official results, especially those unexpected results that were not fully predicted by the market before.

However, by the date of the official implementation of the adjustments, although passive capital “must” be adjusted, actual changes in stock prices are not necessarily in line with the direction of weight adjustments. Instead, they will be more affected by the comparison of strengths and weaknesses between early arbitrage funds and passive capital. Previously, there was no shortage of situations where the stock prices of newly included or weighted individual stocks fell on the day the adjustments were implemented.