Here's Why Kirby (NYSE:KEX) Has Caught The Eye Of Investors

Here's Why Kirby (NYSE:KEX) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

對於許多投資者,尤其是那些缺乏經驗的投資者來說,購買有好故事的公司的股票是很常見的,即使這些公司在虧損。但現實是,當一家公司每年虧損時,在足夠長的時間內,投資者通常會承擔他們的損失份額。雖然一家資金雄厚的公司可能會虧損多年,但它最終需要創造利潤,否則投資者就會離開,公司就會枯萎。

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Kirby (NYSE:KEX). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

儘管處於科技股藍天投資的時代,許多投資者仍採取更傳統的策略;購買盈利的公司的股票,如柯比(紐約證券交易所代碼:KEX)。現在,這並不是說該公司提供了最好的投資機會,但盈利能力是商業成功的關鍵組成部分。

Check out our latest analysis for Kirby

看看我們對柯比的最新分析

How Fast Is Kirby Growing Its Earnings Per Share?

柯比的每股收益增長速度有多快?

In the last three years Kirby's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Kirby's EPS shot from US$1.60 to US$3.33, over the last year. Year on year growth of 109% is certainly a sight to behold.

在過去的三年裡,柯比的每股收益大幅增長;如此之多,以至於試圖用這些數位來推斷長期預期有點不真誠。因此,最好將過去一年的增長率孤立起來,以便我們進行分析。引人注目的是,柯比的每股收益在去年從1.60美元飆升至3.33美元。109%的同比增長當然是一個令人驚嘆的景象。

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Kirby shareholders can take confidence from the fact that EBIT margins are up from 6.5% to 10%, and revenue is growing. That's great to see, on both counts.

要複核一家公司的增長,一種方法是觀察其收入和息稅前利潤(EBIT)的變化情況。Kirby的股東可以從EBIT利潤率從6.5%上升到10%,以及收入不斷增長的事實中獲得信心。無論從哪方面來看,這都是一件好事。

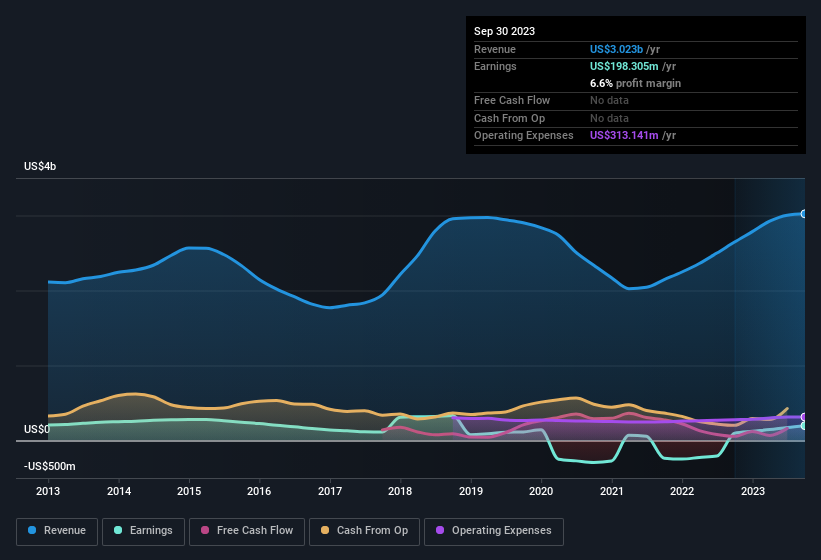

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

下面的圖表顯示了該公司的利潤和收入是如何隨著時間的推移而變化的。要查看實際數位,請點擊圖表。

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Kirby's forecast profits?

在投資中,就像在生活中一樣,未來比過去更重要.那麼為什麼不來看看這個免費Kirby的互動式可視化預測利潤?

Are Kirby Insiders Aligned With All Shareholders?

柯比的內部人士是否與所有股東一致?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. So it is good to see that Kirby insiders have a significant amount of capital invested in the stock. To be specific, they have US$50m worth of shares. This considerable investment should help drive long-term value in the business. Despite being just 1.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

如果內部人士也持有一家公司的股票,這應該會給投資者帶來一種安全感,使他們的利益緊密一致。因此,很高興看到柯比內部人士將大量資本投資於該公司的股票。具體地說,他們擁有價值5000萬美元的股票。這筆可觀的投資應該有助於推動業務的長期價值。儘管只持有該公司1.1%的股份,但這筆投資的價值足以表明,內部人士對這家合資企業有很大的依賴。

Is Kirby Worth Keeping An Eye On?

柯比值得被盯著嗎?

Kirby's earnings per share growth have been climbing higher at an appreciable rate. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, Kirby is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. It is worth noting though that we have found 1 warning sign for Kirby that you need to take into consideration.

柯比的每股收益增長一直在以可觀的速度攀升。每股收益的增長肯定會吸引眼球,而大量的內部人士持股只會進一步激起我們的興趣。當然,人們希望,強勁的增長標誌著商業經濟學的根本改善。因此,從表面上看,柯比值得被列入你的觀察名單;畢竟,當市場低估快速增長的公司時,股東們的表現很好。但值得注意的是,我們發現了柯比的1個警告標誌這是你需要考慮的。

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

總是有可能做得很好,購買股票不是不斷增長的收入和不要有內部人士購買股票.但對於那些考慮這些重要指標的人,我們建議您查看以下公司做擁有這些功能.你可以在這裡訪問它們的免費列表.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文中討論的內幕交易指的是相關司法管轄區內的應報告交易.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.