As an investor, mistakes are inevitable. But you want to avoid the really big losses like the plague. So spare a thought for the long term shareholders of PagSeguro Digital Ltd. (NYSE:PAGS); the share price is down a whopping 82% in the last three years. That'd be enough to cause even the strongest minds some disquiet. And more recent buyers are having a tough time too, with a drop of 52% in the last year. The falls have accelerated recently, with the share price down 33% in the last three months. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since PagSeguro Digital has shed US$167m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for PagSeguro Digital

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, PagSeguro Digital actually managed to grow EPS by 4.7% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

It's pretty reasonable to suspect the market was previously to bullish on the stock, and has since moderated expectations. However, taking a look at other business metrics might shed a bit more light on the share price action.

Revenue is actually up 35% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching PagSeguro Digital more closely, as sometimes stocks fall unfairly. This could present an opportunity.

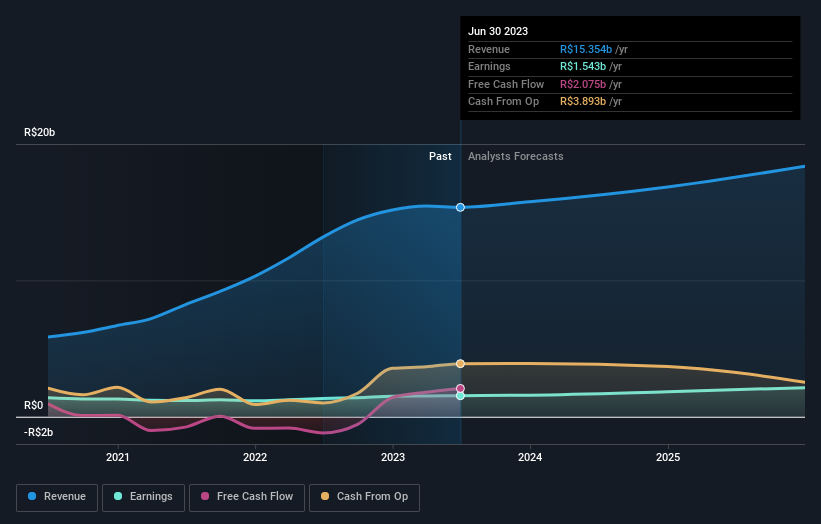

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

PagSeguro Digital is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

A Different Perspective

PagSeguro Digital shareholders are down 52% for the year, but the market itself is up 9.0%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. Before deciding if you like the current share price, check how PagSeguro Digital scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.