European inventories are high, causing unspeakable suffering to inverter companies.

But why is Sunshine Power not only unaffected, but is its performance rising against the trend?

Inverters are weakly affected by inventories, mainly due to the high proportion of ground power plants

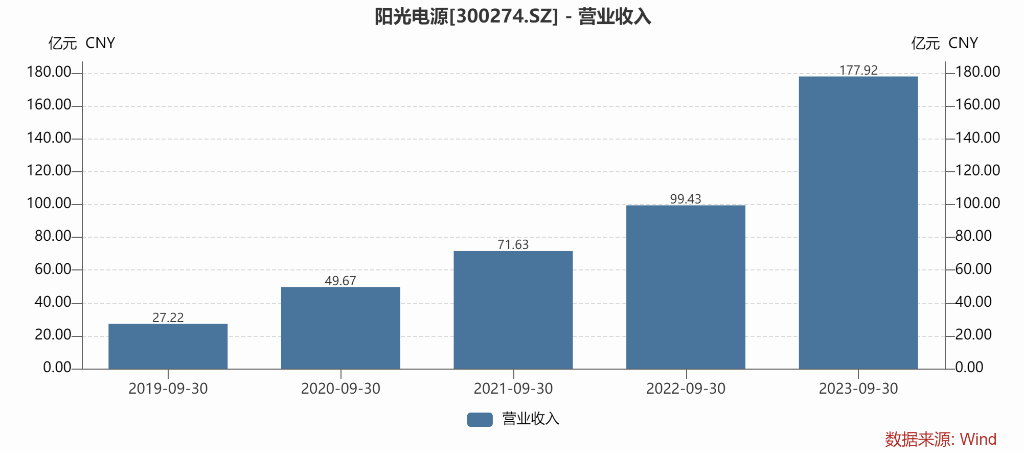

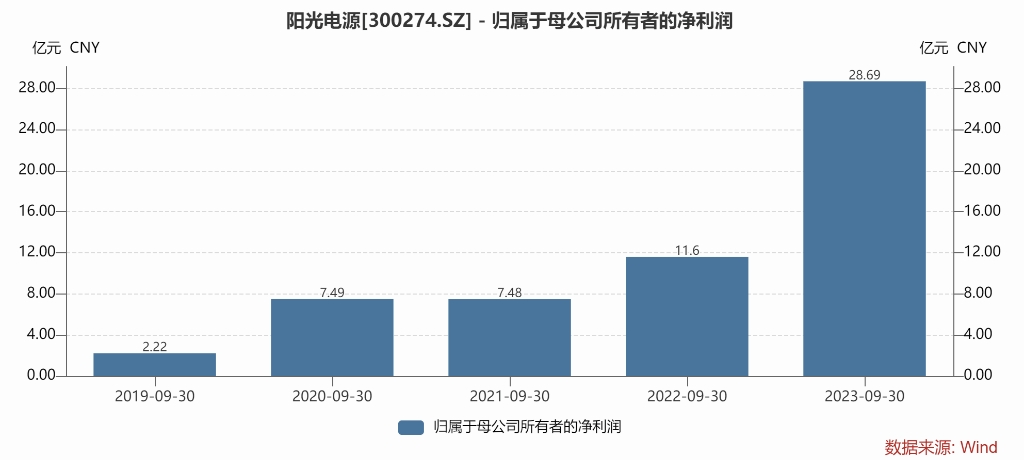

On the evening of October 27, Sunshine Power released its third quarter results announcement. 2023Q1-Q3 revenue was 46.415 billion yuan, up 108.85% year on year; net profit was 7.223 billion yuan, up 250.53% year on year; Q3 single-quarter revenue was 17.792 billion yuan, up 78.5% year on year; and Q3 single-quarter net profit was 2,869 billion yuan, up 147.29% year on year. Compared to Jinlang Technology and Goodway, whose revenue and net profit declined one after another in the third quarter, it can be said that Sunshine Power's performance bucked the trend and rose.

The main reason for the large difference in performance is the difference in business structure. Power conversion equipment such as photovoltaic inverters from Sunshine Power accounts for 40.6%, energy storage systems account for 29.78%, and power plant system integration accounts for 26.41%. However, in the main business composition of Goodway and Jinlang Technology, photovoltaic inverters account for more than 70%. Naturally, they are more seriously affected by the large storage stocks of households in Europe as a whole.

Sunshine Power also said that European households do have a lot of storage stocks, but they are mainly in the German-speaking region, and overall prices and profits have been stable. Among them, in the inverter business, the company delivered more than 83 GW in the first three quarters of this year, an increase of 65% over the previous year. The rapid growth rate mainly comes from ground power plants. Ground power plants account for 67% and a gross profit margin of 40%, making it a steady leader in the ground power plant business.

Growth comes from energy storage in the short term and hydrogen energy in the long term

The company's energy storage revenue for the first three quarters was 13.7 billion yuan, up 177% year on year, of which overseas revenue accounted for 85%. The focus was still on large storage markets in Europe and the US. Apart from inverters and energy storage, the first three quarters of new energy power plant development also performed excellently. Q1-Q3 revenue was 12.7 billion yuan, up 148% year on year, mainly benefiting from the rapid increase in distributed household usage.

The share of the energy storage system business has been increasing year by year since 2020. 2023H1 is already close to 30%. If so, the growth rate of photovoltaics is bound to slow down in the next few years, but the growth rate or market space of energy storage in the next few years is superior to that of photovoltaics.

The company also made it clear that energy storage will gain strength in the second half of this year, and next year will be even better. However, in reality, the profit margin for domestic energy storage is extremely low, and most energy storage is idle, showing no value. It's just that EPC assembly does not make money. Sunshine Power mainly relies on energy storage research and development to make money, starting with improving product utilization and performance, creating a differentiated advantage.

In addition to photovoltaic storage, another point worth paying attention to for solar power is hydrogen energy, because hydrogen energy can be said to be the ultimate in new energy, but hydrogen energy, both domestic and foreign, is in its infancy. Precisely because it is in the early stages, there is plenty of room for market growth, so whoever gives priority to seizing market share will benefit. There are also many types of hydrogen energy deployed in photovoltaic faucets, such as Longji Green Energy, such as solar power sources.

Regarding hydrogen energy, Sunshine Power said that the domestic hydrogen energy market is still in the early stages of explosion and is growing rapidly, but the project implementation cycle is at least 2-3 years. The key to hydrogen energy development is expanding applications. In the industrial chain, storage and transportation links are currently lagging behind. In terms of performance, hydrogen energy does not show profit in the short term, and can be achieved in the medium to long term.

Simply put, it can also be seen from Sunshine Power's three-quarter report that because its business structure is not only inverters, but also energy storage systems, new energy power generation, etc., plus the strength of its own brands, channels, etc., it is not greatly affected by European inventories, so it was able to buck the trend and rise. Moreover, hydrogen energy is a point worth paying attention to. Because the growth rate of photovoltaics is slowing down, energy storage will have similar results in a few years. Hydrogen energy has only just started. If the first-mover advantage is done well, the company will have stable growth support over a long period of time.