Positive Sentiment Still Eludes DarioHealth Corp. (NASDAQ:DRIO) Following 60% Share Price Slump

Positive Sentiment Still Eludes DarioHealth Corp. (NASDAQ:DRIO) Following 60% Share Price Slump

DarioHealth Corp. (NASDAQ:DRIO) shareholders that were waiting for something to happen have been dealt a blow with a 60% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 71% loss during that time.

DarioHealth Corp.納斯達克股票代碼:DIO)上個月股價暴跌60%,令等待事態發展的股東遭受重創。對於股東來說,最近的下跌結束了災難性的12個月,在此期間,他們坐擁71%的損失。

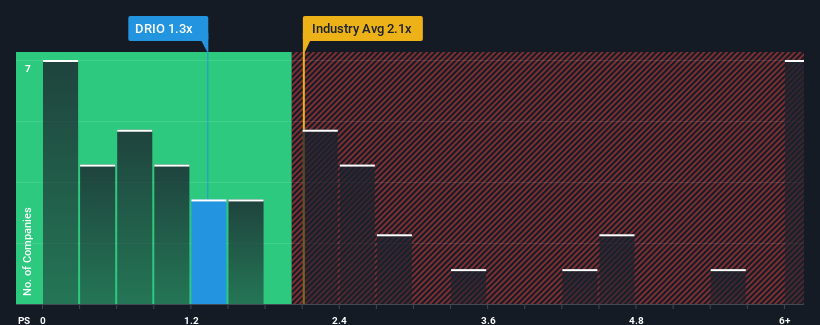

Following the heavy fall in price, when close to half the companies operating in the United States' Healthcare Services industry have price-to-sales ratios (or "P/S") above 2.1x, you may consider DarioHealth as an enticing stock to check out with its 1.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

隨著股價的大幅下跌,當近一半在美國醫療保健服務行業運營的公司的市銷率(或“P/S”)超過2.1倍時,您可能會認為DarioHealth是一隻誘人的股票,其P/S比率為1.3倍。然而,P/S可能是有原因的,需要進一步調查才能確定是否合理。

See our latest analysis for DarioHealth

查看我們對DarioHealth的最新分析

How DarioHealth Has Been Performing

DarioHealth的表現如何

Recent times haven't been great for DarioHealth as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

對於DarioHealth來說,最近的情況並不樂觀,因為它的收入增長一直低於大多數其他公司。本益比與S的比率之所以偏低,可能是因為投資者認為這種平淡無奇的營收表現不會好轉。如果是這樣的話,現有股東很可能很難對股價的未來走勢感到興奮。

How Is DarioHealth's Revenue Growth Trending?

DarioHealth的收入增長趨勢如何?

In order to justify its P/S ratio, DarioHealth would need to produce sluggish growth that's trailing the industry.

為了證明其本益比/S比率是合理的,大健康需要實現落後於行業的低迷增長。

Taking a look back first, we see that the company managed to grow revenues by a handy 2.8% last year. The latest three year period has also seen an excellent 274% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

首先回顧一下,我們看到該公司去年的收入輕鬆增長了2.8%。在最近的三年裡,得益於其短期表現,該公司的整體收入也實現了274%的出色增長。因此,公平地說,最近的收入增長對公司來說是一流的。

Turning to the outlook, the next three years should generate growth of 41% per year as estimated by the five analysts watching the company. With the industry only predicted to deliver 14% each year, the company is positioned for a stronger revenue result.

談到前景,觀察該公司的五位分析師估計,未來三年的年增長率應為41%。由於該行業預計每年僅貢獻14%的收入,該公司將迎來更強勁的收入結果。

In light of this, it's peculiar that DarioHealth's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

有鑒於此,大健康的P/S排名低於大多數其他公司,這是很奇怪的。顯然,一些股東對這些預測持懷疑態度,並一直在接受大幅降低的售價。

What We Can Learn From DarioHealth's P/S?

我們可以從大健康的P/S那裡學到什麼?

The southerly movements of DarioHealth's shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

大健康股價的南下走勢意味著其本益比S目前處於相當低的水準。有人認為,在某些行業中,市銷率是衡量價值的次要指標,但它可能是一個強大的商業信心指標。

A look at DarioHealth's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

看看DarioHealth的收入就會發現,儘管未來的增長預期令人振奮,但其本益比/S比遠遠低於我們的預期。當我們看到如此強勁的增長預測時,我們只能假設潛在風險可能會對P/S比率構成重大壓力。至少價格風險看起來非常低,但投資者似乎認為,未來的收入可能會出現很大的波動。

It is also worth noting that we have found 4 warning signs for DarioHealth that you need to take into consideration.

同樣值得注意的是,我們發現DarioHealth的4個警告信號這是你需要考慮的。

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

當然了,利潤豐厚、盈利增長迅速的公司通常是更安全的押注那就是。所以你可能想看看這個免費其他本益比合理、盈利增長強勁的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.