Under the characteristics of "good track + good driver", the investment value of the company is worth paying attention to.

It is reported that Frances, China's largest provider of on-site logistics equipment solutions, has launched an initial public offering. Franz will not exceedHK $16.18200 shares for each sale, admission fee is about3268.63Hong Kong dollars. The company will end its IPO period on November 3 and plans to list on November 10.

It is worth mentioning that the company was subscribed for 100m yuan by a wholly owned subsidiary of cornerstone investor 000528.SZ. Liugong is the first listed company in the field of construction machinery in China, mainly engaged in R & D, production, sales and service of construction machinery and key parts.

Another piece of information that is also noteworthy is the overseas listed companies United Rentals and Ashtead. Both stocks have performed well in recent years. As a scarce stock of Hong Kong stocks similar to the track, Frances has attracted the attention of the author.

A track where invisible champions are born.

United Rentals is one of the dark horses that have produced a number of outstanding performers in US stocks over the past decade. United Leasing is the largest provider of on-site logistics equipment solutions in the United States, with a market share of 17% in North America.

Although the industry does not look sexy compared with the high-profile consumer and technology sectors, individual stocks are out of proportion to the attention-the share price of United Leasing has risen 28-fold since it went public and has risen nearly tenfold in the past decade. There is no doubt that the leader in this field is ten times the excellent target in a decade, bringing rich returns for investors.The beautiful performance of its capital market also fully proves that the track has high growth flexibility.

Compared with the United States, China's on-site logistics equipment solution industry started relatively late, and the overall development is still in the early stage. In 2022, the penetration rate of logistics equipment solutions in China was only about 3.7%, compared with 54.6% in developed countries such as the United States in the same year.

Due to the convergence of industrial development logic and driving forces, the Chinese market is likely to replicate the trajectory of the US market:

Similar to the development trajectory of the United States in the past, the rapid growth of China's manufacturing and logistics industry in the past two decades has led to a rapid increase in the demand of manufacturing and logistics companies for on-site logistics equipment. However, the traditional equipment procurement model has more and more prominent pain points: high cost, difficulty in equipment management, lack of mobility, difficult to meet seasonal demand and so on. In order to solve these pain points, logistics equipment solutions have sprung up rapidly. The new solution takes the subscription service of on-site logistics equipment as the core, and includes maintenance, management optimization and equipment handling services, which can better meet the needs of on-site logistics equipment such as manufacturing and logistics enterprises.

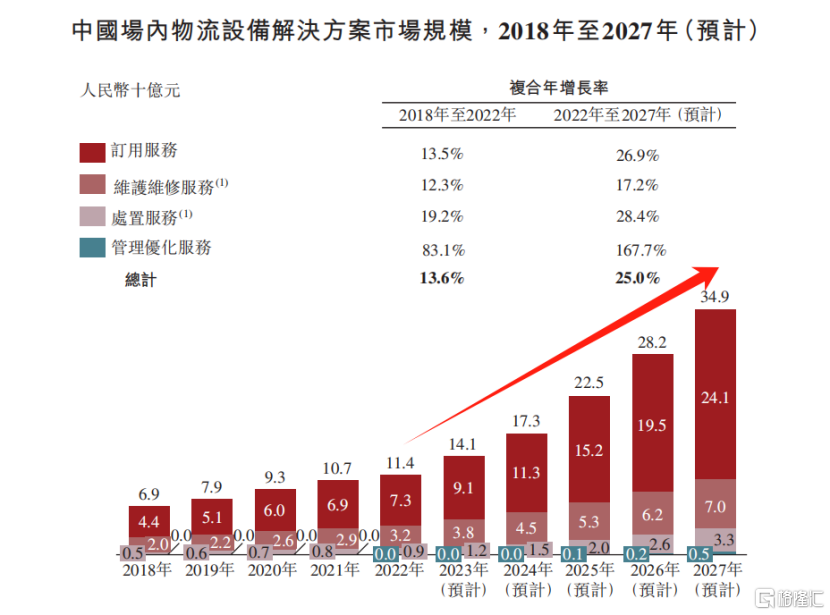

In the future, China's on-site logistics equipment solutions will be driven by factors such as digital transformation, cost reduction, efficiency and other factors, and enter the fast track of growth. According to the data of Zhenshi Consulting, compared with the traditional on-site logistics equipment procurement model, on-site logistics equipment solutions can help enterprises reduce operating costs by about 20% in the whole life cycle of the equipment. Burning knowledge further predicts that the market size of China's on-site logistics equipment solutions will grow at a compound annual growth rate of 25.0% from 2022 to 2027 and will reach 34.9 billion yuan in 2027. This means that the size of the market will triple in five years, making it a golden track with sufficient potential for development.

With the rapid growth of the industry, the relevant targets are expected to show higher stock price elasticity, and investment opportunities similar to those of US stocks are likely to reappear. In other words, a small number of dark horse companies are expected to be born on this track in the future-from the development of United Leasing Company of the United States, the track has a more significant Matthew effect, and the strong will remain strong.

A good driver on the track.

At present, the player who occupies an absolute leading position in the Chinese market is Frances.

Frances specializes in on-site logistics equipment solutions and is one of the earliest enterprises in China to adopt the digital application mode of on-site logistics equipment parts. Frances also pioneered the business model of on-site logistics equipment subscription, leading the trend of reshaping the domestic business format by digital means.

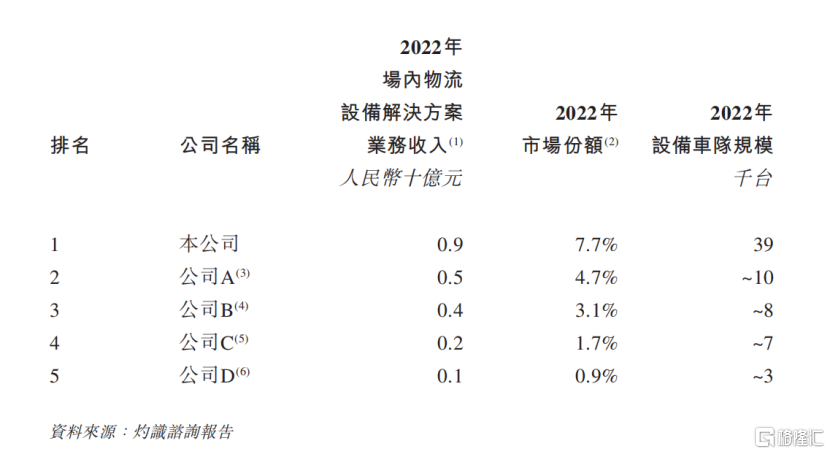

In addition to being on the same track, Frances has the same industry leading position as United Leasing in the United States.According to cautionary Consulting, in terms of revenue in 2022, the company accounts for 7.7% of the total market share, which is not only the first in the industry, but also ahead of the second competitor by 63.8%. In terms of equipment fleet size in 2022, the company ranks first among all on-site logistics equipment solution providers, and its equipment fleet size exceeds the combined size of all other market participants among the top 10 market participants in the same year. At present, Frances is far ahead of its competitors in the industry.

Good companies have similar genes, and the most prominent thing is that both have strong economies of scale, building a broad competitive moat.Both United Leasing and Frances have extensive service networks. According to the prospectus, Franz's national service network includes headquarters, three major supply chain bases and 67 service outlets in 47 cities across the country. Both also have excellent supply chain capabilities. Among them, Franz's supply chain database contains about 331000 kinds of parts information, including spare parts models, specifications, performance indicators, inventory levels and procurement information required by each brand of equipment.

In addition,Compared with United Leasing in the United States, Frances has its own unique advantages.On the basis of better digitization, Frances is better at using technology to empower customers and form full-cycle coverage of equipment subscription, maintenance, equipment and accessories sales, and ultimately help enterprises improve efficiency and reduce operating costs. The company launched a smart assets operation and management system based on the Internet of things technology. Through this system, the company can realize real-time monitoring of equipment status, supply chain and inventory management, as well as real-time scheduling of personnel and equipment. Through successful resource allocation and operation management, the management system has covered at least 97.3% of Frances's equipment fleet.

Although the overall development level of domestic related industries is still relatively primary, Frances, as a leading enterprise, has established a feasible business model and built high competition barriers, which has laid a solid foundation for rapid business expansion. Although the industry inevitably entered a headwind phase affected by the epidemic between 2020 and 2022, Frances's revenue rose by 21.7%, demonstrating the resilience of the leader.

With the listing, the company is expected to move towards a new starting point of development. With the support of sufficient funds, the company can strengthen its original market position, expand the scope and category of services, and carry out mergers and acquisitions-- this is also the development process of American United Leasing Company.

Picture: the development of American United Leasing Company

On the whole, the industry has entered a period of golden growth; the company has a clear logic of long-term growth and is expected to enter the fast lane of growth faster. Under the characteristics of "good track + good driver", the investment value of the company is worth paying attention to.