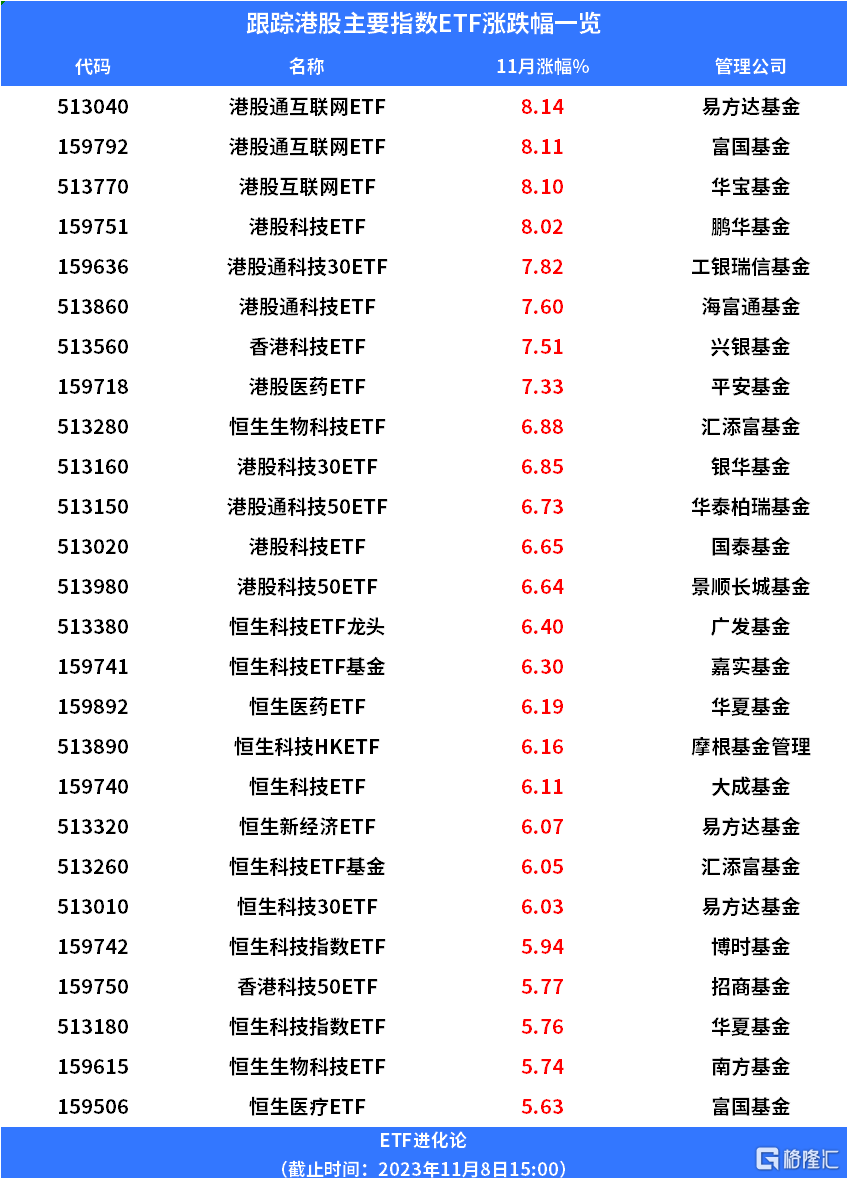

Gelonghui November 8th 丨The major indices of Hong Kong stocks recently rebounded after hitting a new low during the new year on October 24. Since November,E-Fonda Fund Hong Kong Stock Connect to the InternetETF,Wells Fargo Fund Hong Kong Stock Connect to the InternetETF,Huabao Fund Hong Kong Stock InternetETF,Penghua Fund Hong Kong Stock TechnologyETF,ICBC Credit Suisse Fund Hong Kong Stock Connect Technology 30ETF,Hyfutong Fund Hong Kong Stock Connect TechnologyETF,Socibank Fund Hong Kong TechnologyETF,Ping An Fund Hong Kong Stock PharmaceuticalETFThe increase was over 7%.

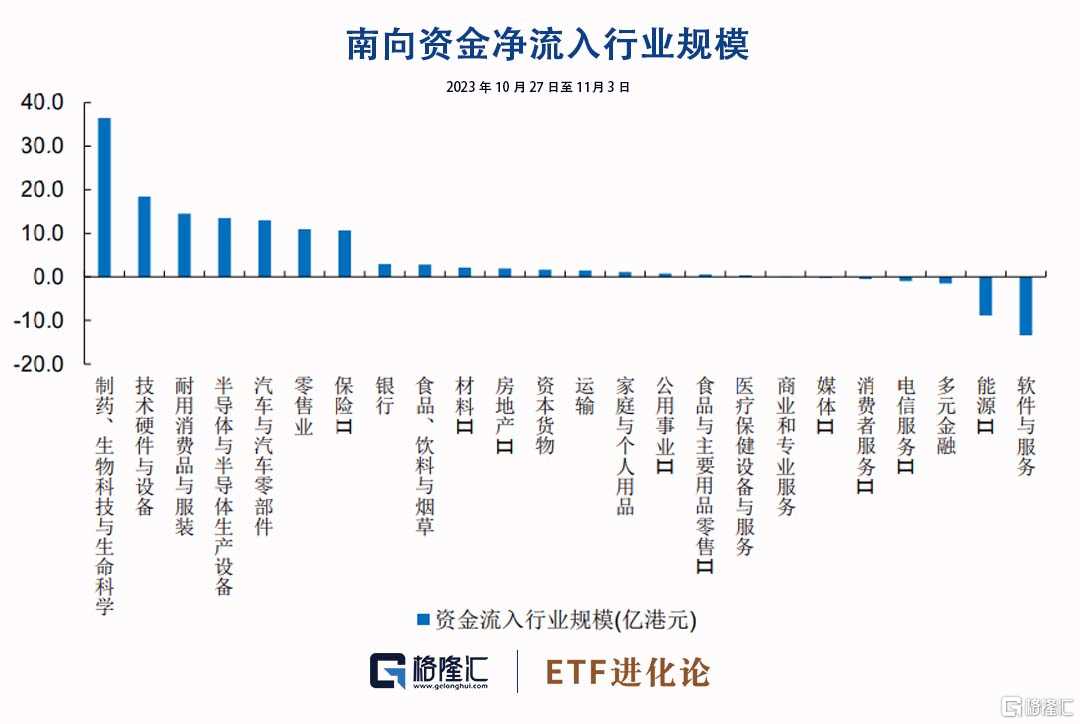

The net purchase of Hong Kong stocks by southbound capital was 9.567 billion yuan yesterday, the highest in the past two months. Last week, there was a cumulative net inflow of southbound capital of HK$8,515 billion. The overall preference was for growth, and some stocks with high dividends were sold.

Recently, southbound capital has favored growth industries. The top six industries with net inflows last week were pharmaceuticals, technical hardware and equipment, consumer durables and clothing, semiconductors and equipment, automobiles and parts, and retail; in terms of net outflows, some came from high-dividend industries. The top six industries with net outflows were software and services, energy, diversified finance, telecommunications services, consumer services, and media.

Since this year, the net value of ETFs in the Hong Kong stock market has generally declined. As capital falls, they buy more, and domestic capital continues to increase their holdings in Hong Kong stocks through ETFs.

According to the data, the scale of the Hong Kong Stock Technology 50 ETF and the Hong Kong Stock Innovative Drug ETF has both increased by more than 1 billion shares since November.In addition, the Hang Seng Internet ETF and the Hang Seng Technology Index ETF also received capital inflows.

Looking at the longer term, the Hang Seng Internet ETF, the Hong Kong Stock Connect Internet ETF, the Hang Seng Medical ETF, the Hang Seng Technology Index ETF, and the Hang Seng Technology ETF all received net subscriptions of more than 10 billion shares during the year, while the Hong Kong Stock Technology 50 ETF received a net subscription of more than 5 billion shares.

The reason behind Hong Kong stocks attracting capital inflows is, on the one hand, that the cycle of tightening overseas liquidity is nearing its end; on the other hand, the current low valuation of Hong Kong stocks and the relatively high value of stocks and bonds.

At the stage of overseas interest rate hikes and downsizing, the valuations of the Hang Seng Index and the Hengke Index have been reduced to historic lows. The current valuation of the Hang Seng Index is 8.46 times, which is 1 times below the average of the past 10 years; the valuation of the Hang Seng Technology Index is 22.5 times, which is at a historically low level.

The short selling ratio of the main board of Hong Kong stocks fell from 17.5% on October 27 to 15.4% on November 3. The AH premium index is 143.9, which is more than 1 times the standard deviation above the average for the past 10 years. In terms of volatility, the Hang Seng Index fell to 23.56 on November 3, close to the historical average for the past 10 years.

Regarding the Hong Kong stock market, Qiu Dongrong of China Geng Fund stated in the three-quarter report that Hong Kong Internet stocks balance certainty and growth:

1. The supply pattern brings certainty: consumption continues to recover and user habits are irreversible, platform competition is relatively controllable, and increased competition among product-based companies further highlights the scarcity of platforms, combined with cost reduction and efficiency, greatly improving profit levels and profit quality;

2. Deep expansion of the value chain leads growth: moderate policies, the return of founders is expected to enhance the confidence and vitality of organizational innovation. Based on China's supply chain advantages, overseas business is expected to become a new growth point, and the platform economy may become the biggest beneficiary of AI progress based on its technology accumulation and application scenarios;

3. The Internet sector shows the characteristics of systematic undervaluation. It is highly cost-effective in both consumer and technology assets. Buybacks further enhance shareholder returns. The market may have excessively underestimated the resilience of its revenue side and overestimated the profit uncertainty brought about by irrational competition.

Guotai Junan believes that expectations of tightening overseas liquidity have peaked, and the valuation level of Hong Kong stocks is historically low. Currently, this is an opportunity for layout. The US economy and employment data have cooled down. Federal Reserve Chairman Powell's attitude is more “bad” than the previous meeting. Market expectations for interest rate hikes will peak, and 10-year US Treasury yields are likely to peak in the short term. However, Hong Kong stock valuations have been reduced to historic lows. When overseas liquidity becomes marginal to easing, there is an incentive for capital to flow back and value China's assets, which are in a slump. In terms of allocation, short-term allocation of growth styles, and medium to long-term allocation of dividend assets. Attention should be paid to the Hang Seng Technology Index and sectors such as Internet retail, innovative pharmaceuticals, semiconductors, new energy, and textiles. Looking at the medium to long term, it is difficult for the US inflation center to decline rapidly. US bond yields may remain at a higher level than before the pandemic. Moreover, due to events such as the 2024 US election and global geological friction, the Hong Kong stock market will still face great uncertainty. It is recommended to allocate dividend assets on dips.