There has been a negative increase in power battery production, and the removal of batteries to storage has not been reversed

In the traditional “gold nine silver ten” peak season, when the NEV market performed well this year, although the power battery market continued to grow, the growth rate of installed capacity in October had clearly slowed, and production even experienced a rare month-on-month decline. The main reason was that the increase in sales of terminal new energy vehicles fell short of expectations.

In October of this year, domestic sales of new energy passenger vehicles were 767,000 units, a month-on-month growth rate of only 2.7%, and a year-on-year increase of only 37.5%.

Compared with the same period in previous years, the popularity of the NEV market declined slightly, so the midstream power battery market is still in a de-inventory cycle. Therefore, unlike what is expected to be an early expansion of production and stocking during the peak season in the fourth quarter of the automobile market, there was actually a decline in production.

1. The growth rate of power battery production turned negative by two degrees

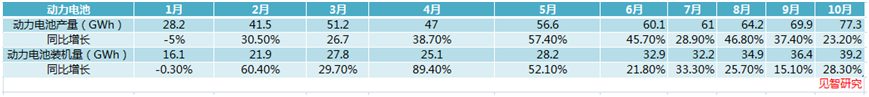

In October of this year, at the peak of prosperity throughout the year, the power battery market did not continue to show a high growth trend. Although the domestic power battery installed volume continued to hit a new high during the year, the growth rate slowed markedly, and the power battery production showed the only negative month-on-month increase this year (the first time in the off-season of April).

Among them, the production of power batteries reached 77.3 GWh, a decrease of 0.1% over the previous year, an increase of 23.2% over the previous year; the installed capacity reached 39.2 GWh, an increase of 28.3% over the previous year and an increase of 7.6% over the previous year.

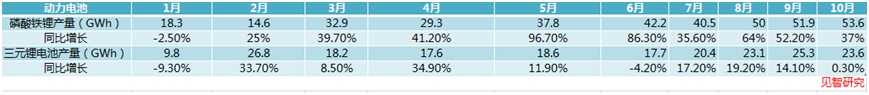

Looking at the specific breakdown, lithium iron phosphate batteries still dominate. The production and loading volume of lithium iron phosphate batteries reached 53.6 GWh and 26.8 GWh respectively, up 37% and 36.4% year on year, accounting for 69.3% and 68.5%.

Meanwhile, the production and loading volume of ternary lithium batteries reached 23.6 GWh and 12.3 GWh, respectively, up 0.3% and 14% year on year, accounting for 30.5% and 31.4%.

Compared with the same period in previous years, the installed volume of power batteries may also turn negative month-on-month due to the decline in sales of terminal new energy vehicles in the current period, but the power battery production is all showing a positive month-on-month growth trend, and the magnitude is not small. It is between 6% and 15%, mainly in preparation for the new energy vehicle market, which was booming in the fourth quarter.

In October of this year, power battery production directly turned negative month-on-month, which may mean that midstream power battery manufacturers do not have high expectations for the power battery market in the next two months, and their confidence in the high sales volume of terminal new energy vehicles at the end of the year is also slightly insufficient, and there should be no possibility of speeding up production in the short term.

2. In the Ningde era, 40% of the market share was lost and recovered

In October of this year, a total of 35 power battery companies in the domestic NEV market achieved vehicle installation support, a decrease of 5 compared to the same period last year.

However, in the increasingly large lithium battery industry, apart from the extreme survival tests faced by power battery manufacturers at the end of the line, where second- and third-tier power battery manufacturers have few opportunities to take a break, today's leading power battery manufacturers are also under a lot of competitive pressure. In September of this year, the market share of the leading power battery company in the Ningde era once fell below the 40% mark to 39.41%.

From 2019 to 2021, the Ningde Era has been steadily capturing half of the installed capacity of the domestic power battery market (the market shares of 50.57%, 50%, and 52.1% from 2019 to 2021, respectively). However, in the first quarter of 2022, after the Ningde Era fell below the 50% mark for the first time, it was difficult to return to previous levels, causing the overall market share in 2022 to fall to 48.2%.

It is worth noting that the declining trend in market share in the Ningde era continues. Although the market share in October this year lost 40% and returned to 42.81%, the year-on-year market share fell by a full 5.52 percentage points. This is also the lowest level in the Ningde era since nearly a year ago.

In the third quarter of this year, the market share of the Ningde era declined sharply, causing its cumulative market share to fall to 42.76%, down 4.86 percentage points from the previous year, and barely remaining above 40%.

In the third quarter of this year, the market share of the Ningde era declined sharply, causing its cumulative market share to fall to 42.76%, down 4.86 percentage points from the previous year, and barely remaining above 40%.

According to Wall Street Insights Research, the main reasons for the decline in market share in the Ningde era were as follows:

First, the rise of BYD, one of the biggest competitors in the Ningde era, has significantly affected the market share of the Ningde era.

BYD mainly produces and sells its own power batteries. In October, sales of its new energy vehicles exceeded 300,000 units, reaching 302,000 units, with cumulative annual sales volume reaching 2.38 million units, an increase of 70% over the previous year. This led to a year-on-year increase in BYD's power battery market share by 5.92 percentage points to 28.58%.

In the field of lithium iron phosphate batteries, BYD far surpassed the Ningde era, accounting for 42% of the installed capacity, which is significantly different from the 33.48% of the Ningde era.

Second, due to poor terminal demand and increased competition, the battery price war is on the rise. Most second- and third-tier battery manufacturers, such as Guoxuan Hi-Tech, Sunwoda, Honeycomb Energy, and Funeng Technology, are at a disadvantage.

However, some second-tier manufacturers with outstanding performance, such as Zhongxin Aviation and Everweft Lithium Energy, stood out. The installed capacity and market share in the first 10 months increased by 72.8% and 155.7%, respectively, and increased by 2.16 and 2.14 percentage points, ranking in the top five in the domestic market.

Since BYD mainly produces lithium iron phosphate batteries, while China Innovation Aviation and Everweft Lithium can produce lithium iron phosphate and ternary lithium batteries, the rise of these two companies has partially encroached on the market share of other manufacturers, which has also had a certain impact on the Ningde era.

Finally, the poor performance of Tesla, the main customer in the Ningde era, is also a reason.

Since the new version of the Model 3 is about to be launched, the old models are mainly being removed from stock at the end of the third quarter. It wasn't until October 26 that Tesla announced the start of delivery of the updated Model 3, and the delivery cycle was 6 to 9 weeks, which failed to have a positive impact on sales in October and November.

As a result, Tesla's sales volume in China in September and October was 74,000 units and 72,000 units respectively, with a continuous decline of 12% and 3% from the previous month, which also had an impact on the Ningde era.

In the last two months of the peak season in the NEV market, the market expects the market share of the Ningde era to pick up. Otherwise, after facing the risk of falling below the 50% market share mark in 2022, the Ningde Era will still have to fight to maintain 40% market share this year.