Changchun Zhiyuan New Energy Equipment Co., Ltd (SZSE:300985) shares have continued their recent momentum with a 42% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 70%.

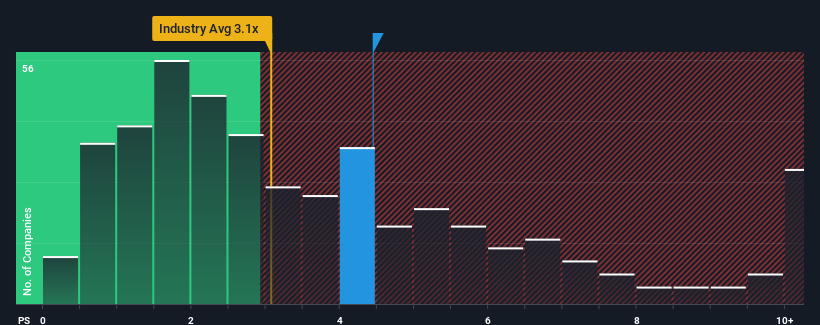

Since its price has surged higher, given close to half the companies operating in China's Machinery industry have price-to-sales ratios (or "P/S") below 3.1x, you may consider Changchun Zhiyuan New Energy Equipment as a stock to potentially avoid with its 4.4x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Changchun Zhiyuan New Energy Equipment

How Changchun Zhiyuan New Energy Equipment Has Been Performing

Changchun Zhiyuan New Energy Equipment certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Changchun Zhiyuan New Energy Equipment, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Changchun Zhiyuan New Energy Equipment's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Changchun Zhiyuan New Energy Equipment's is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. However, this wasn't enough as the latest three year period has seen the company endure a nasty 11% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 32% shows it's an unpleasant look.

With this in mind, we find it worrying that Changchun Zhiyuan New Energy Equipment's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Changchun Zhiyuan New Energy Equipment's P/S Mean For Investors?

The large bounce in Changchun Zhiyuan New Energy Equipment's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Changchun Zhiyuan New Energy Equipment currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Changchun Zhiyuan New Energy Equipment you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.