The lithium battery industry is getting stronger and stronger, and in the harsh market competition, it is not just tail power battery companies that are under pressure. The “chill” has begun to reach second- and third-tier power battery manufacturers. All major second-tier and third-tier power manufacturers have begun to experience declining profit levels, declining market share, and weak installed capacity growth.

As a second-tier leading battery manufacturer, can Everweft Lithium escape a robbery?

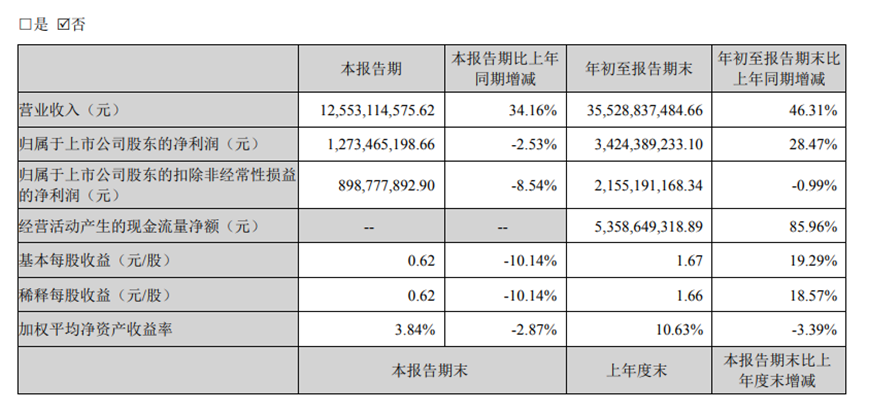

On the evening of October 25, Everweft Lithium announced its results for the third quarter of 2023. In the third quarter of this year, Everweft Lithium achieved operating income of 12.55 billion yuan, up 34.16% year on year, up 6.47% month on month; net profit was 1,273 billion yuan, down 2.53% year on year, up 25.9% month on month; gross margin and net margin reached 18.34% and 10.75%, respectively, up 1.04 and 4.18 percentage points from year to month, up 3.27 and 0.3 percentage points from month to month.

100 million weft lithium energy has once again fallen into an increase in revenue and no increase in profit, but this is not a big problem

In the third quarter of this year, Everweft Lithium once again seemed to fall into the quagmire of increasing revenue without increasing profits, but this time it was not a big problem. First, in the third quarter of this year, even the Ningde Era, which is a leader in power batteries, will face a correction in profit. The operating income of the Ningde Era reached 105.4 billion yuan, an increase of 8.3% over the previous year and an increase of 5.2% over the previous year, but net profit declined, falling 4.3% month-on-month to 10.43 billion yuan.

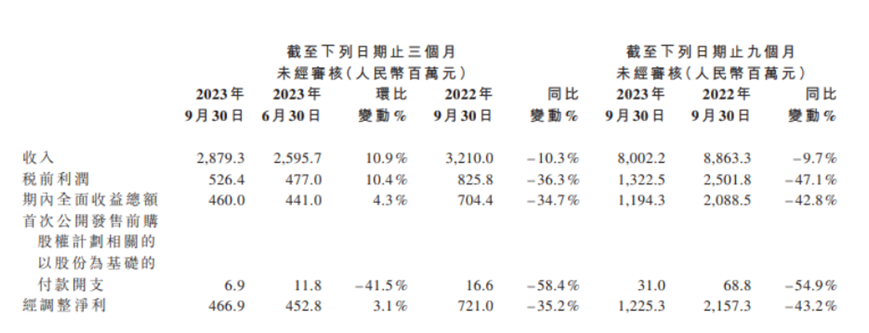

Second, as a joint venture of Everweft Lithium Energy, had poor profit performance in the third quarter. Due to a 30% increase in R&D expenses and other expenses, an increase of 47.6%, the adjusted net profit for the third quarter fell 35.2% year on year to 467 million yuan, which indirectly caused the investment income of Everweft Lithium to drop sharply by 48.75% to 448 million yuan, affecting Everweft Lithium's profit.

Finally, the decline in the profitability of Everweft Lithium Energy is also related to its price reduction to protect market share.

Domestic power battery prices have continued to decline this year. Among them, the average prices of lithium iron phosphate battery power type and ternary cell power type fell from 0.68 yuan/Wh and 0.75 yuan/Wh at the end of the second quarter to 0.5 yuan/Wh and 0.56 yuan/Wh at the end of the third quarter, respectively, and the decline was as high as 26%.

Since demand for terminals is slightly weak, and prices for upstream raw materials have dropped over and over again, strong as in the Ningde era, it is impossible to maintain high prices. Not to mention that as a second-tier power battery manufacturer, Everweft Lithium Energy can guarantee that its market share has not been lost.

Moreover, despite some correction in upstream raw material prices, a major decline was completed in the first half of the year. In the third quarter, due to a wave of recovery in lithium prices, the price of battery-grade lithium carbonate remained around 300,000 yuan/ton for a long time, so compared to the second quarter, the decline was not significant. It was only 20%. It was still not as good as the decline in battery prices. There was not much difference from the decline of about 45% in the previous quarter.

The cash flow of 200 million weft lithium energy continues to improve

The way Everweft Lithium chose to cut prices to protect market share and make profit to terminal new energy vehicle companies has certainly sacrificed its own profitability, but Everweft Lithium's cash flow continues to improve.

At the end of the third quarter of this year, the net cash flow from operating activities of Everweft Lithium reached 3,559 billion yuan, an increase of 2,059 billion yuan over the second quarter, and an increase of 86% over the same period last year, a record high. It can be seen that the current cash flow of Everweft Lithium Energy is still abundant, and its hematopoietic capacity is strong.

Meanwhile, since this year, Everweft Lithium's accounts payable have increased by 7.21 billion yuan compared to the same period last year to 28.51 billion yuan, which is far greater than the 12.71 billion yuan in accounts receivable and notes (an increase of 4.34 billion yuan over the previous year), highlighting the high position of Everweft Lithium Energy in the downstream industry chain.

300. The market share of Everweft lithium energy bucked the trend and went public, ranking first in the overall growth rate

Due to inventory removal pressure from the entire lithium battery industry chain, it is difficult for the overall domestic power battery market to repeat its previous boom this year. Apart from leading battery companies such as Ningde Era, BYD, and China New Aviation, which can still maintain growth, other manufacturers are basically in a negative trend of weak growth.

However, the battery manufacturers that are overwhelmed and breathless are not just tail companies; on the contrary, they are second-tier and third-tier power battery manufacturers that are not inferior.

In the first three quarters of this year, domestic second- and third-tier power battery manufacturers, with the exception of milliweft lithium energy, basically faced a situation where market share declined to varying degrees and installed capacity growth slowed down.

Among them, the market shares of manufacturers such as Guoxuan Hi-Tech, Sunwoda, Honeycomb Energy, and Funeng Technology, which ranked in the top ten in the number of installed power batteries, declined by 0.91, 0.22, 0.65, and 0.6 percentage points, respectively. The growth rate fell to single digits or even negative growth, to 7%, 20.4%, -2.4%, and -9.5%, respectively.

However, Everweft Lithium achieved growth against the trend. In the first three quarters of this year, Everweft Lithium's power battery market share reached 4.3%, defeating four competitors, Honeycomb Energy, Sunwoda, and Guoxuan Hi-Tech, increasing by 2.02 percentage points over the previous year to fourth place. The growth rate of installed power batteries is as high as 148.8%. The growth rate is clearly greater than the overall market, ranking first in the top ten domestic power battery installed capacity.

From the perspective of the global power battery market, Everweft Lithium also shines brightly. In January-August of this year, Everweft Lithium reached 8th place in the world's top ten cumulative installed capacity list for the first time. The overall installed capacity reached 9.2 GWh, and the year-on-year growth rate was as high as 142.8%. It is the only manufacturer in the top ten power battery manufacturers to maintain three-digit growth, and its market share increased by 0.8 percentage points to 2.1%.

Obviously, the overall sales volume has increased, and market share has also increased due to the huge sales of popular models owned by car companies such as GAC Aion S, Nezha Automobile and Xiaopeng Motor, etc., which are major terminal consumers, such as GAC AION S, Hezhong Nacha S and GT, and Xiaopeng Motor G6, and Xiaopeng Motor, which is an important supplier, has also fully benefited.

In the first three quarters of this year, GAC Aian and Nezha Auto entered the top ten retail sales of domestic NEV manufacturers with 357,500 vehicles and 89,000 vehicles respectively. The total market share of these two companies alone was as high as 8.5%, surpassing the NEV giant Tesla; Xiaopeng also regained market attention with the launch of the new model G6 and the modified model P7i. So far, sales volume has risen 9 times over month, breaking the sales volume of 15,000 vehicles.

It is worth noting that in addition to maintaining close ties with domestic NEV companies, Everweft Lithium has not relaxed its development of customers from overseas NEV companies. This year, Everweft Lithium Energy will enjoy a power battery order of around 70 GWh from overseas car giant BMW Auto with its big brother Ningde Era. This represents the recognition of Everweft Lithium Energy's power battery products in overseas markets, and has also strengthened the popularity of Everweft Lithium Energy.

Under fierce competition, Everweft Lithium is the only sprout that has bucked the trend among second- and third-tier power battery manufacturers. The results achieved are still quite impressive. However, the pressure did not end there. From now on, there will still be a stage of gradual excess of annual power production capacity. It is also a critical period for Everweft lithium energy to face the wind situation. Whether it can completely reverse the market still needs to be tested by the market.