Nearly 3,900 shares in the two markets rose, trading 809.5 billion yuan throughout the day, and the net purchase of capital going north was 7.108 billion yuan.

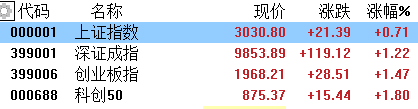

Today,Major indices collectively closed higher. The Shanghai Index rose 0.71% to 3030 points, the Shenzhen Stock Exchange Index rose 1.22%, and the GEM Index rose 1.47%. Nearly 3,900 shares in the two markets rose, trading 809.5 billion yuan throughout the day, and the net purchase of capital going north was 7.108 billion yuan.

On the market, guidelines for the innovation and development of humanoid robots were issued. The robot sector was strong throughout the day, and the direction of actuators, speed reducers, and machine vision rose and stopped, and many stocks such as Haozhi Mechatronics rose and stopped; the semiconductor sector rose, Guoxin Technology and other stocks rose and stopped; the cultural media sector strengthened, and Beidou Xingtong rose and stopped; the cultural media sector bottomed out, and Tianwei Video rose and stopped; sectors such as industrial machines, new industrialization, and memory chips registered the highest gains. Furthermore, the chemical and pharmaceutical sector was divided, with Sailon Pharmaceutical falling to a standstill, Heisen Pharmaceutical rising and halting; the real estate development sector declined, with investment from China and India leading the decline; and the gaming and steel sectors weakened.

Let's take a look specifically:

The robotics sector, such as machine vision and speed reducers, has risen and stopped,The individual stocks of the Beijing Stock Exchange rose and stopped by 30CM, Haozhi Mechatronics and Fengli Intelligence by 20CM, and more than 10 shares, including Julun Intelligence, Tongda Power, Hongying Intelligence, Shenzhen Keda, OFIL, Coli Sensor, and Zhongda Dalide, rose and stopped.

According to the CITIC Securities Research Report,workersFor the first time, the Ministry of Information and Communications Technology's current document raised the focus on the complete machine to the level of national ministries and departments, and proposed a number of new relevant key products, recommending focusing on enterprises related to sensors, actuators, and controllers. Furthermore, we are optimistic about companies that are deeply involved in the robot industry chain and whose recent performance and products continue to be catalyzed. At the same time, the document focuses on applications in special fields, where humanoid robots will be the first to be implemented.

Chip stocks ranked first in terms of surges,Yongxi Electronics rose and stopped in 20CM, Xinyichang rose more than 15%, Huahai Chengke, Shenzhen Keda, Guoxin Technology, Kangqiang Electronics, Tongxingda, etc. rose and stopped, Nike equipment rose more than 9%, Keger Precision Machinery and Feikai materials rose more than 8%, Zhongfu Circuit rose more than 6%, and Nalanwei and Silanwei rose more than 5%.

The media and gaming sector continued to be active in the intraday period. Longyun shares and Tianwei Video rose and stopped, Zitian Technology rose more than 8%, Shengtian Internet rose more than 6%, and Shanghai movies rose more than 5%.

The diet medicine sector is picking up,Hanyu Pharmaceutical rose more than 9%, followed by Aimeike, Shengnuo Biotech, and Tonghua Dongbao.

According to the news, the performance of the two major weight loss drug giants in the third quarter exceeded expectations. Among them, Novo Nordisk's sales were 58.73 billion DKK, and the forecast was 57.8 billion DKK. Eli Lilly's revenue was US$9.499 billion, up 37% year over year, exceeding market expectations.

Apple's concept stock strengthened, Fivotel rose by more than 11%, and Chaoyang Technology rose and stopped.Adachi Intelligence,Opt rose more than 8%, Changying Precision, Lechuang TechnologyIt has increased by more than 7%, and Changxin Technology has risen by more than 6%.

According to the news,Apple's net profit for the third quarter was US$22.96 billion, up 10.8% year on year; adjusted earnings per share of US$1.46 per share, better than the forecast of US$1.39; and operating income of US$89.5 billion, down 1% year on year, for the fourth consecutive quarter, with an forecast of US$89.28 billion.Revenue from all hardware other than the iPhone fell year over year, while revenue from iPad and Mac declined even more sharply. Greater China's revenue was US$15.08 billion, lower than the forecast of US$170.1 billion.

Real estate stocks weakened, Sino-Di investment fell by more than 6%, Suning Global fell by more than 4%, and financial development fell by more than 3%.

Pharmaceutical-related sectors such as recombinant protein, assisted reproduction, and CRO declined. Hite Biotech fell by more than 14%, Theron Pharmaceutical fell to a standstill, and Kyodo Pharmaceutical fell by more than 8%, and Jiangsu Wuzhong followed suit.

At the level of individual stocks, the recent rise in new stocks has been like a rainbow. todayN Baitong once surged by 983.33%, triggering a second pause, and finally closed up 753%, with a turnover exceeding 1.39 billion dollars. According to data, Baitong Energy's main business is steam, electricity, and centralized heating in industrial parks. Its main products and services are steam and electricity. incorporationIt is estimated that this year's net profit attributable to shareholders of listed companies will be 137 million to 143 million yuan, an increase of 24.30%-29.94% over the previous year, and estimated operating income of 1.1 billion to 1.2 billion yuan.

Today,Capital from the NorthNet purchases of 7.108 billion yuan,For the second day in a row, net purchases in a single day hit a new high since September 22 this year.Among them, Shanghai Stock Connect had net purchases of 2,804 billion yuan and Shenzhen Stock Connect net purchases of 4.304 billion yuan.

Looking ahead, Cinda Securities believes that although the market bottom was later than expected due to adjustments in growth track stocks, looking at the next half year from now on, A-shares have three reversal forces: 1) policy bottom & excessive decline repair; 2) inventory cycle reversal; and 3) steady improvement in real estate sales. In terms of allocation, the monthly allocation was overallocated to the financial category (securities banks) within half a year, and the upstream cycle was strategically allocated within 1-2 years.