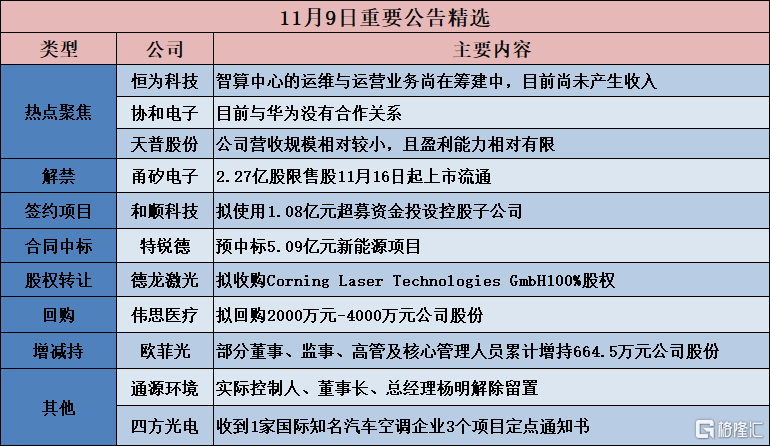

[Focus on hot topics]

Hengwei Technology (603496.SH): The operation, maintenance and operation business of the Intelligent Computing Center is still under construction, and no revenue has yet been generated

Hengwei Technology (603496.SH) announced abnormal fluctuations in stock trading. The operation, maintenance and operation of the company's intelligent computing center is still under construction. Currently, no revenue has been generated, and there is some uncertainty about the future construction cycle and operating conditions.

Concord Electronics (605258.SH): There is currently no partnership with Huawei

Concord Electronics (605258.SH) announced that the company currently has no cooperative relationship with Huawei.

Temple Group (605255.SH): The company's revenue scale is relatively small, and its profitability is relatively limited

Tianpu Co., Ltd. (605255.SH) announced a stock trading risk alert announcement. The closing price of the company's stock rose and stopped for 3 consecutive trading days from November 7 to November 9, with a cumulative increase of 33.12%. The short-term increase was significant. The Shenwan Auto Parts Index fell 1.23% cumulatively during the same period, and the Shanghai Composite Index fell 0.17% during the same period. The short-term increase in company stocks was seriously higher than the industry index and the Shanghai Composite Index during the same period, so there is a risk that market sentiment will overheat. There have been no major changes in the company's fundamentals, and there is no material information that should be disclosed that has not been disclosed. The company's revenue scale is relatively small, there has been no significant increase since listing, and its profitability is relatively limited.

[Contract project]

Heshun Technology (301237.SZ): Plans to use 108 million yuan of overraised capital to set up a holding subsidiary

Heshun Technology (301237.SZ) announced that on November 9, 2023, the company held the 16th meeting of the 3rd board of directors and the 13th meeting of the third board of supervisors to review and pass the “Proposal on Using Some Overraised Funds to Invest in Establishing Holding Subsidiaries”, and agreed that the company would use some of the overfunded capital to jointly invest 108 million yuan with Langfang Hengshou New Materials Technology Partnership (Limited Partnership) (“Hengshou New Materials”) to invest 108 million yuan to establish a holding subsidiary, carbon material technology company (tentative name, specific name approved by the business administration department, “holding subsidiary”) ”), used to engage in R&D, production and sales of M-grade graphite fibers (the specific scope of business, etc. is subject to the registration details of the industrial and commercial department after establishment).

[Contract won the bid]

Teruide (300001.SZ): Pre-winning a bid of 509 million yuan for a new energy project

Teruide (300001.SZ) announced that recently, the National Energy Bidding Network released the announcement of the winning candidate for the 35kV box-type transformer equipment framework procurement public tender project for Longyuan Electric Power's 2023-2024 new energy project. Qingdao Teruide Electric Co., Ltd. was the first successful candidate for section 1 of the project, with a bid price of 5088776 million yuan.

Yueyang Forest Paper (600963.SH): The consortium won the bid for ecological construction in northern Sanmen Bay, Ninghai, ecological protection and surrounding supporting projects for uninhabited islands

Yueyang Forest Paper (600963.SH) announced that the wholly-owned subsidiary Chengtong Kaisheng Ecological Construction Co., Ltd. received the “Ningbo Public Resources Trading Platform Winning Notice” issued by Ninghai County Water Resources Investment Co., Ltd. on November 9, 2023. According to the winning notice, the consortium formed by China Power Construction Group East China Survey, Design and Research Institute Co., Ltd., Zhejiang Yusheng Construction Co., Ltd. and Chengtong Kaisheng is the winning bidder for the Ecological Construction and Uninhabited Island Ecological Protection and Surrounding Support Enhancement Project (Phase I) in Ninghai. The winning bid was At 247,190,726 yuan, Chengtong Kaisheng is responsible for the landscaping part of the project.

Pinggao Electric (600312.SH): Won the bid for a total of about 728 million yuan for national grid-related projects

Pinggao Electric (600312.SH) announced that recently, the State Grid Corporation e-commerce platform issued the “Notice on Winning the Bid for the State Grid Corporation's 83rd batch procurement in 2023 (5th substation equipment (including cable) tender procurement for power transmission and transformation projects)”. Henan Pinggao Electric Co., Ltd. and its subsidiaries were the winning bidders for related projects. The total bid amount was about 728 million yuan, accounting for 7.85% of revenue in 2022.

Nachuan Co., Ltd. (300198.SZ): won the bid of 98.554.46 million yuan for the first and third stages of the procurement of pipe materials for the rural domestic sewage treatment PPP project in Wujiang District of Suzhou

Nachuan Co., Ltd. (300198.SZ) announced that on November 8, 2023, the company received the “Notice of Winning Bid” from Zhongji Water Co., Ltd., confirming that the company has become the winning bidder for the “Procurement Section 1 and 3 of the Pipeline Materials Procurement Section for the Rural Domestic Sewage Treatment PPP Project in Wujiang District, Suzhou City, Jiangsu Province”, with a bid amount of 98.554.46 million yuan.

[[Share acquisition]

De'Longhi Laser (688170.SH): Proposed acquisition of 100% shares in Corning Laser Technologies GmbH

Delon Laser (688170.SH) announced that in order to further improve laser processing technology and effectively expand overseas business, the company and Corning International signed an “Agreement on the Sale and Transfer of All Shares and Part of the Assets of Corning Laser Technologies GmbH” on November 8, 2023, local time in Germany. The company plans to purchase 100% of Corning Laser's shares and part of the assets held by Corning International in Germany (hereinafter referred to as “this transaction”). The purchase price is not expected to exceed 15 million euros (as per 2023/11) (On January 8, the median exchange rate between the euro and the RMB was converted at 1:7.7133, which is approximately no more than RMB 115.6995 million).Corning International is a wholly-owned subsidiary of Corning, Inc. (NYSE: GLW, “Corning Corporation”), one of the world's leading innovators in materials science and has been committed to life-changing innovation for over 170 years. Corning combines its deep expertise in glass science, ceramic science, and optical physics with deep production and engineering capabilities to create products that disrupt industries and improve people's lives. The 2022 US Fortune 500 ranked 292nd, with core sales of US$14.8 billion in 2022.

Meijin Energy (000723.SZ): Plans to transfer 55% of Tanggang Meijin's shares to Tangshan Steel

Meijin Energy (000723.SZ) announced that in order to further optimize the company structure and continuously enhance the company's core competitiveness and sustainable management capabilities, Shanxi Meijin Energy Co., Ltd. plans to sign an “Share Transfer Agreement” with Tangshan Iron and Steel Group Co., Ltd. (“Tangshan Steel”). The company plans to transfer 55% of its shares in Tangshan Steel Meijin (Tangshan) Coal Chemical Co., Ltd. (“Tangshan Steel” and “target company”) to Tangshan Steel. The equity transfer price is 71,78.53 million yuan. After the equity transfer is completed, Tangmei Steel Nishiki is no longer a subsidiary of the company , is no longer included in the scope of the company's consolidated statements.

[[Ban lifted]

Yongxi Electronics (688362.SH): 227 million restricted shares will be listed and distributed from November 16

Yongxi Electronics (688362.SH) announced that the total number of shares that have been lifted and applied for listing and circulation is 227 million shares. Currently, the lockdown period is about to expire, and will be listed for circulation on November 16, 2023.

Huitong Co., Ltd. (688219.SH): 141 million restricted shares will be listed and distributed from November 20

Huitong Co., Ltd. (688219.SH) announced that the restricted shares listed and circulated this time are part of the company's initial public offering of restricted shares. A total of 1 shareholder was involved. The corresponding number of restricted shares was 141 million shares, accounting for 30.61% of the company's total share capital. The lockdown period is 36 months from the date the company's shares are listed. The current lockdown period is about to expire, and will be listed and distributed from November 20, 2023 (since November 18 is a non-trading day, it will be postponed to the next trading day).

[Repurchase]

Weiss Healthcare (688580.SH): Plans to repurchase 20 million yuan to 40 million yuan of company shares

Weiss Healthcare (688580.SH) announced that the total capital of the proposed share repurchase should not be less than RMB 20 million, not more than RMB 40 million, and that the price of the shares to be repurchased should not exceed RMB 90 per share.

ST Jinshi (002951.SZ): Plans to spend 15 million yuan to 30 million yuan to buy back the company's shares

ST Jinshi (002951.SZ) announced that the company plans to use its own funds to repurchase some of the company's issued RMB common shares (A shares) (hereinafter referred to as “this repurchase”) through centralized bidding transactions, and is intended to be used in due course to implement equity incentives or employee stock ownership plans. The total amount of capital used for this repurchase is not less than RMB 15 million (including principal amount) and no more than RMB 30 million (including principal amount). The specific amount of shares repurchased is based on the actual repurchase amount when the repurchase is completed. The source of capital is the company's own capital.The current repurchase price does not exceed RMB 12 per share (including principal amount), not higher than 150% of the average trading price of the company's shares in the 30 trading days before the board of directors passed the repurchase plan decision.

Shengong Co., Ltd. (688233.SH): Plans to repurchase 15 million yuan to 30 million yuan of shares

Shengong Co., Ltd. (688233.SH) announced that the company plans to use its own capital to buy back some of the RMB common stock (A shares) shares publicly issued by the company through centralized bidding transactions through the Shanghai Stock Exchange trading system. The total share repurchase capital shall not be less than RMB 15 million (inclusive) and not more than RMB 30 million (inclusive). The repurchase price shall not exceed RMB 44.00/share (inclusive).

[Increase or decrease holdings]

Rong Zhi Rishin (688768.SH): Actual controllers and some directors, senior managers, and core managers increased their holdings of the company by a total of RMB 21.09985 million

Rongzhi Rishin (688768.SH) announced that as of the disclosure date of this announcement, the controlling shareholders, actual controllers, and some directors, senior managers, and core managers have accumulated 414,423 shares of the company's shares through centralized bidding through the Shanghai Stock Exchange trading system, accounting for 0.5077% of the company's total share capital. The total increase amount is RMB 21.0985 million, which has exceeded the minimum amount of the current holdings increase plan, and the implementation of this plan has been completed.

Ou Fei Guang (002456. SZ): Some directors, supervisors, senior management and core managers increased their holdings of the company by a total of 6.645 million yuan

OFIL (002456.SZ) announced that as of the disclosure date of this announcement, the period of the current shareholding increase plan expires. Recently, the company received a “Notice of Stock Increase Results” from the owners of the increase in holdings from Mr. Huang Lihui, Mr. Haijiang, Mr. Liu Xiaochen, Mr. Li Yun, Mr. Luo Yonghui, Mr. Lin Hongping (who has left office), Mr. Li Yingping, Mr. Zhou Liang, Mr. Tan Zhenlin, Mr. Ye Qingbiao, and Ms. Yin Yunyun (who has left office). The implementation of the plan for the increase in holdings of the company was completed. The total increase in holdings of the company was 870,600 shares, with an increase of RMB 6.645 million. The implementation of the current holdings increase plan has been completed in full.

[Other]

Sifang Optoelectronics (688665.SH): Received targeted notices for 3 projects from an internationally renowned automotive air conditioning company

Sifang Optoelectronics (688665.SH) announced that it has successively received targeted notices for 3 projects from an internationally renowned automobile air conditioning company, confirming that the company supplies car-grade PM2.5 sensors to them. According to the above customer forecasts, the fixed life cycle of the above three projects is expected to be 7 years, with a total amount of about 128.12 million yuan.

Tongyuan Environment (688679.SH): Yang Ming, the actual controller, chairman, and general manager, was released from detention

Tongyuan Environment (688679.SH) announced that on October 18, 2023, the company disclosed the “Notice on the Investigation of the Detention of the Company's Actual Controller, Chairman, and General Manager”, and Mr. Yang Ming, the actual controller, chairman and general manager of the company was detained. On November 9, 2023, the company received the “Notice of Cancellation of Detention” issued by the Hexian County Supervisory Commission, and the Hexian Supervisory Commission has lifted the detention measures against Mr. Yang Ming.