[Focus on hot topics]

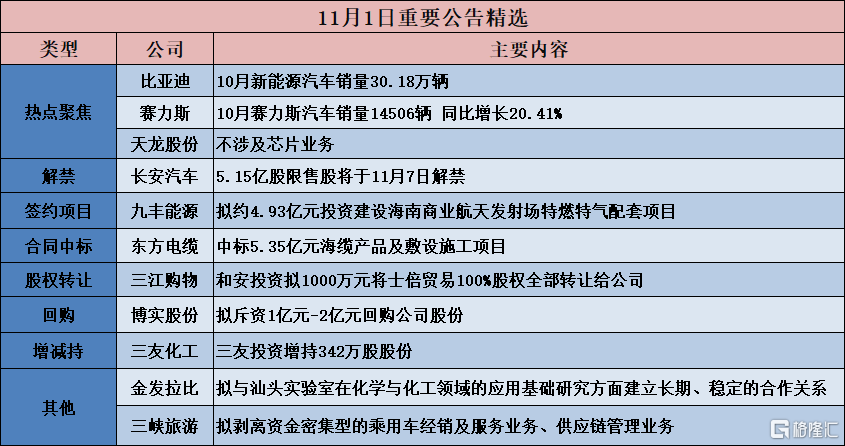

BYD (002594.SZ): New energy vehicle sales volume in October is 301,800 units

BYD (002594.SZ) announced that sales of new energy vehicles in October were 301,800 units, up 38.57% year on year; the company sold a total of 30,521 new energy passenger vehicles overseas in October 2023; the company's total installed capacity of new energy vehicle power batteries and energy storage batteries in October 2023 was about 15.286 GWh, and the cumulative total installed volume in 2023 was about 116.217 GWh.

Cyrus (601127.SH): In October, Cyrus's sales volume of 14,506 cars increased 20.41% year on year

Cyrus (601127.SH) announced that the sales volume of Cyrus cars in October 2023 was 14,506 units, up 20.41% year on year.

Tianlong Co., Ltd. (603266.SH): Not involved in the chip business. The chip company that invests in foreign countries is a shareholding company and has not yet achieved profit

Tianlong Co., Ltd. (603266.SH) announced a risk warning on stock trading. The company is mainly engaged in mold, injection molding, and assembly business. The main products are plastic functional structural parts. Although there are many application scenarios, they are not core components, and the added value of the products is not high. The company is not involved in the chip business. The chip company that invests in foreign investment is a shareholding company. Currently, no profit has been achieved, and the impact on the company's performance is limited. From January to September 2023, the company's net profit fell 9.97% year on year. At the same time, the company's revenue scale was relatively small, and its profitability was relatively limited.

[Contract project]

Xinqiang Alliance (300850.SZ): Plans to invest in a high-end wind power equipment project with an annual output of 20,000 sets in Daxin Town

Xinqianglian (300850.SZ) announced that in order to further implement the development strategy of Luoyang Xinqianglian Slewing Bearing Co., Ltd. (“Company” or “Party B”), implement the overall development layout plan, meet future market demand, and increase market share, the company signed an “Investment Agreement” with the People's Government of Daxin Town, Zhangjiagang City. The company plans to invest 1 billion yuan in fixed assets through self-funded investment in construction, and implement it through its wholly-owned subsidiary Xinqianglian (Jiangsu) Heavy Industry Technology Co., Ltd. (“Project Company”). The project construction cycle is 3 years. Party B plans to invest in the construction of a high-end wind power equipment project with an annual output of 20,000 sets in Daxin Town, mainly producing large-scale offshore fans, supporting offshore equipment, and core precision equipment for large-scale shield machines. The project company is responsible for the investment, construction and operation of the project.

Jiufeng Energy (605090.SH): Plans to invest about 493 million yuan to build a special gas supporting project for the Hainan Commercial Space Launch Site

Jiufeng Energy (605090.SH) announced that with the advancement of China's satellite communication industry and rocket launch technology, the commercial space industry has entered the fast track of development, and the market space is broad. In order to take advantage of its advantages, promote the support and integration of the company's special gas business in the commercial space field and strengthen the terminal market layout, on October 31, 2023, the company held an investment decision committee meeting and conducted a comprehensive review, agreed to invest in the commercial development of a special gas project to supply special gas products such as liquid hydrogen, liquid oxygen, liquid nitrogen, helium, and high-purity liquid methane to support the Hainan commercial space launch site as a rocket launch fuel propellant, oxidizer, and related system replacement, purge, purification, etc. The total investment of the project is about 493 million yuan. In the end, the actual investment amount is based on the actual investment amount, and the source of capital is owned or raised by oneself.

[Contract won the bid]

Railway Science Track (688569.SH): Signed a 470 million yuan project contract

Railway Track (688569.SH) announced that the company signed a project contract with Xiong'an High Speed Railway Co., Ltd. to supply high-speed rail fasteners. The contract amount is RMB 470 million (tax included).

Dongfang Cable (603606.SH): won a bid of 535 million yuan for submarine cable products and construction projects

Dongfang Cable (603606.SH) announced that the company and its wholly-owned subsidiary Ningbo Subsea Cable Research Institute Engineering Co., Ltd. (“Dongfang Offshore Engineering”) received a “Notice of Transaction” confirming that the company and the Oriental Offshore Industry Consortium were the successful bidders for the relevant projects. The EPC general contracting project for the Three Gorges Yangjiang Qingzhou Liuhai Wind Farm Project, the procurement and laying of submarine cables for the 66kV power collection line, and the non-excavation targeted drilling and construction of the 330 kV submarine cable crossing shoreline (section I, section II) project won the bid amount of 535 million yuan.

Jiaotong Construction Co., Ltd. (603815.SH): won the bid for the 762 million yuan project

Jiaotong Construction Co., Ltd. (603815.SH) announced that the company has received successful bid notices for two projects, with a total bid amount of 762 million yuan. 1. Xiuning Road (West Second Ring Road - Feicui Road) project; 2. Hefei Xinqiao Airport S1 Line Gangji Vehicle Section Civil Construction General Contracting Project.

China Super League Holdings (002471.SZ): won a total of 311 million yuan in projects

China Super League Holdings (002471.SZ) announced that recently, the State Grid Corporation and other companies issued winning bid results or public announcement results. The company and its wholly-owned subsidiaries, Wuxi Pearl Cable Co., Ltd., Jiangsu Yuanfang Cable Co., Ltd., Jiangsu Changfeng Cable Co., Ltd., and holding subsidiaries Jiangsu Super Cable Co., Ltd., and Kenite Power Transmission and Transformation Technology Co., Ltd. were the winners or candidates for winning the bid. The total bid amount won this time was RMB 31,1321,000. The winning bid amount accounted for 5.28% of the company's total audited operating income in 2022. There is no correlation between the Company, the wholly-owned subsidiary, holding subsidiary that won the bid, and the bidding company.

[[Share acquisition]

Sanjiang Shopping (601116.SH): He'an Investment plans to transfer all 100% of Shibai Trading's shares to the company for 10 million yuan

Sanjiang Shopping (601116.SH) announced that He'an Investment, the controlling shareholder of the related company, plans to transfer 100% of its shares in Ningbobei Trading Co., Ltd. (hereinafter referred to as “Shibai Trading” and the “target company”) to the company through a share transfer. The transfer price is RMB 10 million. After the equity transfer is completed, the company will hold 100% of Shibai Trading's shares, and He'an Investment will no longer hold shares in Shibei Trading.

[[Ban lifted]

Zhizhen Technology (003007.SZ): The ban on 63.882.97 million shares issued before the initial launch will be lifted on November 3

Zhizhen Technology (003007.SZ) announced an indicative announcement on the listing and circulation of issued shares prior to the initial public offering. The number of shares that have now been lifted is 63.882.97 million shares, accounting for 61.4259% of the company's total share capital; the current restricted share listing date is November 3, 2023 (Friday).

Changan Automobile (000625.SZ): The ban on 515 million restricted shares will be lifted on November 7

Changan Automobile (000625.SZ) announced an indicative announcement on the listing and circulation of non-public restricted shares. The current number of restricted shares listed and distributed is 515 million shares, accounting for 5.20% of the company's total share capital; the current restricted stock listing and circulation date is November 7, 2023.

[Repurchase]

Jinzai Food (003000.SZ): Plans to spend 20 million yuan to 40 million yuan to buy back the company's shares

Jinzai Food (003000.SZ) announced an announcement on the company's share repurchase plan. The company plans to use its own funds to repurchase some of the company's shares through centralized bidding transactions. The price of the shares repurchased this time is no more than 16 yuan/share (inclusive), and the total repurchase capital is not less than RMB 20 million (inclusive) and no higher than RMB 40 million (inclusive). The specific number of shares repurchased is based on the actual number of shares repurchased at the end of the repurchase period or when the repurchase of shares is completed. The repurchase period is not more than 12 months from the date of review and approval of the repurchase plan by the company's board of directors. This share repurchase will later be used as an equity incentive plan or employee stock ownership plan.

Chenguang Biotech (300138.SZ): Plans to spend 50 million yuan to 100 million yuan to buy back the company's shares

Chenguang Biotech (300138.SZ) announced that the company plans to use its own capital to repurchase some of the company's RMB common stock A shares through centralized bidding transactions to cancel and reduce the company's registered capital. The total repurchase capital is not less than RMB 50 million (inclusive) and no more than RMB 100 million (inclusive); the price of the repurchased shares is not more than RMB 16.5 yuan/share (inclusive); the number of shares repurchased is about 3,0303 million shares to 6,0606 million shares, accounting for approximately 0.57% to 1.14% of the company's total issued share capital. The repurchase period is not more than 12 months from the date the shareholders' meeting deliberates and approves this share repurchase plan.

Youcai Resources (002998.SZ): Plans to spend 20 million yuan to 30 million yuan to buy back the company's shares

Youcai Resources (002998.SZ) announced that the company plans to use its own funds to repurchase RMB common shares (A shares) issued by the company through centralized bidding transactions and use them for employee equity incentives or employee stock ownership plans at an appropriate time in the future, and decide on implementation methods in accordance with relevant laws and regulations. The total amount of capital used for the repurchase is not less than RMB 20 million (inclusive), no more than RMB 30 million (inclusive), and the repurchase price is no more than RMB 11.58 yuan/share (inclusive). Based on the upper limit of the total repurchase capital of RMB 11.58 million per share, the estimated number of repurchases is 1,727,116 shares, accounting for 0.53% of the company's current total share capital (total share capital up to October 31, 2023, same below); based on the maximum total repurchase capital of RMB 30 million, the estimated number of repurchases is 2,590,673 shares, accounting for 0.79% of the company's current total share capital. The specific number of shares repurchased is based on the number of shares actually repurchased at the end of the repurchase.

Boshi Co., Ltd. (002698.SZ): Plans to spend 100 million yuan to 200 million yuan to repurchase the company's shares

Boshi Co., Ltd. (002698.SZ) announced that the company plans to use its own funds to repurchase some of the company's shares through centralized bidding transactions to implement equity incentives or employee stock ownership plans. The share repurchase will be used for equity incentives or employee stock ownership plans. The repurchase price does not exceed 17.88 yuan/share (including principal amount). The total capital of this repurchase is not less than RMB 100 million (including principal amount) and no more than RMB 200 million (including principal amount).

[Increase or decrease holdings]

Yongguan New Materials (603681.SH): Controlling shareholder, chairman and general manager Lu Xinmin reduced his holdings by a total of 5.71 million shares and terminated the share reduction plan ahead of schedule

Yongguan New Materials (603681.SH) announced that on October 31, 2023, the company received the “Notice Letter on Early Termination of the Shareholding Reduction Plan and Results of the Shareholding Reduction Plan” from Mr. Lu Xinmin, the controlling shareholder, chairman and general manager. From May 25, 2023 to October 31, 2023, I reduced my holdings by a total of 5.71 million shares in this round of holdings reduction plans, accounting for 2.99% of the company's total share capital, and terminated this share reduction plan ahead of schedule.

Sanyou Chemical (600409.SH): Sanyou Investment increased its shareholding by 3.42 million shares

Sanyou Chemical (600409.SH) announced that on November 1, 2023, Tangshan Sanyou Investment Co., Ltd. (“Sanyou Investment”), a wholly-owned subsidiary of Tangshan Sanyou Alkali (Group) Co., Ltd. (“Alkali Group”), the controlling shareholder of the company, increased its holdings by 3.42 million shares through centralized bidding transactions, accounting for 0.17% of the company's total share capital. After this increase in holdings was completed, Sanyou Investment did not propose a subsequent increase in holdings.

[Other]

Ruby Jin (002762.SZ): Plans to establish a long-term and stable cooperative relationship with Shantou Laboratory in basic applied research in the field of chemistry and chemistry

Golden Rabbi (002762.SZ) announced that in order to continue product and technology research and development and reserve, and promote new product research and development to actively move closer to new materials, new processes, and new technology, Golden Rabbi Maternal and Child Products Co., Ltd. and the Guangdong Laboratory of Chemistry and Fine Chemicals (“Shantou Laboratory” for short) recently signed a “Strategic Cooperation Agreement” after friendly negotiations. The two sides will establish a long-term and stable cooperative relationship in the field of chemistry and applied basic research. Through resource sharing, complementary advantages, and common development, cooperation and development in scientific and technological innovation, transformation of achievements, and talent training can be realized.

Three Gorges Tourism (002627.SZ): Proposed divestment of capital-intensive passenger car distribution and service business and supply chain management business to further focus on integrated tourism services

Three Gorges Travel (002627.SZ) announced a major asset sale and related transaction report (draft). The company plans to sell 40% of its shares in the automobile sales company to the controlling shareholder Yichang Jiaotong Travel and the indirect controlling shareholder Yichang Chengfa for 20% each; at the same time, sell all of its direct claims on the car sales company and its subsidiaries to Yichang Chengfa, as well as 100% of Tianyuan's supply chain shares held indirectly through its wholly-owned subsidiary Tianyuan Logistics. The transaction was carried out by means of a private agreement transfer, and Yichang Jiaotong Travel and Yichang Chengfa made the purchase by means of cash payment. After the transaction was completed, Three Gorges Tourism still held 30% of the shares in the automobile sales company, and the automobile sales company and Tianyuan supply chain were no longer included in the consolidated statements of listed companies.