The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the L3Harris Technologies, Inc. (NYSE:LHX) share price slid 22% over twelve months. That falls noticeably short of the market return of around 16%. The silver lining (for longer term investors) is that the stock is still 1.1% higher than it was three years ago. In contrast, the stock price has popped 8.1% in the last thirty days.

The recent uptick of 4.5% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for L3Harris Technologies

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the L3Harris Technologies share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

The divergence between the EPS and the share price is quite notable, during the year. So it's well worth checking out some other metrics, too.

L3Harris Technologies managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

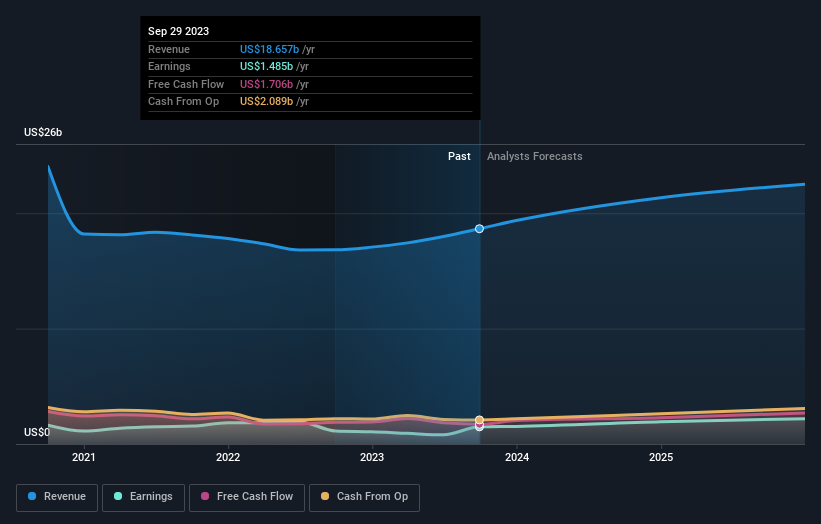

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

L3Harris Technologies is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling L3Harris Technologies stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Investors in L3Harris Technologies had a tough year, with a total loss of 20% (including dividends), against a market gain of about 16%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 6% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for L3Harris Technologies you should be aware of, and 1 of them is concerning.

Of course L3Harris Technologies may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.