Lumentum Holdings Inc.'s (NASDAQ:LITE) CEO Might Not Expect Shareholders To Be So Generous This Year

Lumentum Holdings Inc.'s (NASDAQ:LITE) CEO Might Not Expect Shareholders To Be So Generous This Year

Key Insights

關鍵見解

- Lumentum Holdings will host its Annual General Meeting on 17th of November

- Salary of US$980.8k is part of CEO Alan Lowe's total remuneration

- The total compensation is similar to the average for the industry

- Over the past three years, Lumentum Holdings' EPS fell by 73% and over the past three years, the total loss to shareholders 52%

- Lumentum Holdings將於11月17日舉辦年度股東大會

- 98.08萬美元的薪水是首席執行官艾倫·洛威總薪酬的一部分

- 總薪酬與該行業的平均水平相似

- 在過去三年中,Lumentum Holdings的每股收益下降了73%,在過去三年中,股東的總虧損爲52%

The results at Lumentum Holdings Inc. (NASDAQ:LITE) have been quite disappointing recently and CEO Alan Lowe bears some responsibility for this. At the upcoming AGM on 17th of November, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

Lumentum Holdings Inc.(納斯達克股票代碼:LITE)最近的業績相當令人失望,首席執行官艾倫·洛對此負有一定責任。在即將於11月17日舉行的股東大會上,股東們可以聽取董事會的意見,包括他們扭轉業績的計劃。這也將是股東通過對高管薪酬等公司決議進行投票來影響管理層的機會,這可能會對公司產生重大影響。我們在下面提供的數據解釋了爲什麼我們認爲首席執行官的薪酬與最近的表現不一致。

See our latest analysis for Lumentum Holdings

查看我們對 Lumentum Holdings 的最新分析

How Does Total Compensation For Alan Lowe Compare With Other Companies In The Industry?

與業內其他公司相比,艾倫·洛威的總薪酬如何?

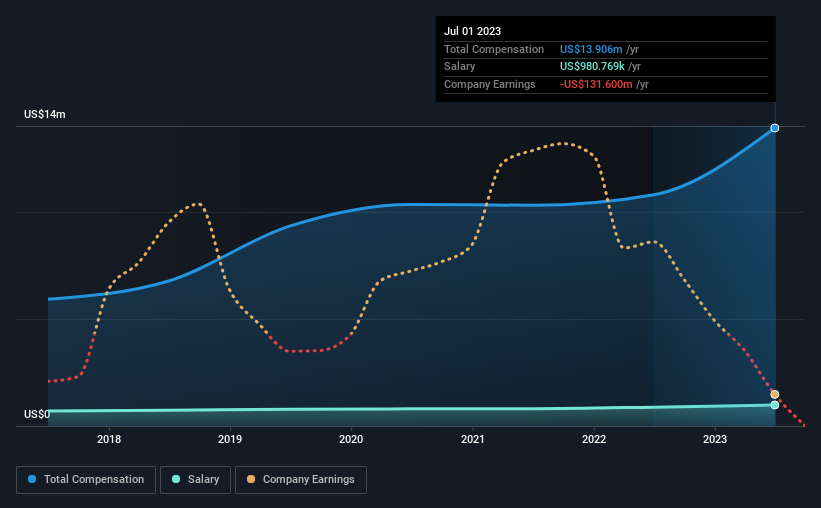

At the time of writing, our data shows that Lumentum Holdings Inc. has a market capitalization of US$2.6b, and reported total annual CEO compensation of US$14m for the year to July 2023. That's a notable increase of 29% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$981k.

在撰寫本文時,我們的數據顯示,Lumentum Holdings Inc.的市值爲26億美元,截至2023年7月的一年中,首席執行官的年薪總額爲1400萬美元。這比去年顯著增長了29%。雖然我們總是首先考慮總薪酬,但我們的分析表明,薪資部分較少,爲98.1萬美元。

In comparison with other companies in the American Communications industry with market capitalizations ranging from US$2.0b to US$6.4b, the reported median CEO total compensation was US$14m. From this we gather that Alan Lowe is paid around the median for CEOs in the industry. Moreover, Alan Lowe also holds US$3.5m worth of Lumentum Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

與市值介於20億美元至64億美元之間的美國通信行業其他公司相比,報告的首席執行官總薪酬中位數爲1400萬美元。由此我們可以得出結論,艾倫·洛威的薪水與該行業首席執行官的薪水中位數差不多。此外,艾倫·洛威還直接以自己的名義持有價值350萬美元的Lumentum Holdings股票,這向我們表明他們在該公司擁有大量個人股份。

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$981k | US$881k | 7% |

| Other | US$13m | US$9.9m | 93% |

| Total Compensation | US$14m | US$11m | 100% |

| 組件 | 2023 | 2022 | 比例 (2023) |

| 工資 | 98.1 萬美元 | 88.1 萬美元 | 7% |

| 其他 | 1300 萬美元 | 990 萬美元 | 93% |

| 總薪酬 | 1400 萬美元 | 1100 萬美元 | 100% |

Talking in terms of the industry, salary represented approximately 20% of total compensation out of all the companies we analyzed, while other remuneration made up 80% of the pie. Lumentum Holdings pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

就行業而言,在我們分析的所有公司中,工資約佔總薪酬的20%,而其他薪酬佔總薪酬的80%。與整個行業相比,Lumentum Holdings通過工資支付的薪酬微不足道。如果非工資薪酬在總薪酬中占主導地位,則表明高管的薪水與公司業績息息相關。

A Look at Lumentum Holdings Inc.'s Growth Numbers

看看 Lumentum Holdings Inc.”s 增長數字

Lumentum Holdings Inc. has reduced its earnings per share by 73% a year over the last three years. In the last year, its revenue is down 11%.

在過去三年中,Lumentum Holdings Inc.的每股收益每年減少73%。去年,其收入下降了11%。

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

很少有股東會高興地得知每股收益下降了。當你考慮到收入同比下降時,印象會更糟。很難說該公司正在全力以赴,因此股東可能不願接受高額的首席執行官薪酬。展望未來,您可能需要查看這份關於分析師對公司未來收益預測的免費可視化報告。

Has Lumentum Holdings Inc. Been A Good Investment?

Lumentum Holdings Inc. 是一筆不錯的投資嗎?

The return of -52% over three years would not have pleased Lumentum Holdings Inc. shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

三年內-52%的回報率不會讓Lumentum Holdings Inc.的股東感到高興。這表明該公司向首席執行官支付過於慷慨的工資是不明智的。

In Summary...

總而言之...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

股東不僅沒有獲得可觀的投資回報,而且業務表現也不佳。很少有股東願意向首席執行官加薪。在即將舉行的股東周年大會上,董事會將有機會解釋其計劃採取的改善業務績效的措施。

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Lumentum Holdings that investors should think about before committing capital to this stock.

儘管首席執行官薪酬是一個需要注意的重要因素,但投資者還應注意其他領域。這就是爲什麼我們進行了一些挖掘並確定了Lumentum Holdings的1個警告信號,投資者在向這隻股票投入資金之前應該考慮這個警告。

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

可以說,業務質量比首席執行官的薪酬水平重要得多。因此,請查看這份具有高股本回報率和低債務的有趣公司的免費清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。我們僅使用公正的方法提供基於歷史數據和分析師預測的評論,我們的文章並非旨在提供財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不會考慮最新的價格敏感型公司公告或定性材料。華爾街只是沒有持有上述任何股票的頭寸。