When the concept of AI reaches the "deep water zone", foreign technology giants are also faced with business model problems, while the gap between domestic companies betting in this direction is also gradually emerging.

The third quarterly report shows that the performance of A-share "AI concept stocks" continues to show a trend of differentiation: the dawn of China Science and Technology, the leader of arithmetic, has maintained a stable profit, Kunlun Wanwei, the leader of large models, has changed from profit to loss, while the performance of Tom Cat, which focuses on IP AI interaction, is now "ankle chopping".

China Science Dawn: net profit increased by 20% compared with the same period last year.

Xinchuang + AI leader in the branch dawning revenue fell slightly in the third quarter, net profit maintained steady growth.

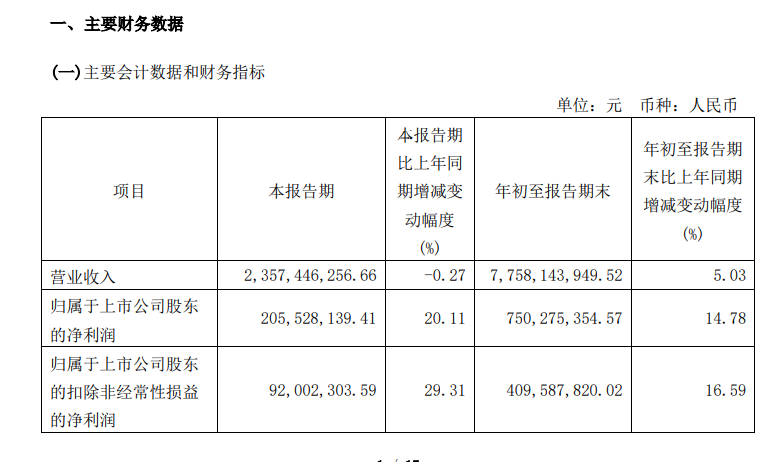

In the third quarter of this year, China Science and Technology Shuguang achieved operating income of 2.357 billion yuan, down 0.27% from the same period last year. The net profit attributed to shareholders of listed companies was 206 million yuan, up 20.11% from the same period last year. The non-parent profit was 92 million yuan, an increase of 29.31% over the same period last year.

In the first three quarters, the operating income of China Science and Technology Shuguang reached 7.758 billion yuan, an increase of 5.03 percent over the same period last year, and its net profit was 750 million yuan, an increase of 14.78 percent over the same period last year, deducting 410 million yuan from non-parent net profit, an increase of 16.59 percent over the same period last year.

Guohai Securities believes that in the first three quarters of China Science and Technology, in the face of adverse factors such as changes in the rhythm of Xinchuang and the tension in the supply chain of AI chips, it still achieved steady growth in business performance, reflecting the remarkable results of enhancing its core competitiveness, improving its technological strength and strengthening its independent controllability.

According to reports, the dawning controller of China Science and Technology is the Institute of Computing Technology of the Chinese Academy of Sciences, and the company is a leading enterprise in the field of core information infrastructure in China, mainly engaged in the research, development and manufacture of related products such as high-end computing, storage, security, data centers, and so on. and through the active layout of intelligent computing, big data, cloud computing and other business, has formed a perfect layout of "core-end-cloud" integrated whole industry chain. The company ranks first in the domestic industry in terms of market share of liquid-cooled data center infrastructure for many years, and has built and operated more than 50 cloud computing centers across the country, with the largest computing service network in China.

Up to now, dawning of Chinese Science has participated in the training, fine-tuning and reasoning of many kinds of large models, such as "Wudao 2.0", "Zidong Taichu", "Wen Xin Yi Yan" and "Tongyi Thousand questions", and has completed the adaptation and incubation of more than 30 mainstream models at home and abroad, including GPT series, LLaMA series, GLM series and so on. At the same time, the company has built large model all-in-one machine, large model storage solution, etc., and developed the leading immersion phase change liquid cooling technology and cold plate cooling technology, which has a market share of more than 58% in liquid cooling data centers in China.

Kunlun Wanwei: loss of 29.83 million in the third quarter

Kunlun Wanwei's third-quarter performance continued to decline, from profit to loss.

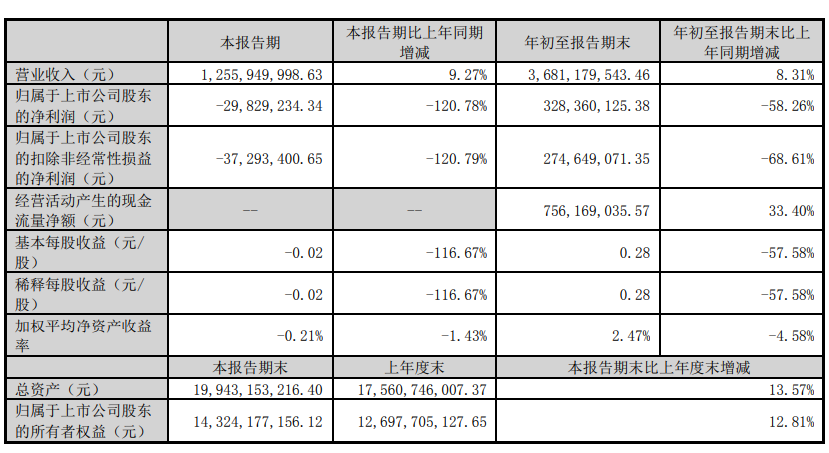

In the third quarter, Kunlun Wanwei realized operating income of 1.256 billion yuan, an increase of 9.27% over the same period last year, and a net loss of 29.8292 million yuan, down 120.78% from profit to loss. The non-net loss was 37.2934 million yuan, down 120.79% from the same period last year. The net loss per share is 0.02 yuan.

In the first three quarters, Kunlun Wanwei's operating income was 3.681 billion yuan, up 8.31% from the same period last year, and the net profit was 3.28 yuan, down 58.26% from the same period last year, deducting 275 million yuan from non-net profit, down 68.61% from the same period last year.

Kunlun Wanwei said that in the first three quarters of this year, the share of the company's overseas business revenue further increased to 84%, an increase of nearly 9% compared with the same period last year, while the overall gross profit margin remained at a high level.

Kunlun Wanwei said in the financial report that during the reporting period, the company's "Tiangong" model made significant breakthroughs in logical reasoning ability, text comprehension ability, multimodal ability and so on. On the application side, "Tiangong" APP ushered in a comprehensive iterative upgrade, integrating AI search, AI reading, AI creation and other core functions, covering work, study, life and many other application scenarios.

In terms of AI games, Club Koala, the first AI game developed by the company's Play for Fun Game Studio, was unveiled at the International Game Show in Cologne, Germany on August 25. The game comes with UGC game editor Koala Editor to help users achieve zero-code game development, greatly reducing the threshold for game creation.

In terms of math, by the end of this quarter, Kunlun Wanwei had purchased and leased about 6000 chips, and there were about 3000 chips to be delivered. At present, the company has the computing power expected to meet the computing needs of large models in addition to video AIGC in the next 1-2 years.

In addition, in order to establish and maintain its long-term core competitive advantage in the artificial intelligence track, Kunlun Wanwei previously announced that it would take control of AI computing chip enterprise Beijing Aijie Core Technology Co., Ltd. (hereinafter referred to as "Aijie Core") through capital increase, and complete the layout of the whole industry chain of "Computational Infrastructure-Big Model algorithm-AI Application". Agenco Core aims to develop a programmable, high-performance NPU product, which is also used in model training and reasoning.

Tom Cat: net profit has dropped by 87.53%, and social security fund has become one of the top ten circulating shareholders.

Affected by the weak global macro-economy and no new products on the line during the period, Tom Cat's performance remained depressed in the third quarter, deducting non-net profit is now "ankle chopping".

In the third quarter of this year, Tom Cat's operating income was 340 million yuan, down 16.53% from the same period last year. The net profit belonging to shareholders of listed companies was 13.64 million yuan, down 87.53% from the same period last year, while non-net profit was only 8.65 million yuan, down 91.90% from the same period last year.

In the first three quarters, Tom Cat's operating income was 1.028 billion yuan, down 18.38% from the same period last year, while its mother's net profit was 200 million yuan, down nearly half from the same period last year, deducting 189 million yuan from non-net profit, down more than 50% from the same period last year.

As for the reasons for the sharp decline, Tom Cat explained in the report that the company's Tom Cat family IP products continued to be active in the global market, with stable data for products such as MAU (monthly active users) and DAU (daily active users), but the company's overall revenue declined due to factors such as global macroeconomic weakness and no new products launched during the period. At the same time, during the reporting period, the company continued to increase investment in new product research and development, development expenditure and related expenses increased. In addition, the company's local income tax in Slovenia has increased. The above reasons led to a decline in the company's current profits.

In terms of AI products, Tom Cat said that the company's R & D team at home and abroad is promoting the development and testing of three AI application products. Among them, the multimodal AI Tom cat product jointly developed by the company's domestic R & D team and West Lake Xinchen has initially realized many functions, such as photo recognition, oral English enlightenment, interest guidance, popular science education, AI life map, AI generation picture book, situational dialogue and so on. The first AI mobile game "Talking Ben AI" developed by the company's overseas team opened its first round of overseas testing in Slovenia, Cyprus, South Africa and other regions on August 28, 2023. The Tom Cat storytelling AI product, developed by the company's domestic team, plans to start the first round of testing in the fourth quarter of 2023.

In addition, the Tom Cat financial report shows that in the third quarter, the 414 portfolio of the social security fund entered the top 10 tradable shareholders, with a total shareholding of 8.1 million shares, accounting for 0.26% of the tradable shares.