Unfortunately for some shareholders, the Nerdy, Inc. (NYSE:NRDY) share price has dived 35% in the last thirty days, prolonging recent pain. The last month has meant the stock is now only up 8.7% during the last year.

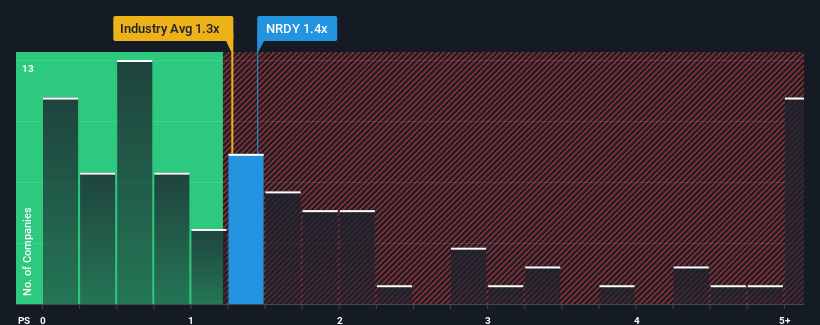

In spite of the heavy fall in price, there still wouldn't be many who think Nerdy's price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in the United States' Consumer Services industry is similar at about 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Nerdy

What Does Nerdy's P/S Mean For Shareholders?

Nerdy certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Nerdy will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Nerdy?

In order to justify its P/S ratio, Nerdy would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. The latest three year period has also seen an excellent 73% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 22% per year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 16% each year, which is noticeably less attractive.

With this information, we find it interesting that Nerdy is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Nerdy's P/S

With its share price dropping off a cliff, the P/S for Nerdy looks to be in line with the rest of the Consumer Services industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Nerdy's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Nerdy that you should be aware of.

If you're unsure about the strength of Nerdy's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.