Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. Zooming in on an example, the Kingenta Ecological Engineering Group Co., Ltd. (SZSE:002470) share price dropped 69% in the last half decade. That's not a lot of fun for true believers. The falls have accelerated recently, with the share price down 21% in the last three months. But this could be related to the weak market, which is down 8.7% in the same period.

While the last five years has been tough for Kingenta Ecological Engineering Group shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

View our latest analysis for Kingenta Ecological Engineering Group

Given that Kingenta Ecological Engineering Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Kingenta Ecological Engineering Group reduced its trailing twelve month revenue by 14% for each year. That puts it in an unattractive cohort, to put it mildly. Arguably, the market has responded appropriately to this business performance by sending the share price down 11% (annualized) in the same time period. It's fair to say most investors don't like to invest in loss making companies with falling revenue. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

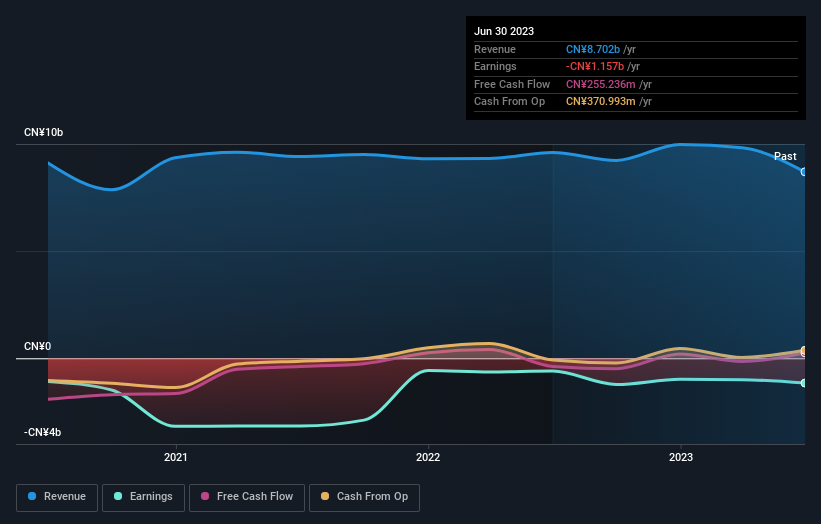

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Kingenta Ecological Engineering Group's earnings, revenue and cash flow.

A Different Perspective

Investors in Kingenta Ecological Engineering Group had a tough year, with a total loss of 7.9%, against a market gain of about 0.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Kingenta Ecological Engineering Group better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Kingenta Ecological Engineering Group .

Of course Kingenta Ecological Engineering Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.