Despite an already strong run, Edvance International Holdings Limited (HKG:1410) shares have been powering on, with a gain of 29% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

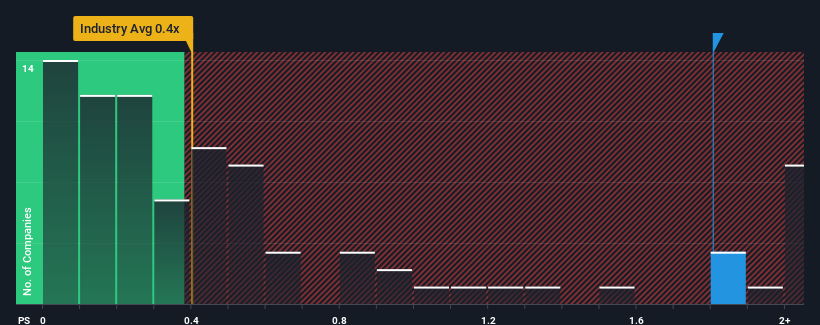

Following the firm bounce in price, given close to half the companies operating in Hong Kong's Electronic industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider Edvance International Holdings as a stock to potentially avoid with its 1.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Edvance International Holdings

How Has Edvance International Holdings Performed Recently?

Revenue has risen firmly for Edvance International Holdings recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Edvance International Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Edvance International Holdings?

In order to justify its P/S ratio, Edvance International Holdings would need to produce impressive growth in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 9.9%. Pleasingly, revenue has also lifted 46% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

With this in mind, we find it intriguing that Edvance International Holdings' P/S exceeds that of its industry peers. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Key Takeaway

Edvance International Holdings shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Edvance International Holdings has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Plus, you should also learn about this 1 warning sign we've spotted with Edvance International Holdings.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.