Anshan Senyuan Road and Bridge Co., Ltd's (SZSE:300210) 34% Price Boost Is Out Of Tune With Revenues

Anshan Senyuan Road and Bridge Co., Ltd's (SZSE:300210) 34% Price Boost Is Out Of Tune With Revenues

Anshan Senyuan Road and Bridge Co., Ltd (SZSE:300210) shares have continued their recent momentum with a 34% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 57%.

鞍山市森源路橋有限公司(SZSE:300210)股價延續了近期的勢頭,僅在上個月就上漲了34%。在過去的30天裡,年度漲幅達到了非常大的57%。

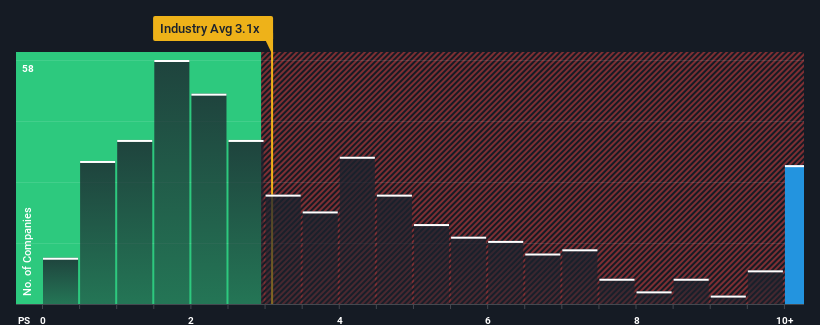

After such a large jump in price, given around half the companies in China's Machinery industry have price-to-sales ratios (or "P/S") below 3.1x, you may consider Anshan Senyuan Road and Bridge as a stock to avoid entirely with its 13.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

經過如此大的漲幅,鑑於中國所在機械行業約有一半的公司市銷率(P/S)低於3.1倍,您可能會考慮將鞍山森源路橋作為一隻股票,以避免其13.4倍的P/S比率。儘管如此,僅僅從表面上看待P/S是不明智的,因為可能會有一個解釋為什麼它如此之高。

Check out our latest analysis for Anshan Senyuan Road and Bridge

查看我們對鞍山森園路橋的最新分析

How Anshan Senyuan Road and Bridge Has Been Performing

鞍山森園路橋的表現如何

As an illustration, revenue has deteriorated at Anshan Senyuan Road and Bridge over the last year, which is not ideal at all. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

舉個例子,鞍山森源路橋的收入在過去一年裡惡化了,這根本不是理想的情況。或許,市場認為該公司在不久的將來可以做得足夠好,跑贏業內其他公司,這使得本益比和S的本益比保持在較高水平。然而,如果情況並非如此,投資者可能會被髮現為該股支付過高的價格。

How Is Anshan Senyuan Road and Bridge's Revenue Growth Trending?

鞍山森園路橋收入增長趨勢如何?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Anshan Senyuan Road and Bridge's to be considered reasonable.

有一個固有的假設,即一家公司的表現應該遠遠超過行業,才能讓鞍山森源路橋這樣的P/S比率被認為是合理的。

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 18%. As a result, revenue from three years ago have also fallen 53% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

回顧過去一年的財務狀況,我們沮喪地看到該公司的收入下降到了18%。因此,三年前的整體營收也下降了53%。因此,不幸的是,我們不得不承認,在這段時間裡,該公司在收入增長方面做得並不出色。

In contrast to the company, the rest of the industry is expected to grow by 32% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

與該公司形成鮮明對比的是,該行業其他業務預計將在未來一年增長32%,這確實讓人對該公司最近中期收入的下降有了正確的認識。

With this in mind, we find it worrying that Anshan Senyuan Road and Bridge's P/S exceeds that of its industry peers. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

考慮到這一點,鞍山森源路橋的P/S超過了行業同行,我們感到擔憂。似乎大多數投資者都忽視了最近糟糕的增長率,並希望該公司的業務前景有所好轉。只有最大膽的人才會認為這些價格是可持續的,因為最近收入趨勢的延續最終可能會對股價造成沉重壓力。

The Final Word

最後的結論

The strong share price surge has lead to Anshan Senyuan Road and Bridge's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

強勁的股價飆升導致鞍山森源路橋的P/S也飆升。通常情況下,在做出投資決策時,我們會告誡不要過度解讀本益比,儘管它可以充分揭示其他市場參與者對該公司的看法。

We've established that Anshan Senyuan Road and Bridge currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

我們已經確定,鞍山森源路橋目前的本益比遠高於預期,因為其最近的收入在中期內一直在下降。由於投資者擔心營收下滑,市場情緒惡化的可能性相當高,這可能會使本益比/S回到我們預期的水準。如果近期的中期營收趨勢持續下去,將使股東的投資面臨重大風險,潛在投資者面臨支付過高溢價的危險。

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Anshan Senyuan Road and Bridge (2 shouldn't be ignored) you should be aware of.

別忘了,可能還有其他風險。例如,我們已經確定鞍山森園路橋3個警示標誌(2不應忽視)你應該意識到。

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

如果過去收益增長穩健的公司符合你的胃口,你可能想看看這個免費其他盈利增長強勁、本益比較低的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.